What is a certified financial planner?

What is a Certified Financial Planner, or CFP?

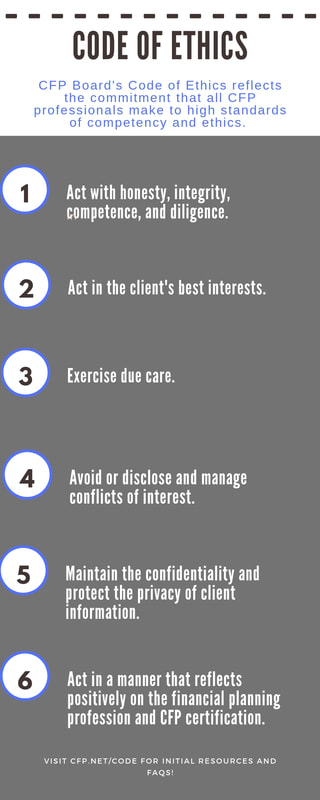

This is a title recognized by the International Board of Standards and Practices for Certified Financial Planners. A Certified Financial Planner (CFP) must pass a rigorous series of exams and enroll in continuing education classes. Knowledge of estate planning, tax preparation, insurance, and investing is required. A CFP is committed to their professional responsibility of ethical behavior when providing financial advice and must abide by the CFP Board’s Code of Ethics (see diagram below) and Professional Responsibility and Planning Practice Standards.

How do I know if I can benefit from a Certified Financial Planner managing my finances?

These are the questions you need to ask yourself: Do you have time to devote to the maintenance of your finances? Do you possess a comprehensive and thorough knowledge and experience in finance, economics, taxation, insurance, and estate planning? Do you keep abreast of new information and developments in a dynamic industry? Can you make objective decisions of your own future without allowing emotion to influence those decisions?

*Only if you answer affirmatively to these questions, we would suggest that you can effectively manage your own finances.