|

1. What happens if I give a gift in 2024 when it’s $13.61 million per person and then the exemption is reduced to something like $7 million later? If I start gifting significant amounts while I'm alive, will this cause problems when the current limits sunset after 2025, or if they are changed sooner?

Under current law there will be no "clawback" of exemption previously used that would cause estate taxes on the extra gifted amount. This would still be the case even if the changes to the exemption amounts are put into effect as of an earlier date. Individuals can also give away money annually up to the current limit, which is $18,000 in 2024, to as many people as they would like before it impacts the lifetime limit. 2. For estate taxes, does it matter what types of accounts I'm leaving to heirs? What if all my money is in a retirement account, like a 401(k), or it's all in a brokerage account or some other type of account? Do I need to start reorganizing how my money is held given the changes ahead? The federal estate tax applies to the value of all assets that a decedent owns or controls at death, regardless of the type of account in which the asset is held. Another option to consider, is that only assets held in certain types of accounts can be efficiently transferred. For example, retirement accounts, such as 401(k)s or traditional IRAs, cannot be transferred to a third party during the account holder's lifetime without triggering income taxes and possibly penalties. 3. If I'm leaving real estate to my heirs and they aren't going to sell it, do any possible changes in the estate tax matter to me? Would my heirs possibly be hit with a tax bill upon inheriting and have to come up with the cash? Does the same apply for leaving rental property, a family business, or a share in a business? Any estate tax liability is generally the obligation of the decedent's estate, and not the beneficiaries who will inherit the property. The beneficiaries' plans for the assets are not relevant to the taxation of the inherited asset. The value of all real estate would be included in the decedent's gross estate and could be subject to the estate tax, depending on the aggregate size of the estate. That said, for those in states with an inheritance tax, the beneficiary is typically responsible for paying the tax due. Six states have an inheritance tax: Nebraska, Iowa, Kentucky, Maryland, Pennsylvania, and New Jersey. 4. How should I deal with life insurance and my estate? Will any of that change in 2026? The death benefit of life insurance is considered part of the decedent's gross estate. However, because an irrevocable trust is a separate and distinct entity for estate tax purposes, the value of a life insurance policy owned by the trust would not be included in the estate of the insured. 5. I haven't touched my estate plan in 10 years and I no longer have an estate attorney or anyone to consult. How often do I need to revisit my plan and can you recommend anyone to help me? How do I even get started with so much in flux with the laws? A good practice is to review your estate plan every 3 to 5 years, and potentially more frequently if certain life events intervene, such as:

0 Comments

by Denise Appleby, APA, CISP, CRC, CRPS, CRSP

Since the Roth IRA was introduced in 1998, the Roth-versus-traditional-IRA debate has been a hot topic, with various arguments being made for one or the other. A key selling point for those who favor Roth IRAs is that the upfront cost of paying taxes on contributions when they are made will be rewarded with tax-free earnings. But Roth IRA earnings are tax-free only if they are part of a qualified distribution. For interested parties, the question becomes, “How does one know if a Roth IRA distribution is qualified?” And if the distribution isn’t qualified, “What are the tax implications?” The following two steps can be used to help provide the answers to these questions. Step 1: Determine if the Roth IRA distribution is qualified. A Roth IRA distribution is qualified if it meets the following two requirements: 1. It occurs at least five years after the owner first funded a Roth IRA. This funding can be with a valid regular Roth IRA contribution or a qualified rollover contribution. A qualified rollover contribution is a conversion from a traditional IRA, SEP IRA, a SIMPLE IRA—providing that the SIMPLE IRA has been funded for at least two years at the time of the conversion, or a rollover of traditional (non-Roth) amounts from an employer-sponsored retirement plan. 2. The distribution is made under any of the following circumstances:

1. The rule starts with the owner’s first Roth IRA: The five-year period for a qualified Roth IRA distribution starts January 1 of the first year that the Roth IRA owner funded any Roth IRA. Example: John made a regular Roth IRA contribution in February 2023 for 2022. Making this contribution is the first time John funded a Roth IRA. John converted his traditional IRA to his Roth IRA in 2023. John’s five-year period for determining if he meets Five-Year Rule Number One is January 1, 2022. If John had made the regular Roth IRA contribution for 2023, his five-year period for determining if he meets Five-Year Rule Number One would have started on January 1, 2023. 2. It does not restart. Example: Susie converted $5,000 to her Roth IRA in 2015. This conversion is her first Roth IRA funding. She withdrew the entire amount, including earnings, in 2016. She no longer has a Roth IRA at this point. Susie started a new Roth IRA in 2023. When Susie takes a distribution from this new Roth IRA, the five-year period for a qualified distribution still starts January 1, 2015, even though the 2015 Roth IRA was fully distributed and closed. 3. A beneficiary inherits a Roth IRA owner’s five-year clock. A distribution from a beneficiary Roth IRA is qualified if it meets Five-Year Rule Number One. The five-year period is inherited from the owner. Using the example of Susie above, if she dies in 2023, the five-year period for her inherited Roth IRA starts January 1, 2015. All of an individual’s Roth IRAs (not including beneficiary Roth IRAs) are aggregated and treated as one to determine if Five-Year Rule Number One is satisfied. No further assessment is needed if a Roth IRA distribution is qualified because the distribution is tax-free; there is no federal income tax, and there is no 10% additional tax (early distribution penalty). If a Roth IRA distribution is nonqualified, then Step 2 must be taken. Step 2: Apply the ordering rules for nonqualified distributions. A Roth IRA distribution is nonqualified if it does not meet the two requirements above. The ordering rules must be used to determine what portion of a nonqualified distribution is subject to income tax and/or the 10% early distribution penalty. Under the ordering rules, distributions are taken from the following layers of sources in the order listed. 1. Layer 1 consists of regular Roth IRA contributions and rollover of basis amounts from designated Roth accounts. A designated Roth account can be a Roth 401(k), Roth 403(b), or governmental Roth 457(b) account. All an individual’s Roth IRAs (not including beneficiary Roth IRAs) are aggregated and treated as one to determine an individual’s total amount in Layer 1. Distributions from Layer 1 are tax-free. 2. Layer 2 consists of qualified rollover contributions. (See above under Step 1: Determine if the Roth IRA Distribution Is Qualified). Distributions from Layer 2 are tax-free. However, if the distribution occurs before the Roth IRA owner is at least age 59½, it is subject to a 10% early distribution penalty tax unless the distribution qualifies for an exception. One of the exceptions is Five-Year Rule Number Two. Under Five-Year Rule Number Two, the five-year period starts January 1 of the year the qualified rollover contributions are done and applies separately to each year. All of an individual’s qualified rollover contributions (not including rollovers to beneficiary Roth IRAs) are aggregated by year to determine an individual’s total amount in Layer 2. Example: 45-year-old Tara converted $75,000 from her traditional IRA to her Roth IRA in 2018, and $25,000 from her SEP IRA to her Roth IRA in 2018. This is a total of $100,000 for 2018. Tara also converted $50,000 from her traditional IRA to her Roth IRA in 2023. The $100,000 2018 conversion will be distributed before the $50,000 2023 conversion. Scenario 1: If Tara distributes the $100,000 in 2023, it will not be subject to the 10% early distribution penalty because it would have been at least five years since it was converted to her Roth IRA. Scenario 2: If Tara distributes the $100,000 and the $50,000 in 2024, only the $50,000 would be subject to the 10% early distribution penalty because it would not have been at least five years since it (the $50,000) was converted to her Roth IRA. The 10% early distribution penalty would be waived if Tara qualifies for an exception. One would only get to Layer 2 once the entire amount in Layer 1 is distributed. 3. Layer 3 consists of earnings accrued in the Roth IRA and the earnings portion of a nonqualified distribution from a designated Roth account. All of an individual’s Roth IRAs (not including beneficiary Roth IRAs) are aggregated and treated as one for purposes of determining an individual’s total amount in Layer 3. One would only get to Layer 3 once the entire amount in Layer 2 is distributed. The road to tax-free Roth IRA distributions. The goal of saving in a Roth IRA is to get tax-free distributions—including no 10% early distribution penalty. If one cannot wait until one is eligible for a qualified distribution, the next best strategy is to ensure withdrawals consist only of amounts from Layer 1 as those amounts would be tax-free and penalty-free. For Layer 2, one could wait five years to avoid the 10% early distribution penalty on distributions if one is under age 59½ and does not qualify for an exception. For earnings, the only way to avoid income tax is to ensure the distribution is qualified. However, the 10% early distribution penalty can be avoided if one qualifies for an exception. To find out if your Roth IRA distribution is taxable, please reach out to Brien or Laurie, Brien@TraditionsWealthAdvisors.com Laurie@TraditionsWealthAdvisors.com or 979-694-9100. As you can see, there are definite advantages to both approaches. Starter homes are more likely to be cheaper and allow you to start building equity sooner, but you may outgrow them. A forever home will probably be much more in terms of your monthly payment, but you’ll have a space with more of what you want and a lasting place to build a life for yourself. Check with your financial professional first before making this large purchase and feel free to ask questions to Brien@TraditionsWealthAdvisors.com

Source: https://www.rate.com/resources/starter-home-vs-forever-home?utm_source=RAC&utm_medium=Email&utm_campaign=gri-november-2023-topical-rps&utm_content=november-monthly-topical-rp-gri&utm_term=ForeverHomeCTA&loid=17379&adtrk=|Email|RAC|gri-november-2023-topical-rps|november-monthly-topical-rp-gri|ForeverHomeCTA| Overall the economic reports last week were positive for equities, even though bond yields rose after their very steep decline over the last two months. Data was trending soft recently—not recession level but indicating soft activity. That tone reversed last week.

Then the labor market report last Friday confirmed underlying health. The new jobs number came in pretty much with expectations, except the unemployment rate which dropped from 3.9% to 3.7%. This drop of unemployment is why bond yields jumped over 10 basis points (bps). Year-over-year wage growth was 4% but given how strong the productivity numbers have come in, this is not inflationary. In fact, unit labor costs are negative this year, so I do not regard data on the labor front as inflationary. I also like that the labor participation rate ticked up one tenth—this brings in further slack and lowers wage pressures. The household jobs report was also very strong, reversing some of the losses in the previous month. Of course, that report is much more volatile because of the smaller sample size. We also received really good numbers from the University of Michigan Consumer Sentiment surveys. One-year inflation expectations dropped from 4.3% to 3.1%—one of the biggest one-month drops in this survey I have ever seen. The five-year inflation expectations dropped from 3.1 to 2.8%. So, a cautionary tale: don't put any credence in the one-year-ahead forecast of the FOMC(Federal Open Market Committee). Jerome Powell (Chair of the Federal Reserve) will want to keep optionality of raising rates, particularly if there is a hot inflation report. But the data—commodity prices, oil prices and everything else—do not look inflationary. The primary risk to equities in the first half of 2024 is a Fed that remains too stubborn to see the downward inflation path. If Powell is overly stubborn, we could see up to a 10% correction in the first half of the year, but I expect 2024 to close fairly strong once the Fed finally gets it. The technicals of the market currently look quite strong, and I see December continuing these positive trends. I see the 10-year Treasury not going much below 4% and Fed funds rate down to 3.5% by year end. Given what I see for earnings, I think the equity market is poised to perform well, and while I expect the productivity trends from advances in technology to support real economic growth, there could be a broadening participation in equity markets beyond the Magnificent 7 tech stocks. ----------------------------------------------------------------------------------------------------------------------------------- The above article is commentary from Professor Jeremy Siegel a world-renowned expert on the economy and financial markets. Siegel is the winner of dozens of awards for his research, writing, and teaching. He served for 15 years as head of economics training at JP Morgan and is currently the academic director of the U.S. Securities Industry Institute. The world of retail used to explode the day after Thanksgiving. To shoppers of a certain age, the term “Black Friday” used to mean a lot of things, including early mornings, long lines, and near-riots in store aisles. But since the rise of ecommerce, Black Friday turned into Cyber Monday. Lately, there have been more and more days throughout the year that see online retailers holding large price markdowns, but Cyber Monday still reigns supreme. With all of the pomp and circumstance around online shopping and deal days, you need to be prepared. It’s easy to be distracted by all of the emails and ads you see about sales and end up buying things you don’t want, or even worse, grabbing items that aren’t even discounted. Check out these Cyber Monday strategies: 1. Give yourself a Cyber Monday budget 2. Identify your targets 3. Bookmark your online stores 4. Follow your stores on social 5. Sign up for newsletters 6. Look for gift codes first 7. Know your return policies 8. Automate price comparison 9. Avoid suspicious sites 10. Shop privately 11. Use a rewards card if you have one 12. Finally, keep an eye on your accounts Each year, Cyber Monday changes and evolves. As this is written, there’s no telling what tech trends will get the most deals and which retailers will offer the most markdowns. That’s why it’s so important to start with a strategy that can help you maximize your deal making ability and set yourself up to be most impressive gift giver this holiday season.

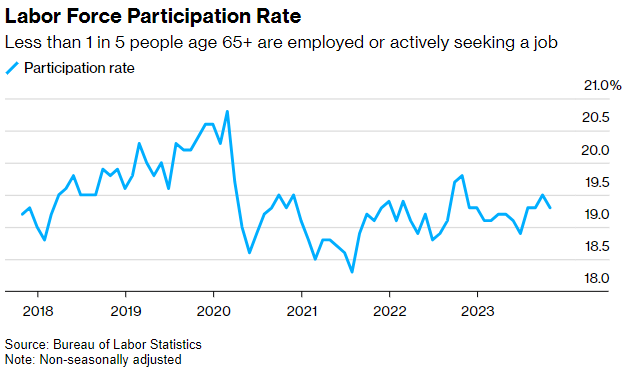

To find out more details on each of the above tips, visit https://www.rate.com/resources/cyber-monday-strategies More than three-and-a-half years after COVID struck, the U.S. still has around 2 million more retirees than predicted, in one of the most striking and enduring changes to the nation’s labor force. The so-called, 'Great Retirement,' induced by COVID-19 is evident in the divergence between the actual number of retirees and that predicted by a Federal Reserve economic model. While down from a 2.8 million gap late last year, it remains elevated today and has even risen from 1.7 million in June. Before the pandemic, the participation rate for workers age 65 and older reached 20.8% before dropping two-and-a-half percentage points by July 2021. The rate has since risen a percentage point to 19.3% but remains well below the pre-pandemic high. The lack of older workers is creating some shortages. In Michigan, a state law was tweaked to make it easier for teachers to “un-retire” without risking their pensions.

Before this summer’s rise in excess retirees, there was speculation that a whole “un-retirement” wave was under way, but that seems to have not been the reality. For many older Americans, leaving the labor market is a one-way street. While many may miss the routine and stimulation and want to resume work for financial reasons, rejoining the workforce can be difficult. Skills decline, work connections rapidly fade and job-seekers may confront an age gap, all making it harder for many older workers to find a job. In 2022, the mean duration to find a job for people age 65 and older was 31.6 weeks, 9 weeks longer that the overall average. Before the pandemic, from 2017 to 2019, roughly 3% of retired workers on average ended up having a job a year later. Source: https://www.bloomberg.com/news/articles/2023-11-06/us-retiree-surplus-is-still-near-two-million-years-after-covid?utm_source=website&utm_medium=share&utm_campaign=email&leadSource=uverify%20wall#xj4y7vzkg Government Shutdown

Budget deficit

Source: https://www.cato.org/blog/cbo-budget-economic-outlook-post-covid-fiscal-era https://www.reuters.com/markets/us/moodys-changes-outlook-united-states-ratings-negative-2023-11-10/#:~:text=%22It%20is%20hard%20to%20disagree,burden%20will%20continue%20to%20grow.%22

Here are three factors to consider when making charitable donations:

There are more than 1.5 million nonprofit organizations in the United States. With a little planning, helping some of these groups achieve their missions can also have the additional benefit of tax savings for you. Source: https://www.capitalgroup.com/ria/insights/articles/giving-and-receiving-3-tips.html The current economic climate is facing higher inflation than previously expected, as indicated by increases in both the Producer Price Index (PPI) and Consumer Price Index (CPI). PPI indicates the cost of production from a producer standpoint while CPI reflects cost of living for consumers. On October 12th, CPI was reported to rise 0.4% on the month, above 0.3% forecast. The PPI increased 0.5% for September, against the estimated 0.3% rise. Several factors are contributing to this inflationary trend, including the persistent high cost of oil due to OPEC’s supply restriction and corporate consolidations in the oil sector, ongoing labor strikes, and a highly competitive job market. Federal Reserve Chairman Powell, in his address on October 19th, offered limited insight into the Fed’s outlook, but highlighted prevailing uncertainties. Due to elevated inflation, Powell hinted at the possibility of maintaining the current interest rate of 5.25% - 5.50% at the November 1st meeting further extending the period of high interest rates. The Federal Reserve, adopting a cautious stance, is prepared to reassess the situation during their meeting on December 13th if necessary.

Adding to the complexity is the ongoing conflict in the Middle East. A seminar hosted by Fidelity (script available in the source section) emphasized a probable escalation of tensions between Israel and Palestine due to the decisive determination of removing Hamas-controlled Gaza. The problem is rooted in the complex territorial landscape of Gaza. Twenty-five-mile land encompassing 2 million people, operates on two distinct levels. The first is the visible, densely populated urban area that exists on the surface. The second is the "subterranean" Gaza, an underground region primarily utilized for weapon manufacturing. Since the area is heavily urbanized, this possess a challenge to the Israeli army when it comes to deterring terroristic group while preserving lives of all civilians. An escalation is said to cause supply chain disturbance causing the oil prices to increase back to September levels. On October 19th, oil prices saw a moderate increase of 2.47%. With the situation evolving, a short-term gradual uptrend is anticipated within the industry. Despite losing their relevance, the monthlong auto strikes are continuing with union demand for substantial pay and benefits. Although production and revenues are impacted, a resolution is anticipated once demands are met, marking a pathway to recovery. Overall, the Federal Reserve is exercising caution. The risk of over-tightening is balanced with the need for inflation control. The Fed is likely awaiting October's CPI and PPI data to gain clearer insights into inflation trends. Despite energy market fluctuation, there is a promising sign in real estate. With the 10-year note yield above median cap rate, bonds offer more attractive returns. This gives an opportunity for investors to reallocate assets and “meet” the supply of bonds thus creating an equilibrium in which supply equals demand. This would bolster confidence in government fiscal policy and economic stability, potentially eliminating the need to raise interest rates. However, at Traditions Wealth Advisors we have diversified your portfolios well to buffer against inflation and protect against geo-political events like Israel and Ukraine. Source: https://www.crossmarkglobal.com/wp-content/uploads/A-Message-from-Bob-Ramifications-from-Middle-East-War.pdf https://institutional.fidelity.com/app/literature/item/9910988.html |

Archives

April 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email Michael@TraditionsWealthAdvisors.com

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|