|

If you are approaching retirement or already there, here are 5 rules of thumb to help manage your income.

1. Plan for health care costs With longer life spans and fast rising medical costs it is important to manage your health care costs during retirement. An average retired 65 year old couple may need approximately $295,000 to cover health care expenses in retirement. About 70% of those aged 65 and older will need long term care services either at home or in assisted living. Consider purchasing long-term-care (LTC) insurance and the earlier you purchase a policy the lower the annual premium. It is important to research the company you select and the potential LTC options and costs. 2. Expect to live longer It is quite likely that today’s healthy 65-year-olds will live into their 80s and 90s. This means you may need 30 or more years of retirement income. It is important to plan ahead so that you do not outlive your savings and depend on social security. On average, social security income is only $1500 a month which may not cover all of your needs. 3. Be prepared for inflation Inflation affects your retirement income by increasing the costs of goods and services. Choose investments that have the potential to keep up with inflations. An age-appropriate, diversified portfolio that reflects your risk tolerance and financial circumstance is important and can be discussed further with your financial planner. 4. Position investments for growth Being too conservative or too aggressive in your investments can affect how long your money may last. An investment strategy that is balanced in growth potential and risk may be the answer. Build a mix of stocks, bonds, and short-term investments. Diversification and asset allocation is ideal but does not ensure a profit or guarantee against loss. 5. Don’t withdrawal too much from savings Consider conservative withdrawal rates so you don’t spend your savings too rapidly. To make sure your savings will last for 20-30 years, consider withdrawing no more than 4%-5% from saving in the first year of retirement, then adjust that percentage for inflation in future years. After many hardworking years spent saving and planning for retirement, it can be stressful to change from saving to spending that money. It doesn’t have to be that way when you take these steps leading up to and during retirement. Contact Traditions Wealth Advisors at [email protected] or 979-694-9100 for questions or comments about your retirement portfolio. Source: 29 September 2020. Fidelity Viewpoints. https://www.fidelity.com/viewpoints/retirement/protect-your-retirement-income?ccsource=Twitter_Retirement&sf241687220=1

0 Comments

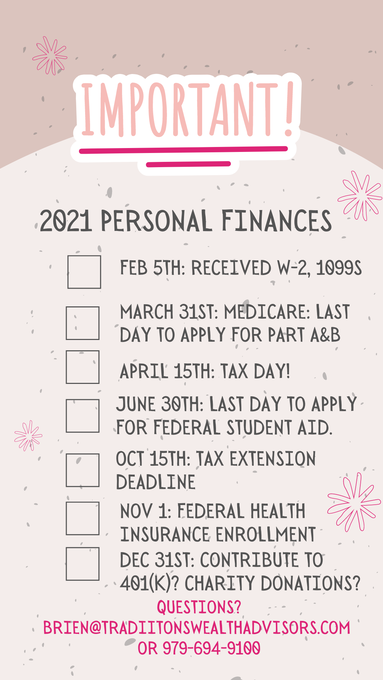

The year is flying by and you might have forgotten half of your resolutions. If you are thinking it is time to get back on track with your financial goals, use these important dates to help you. Get out your electronic or paper 2021 calendar, and click the button below to mark down these dates.

|

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|