|

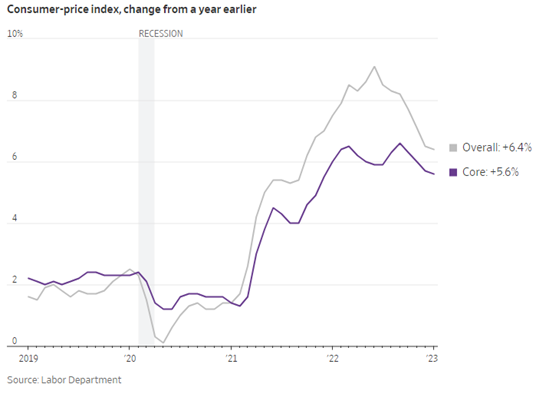

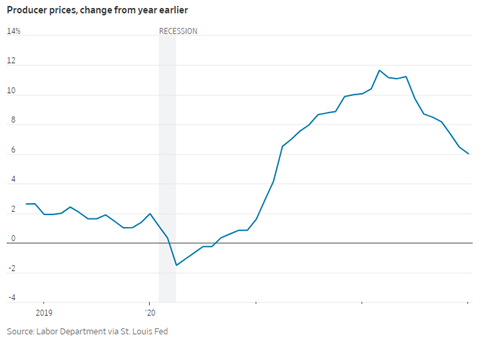

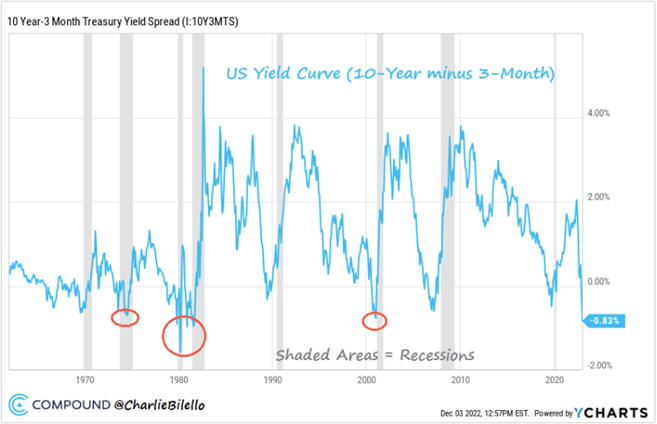

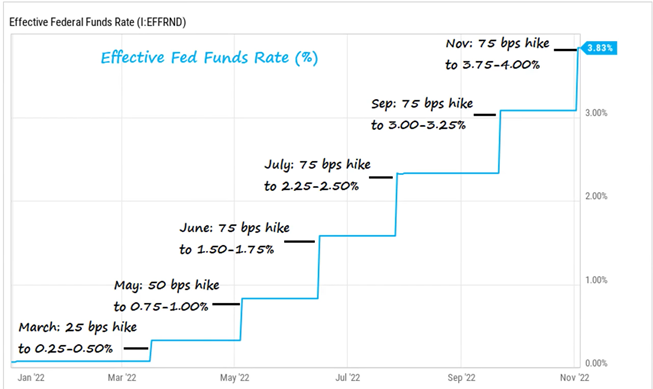

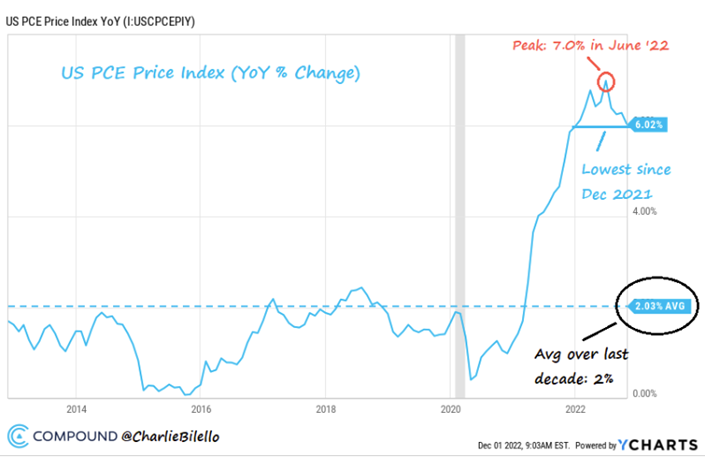

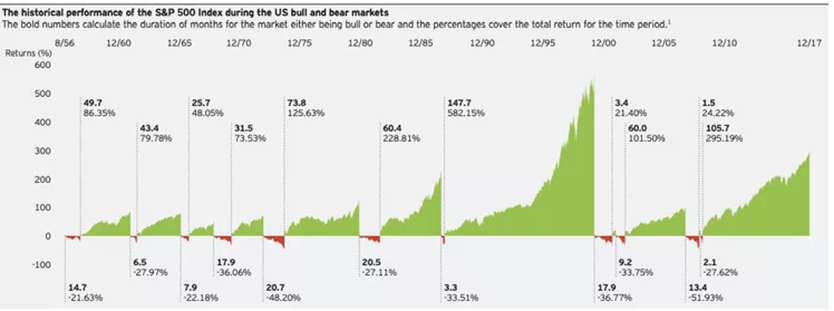

2022 was an interesting year to say the least. We saw rampant inflation from increased COVID spending and a decade of low interest rates finally come full circle, hurting the markets this past year. It appears that the Federal Reserve’s policy is starting to help the economy, but many analysts and economists believe that the worst is yet to come. Luckily, the upcoming recession is expected to be much shallower and “easier” than previous recessions. Federal Reserve Chairman Jerome Powell has been very transparent with the public on his goal of taming inflation, and analysts expect him to continue his course of action through interest rate hikes to achieve this goal. I know that 2022 was a challenging year for the financial markets in general. We saw a large decline in the value of stocks, bonds, and most other assets. Pair this with high inflation, supply chain issues, and other socioeconomic issues with Russia and Ukraine and it is easy to see why this year has been particularly stressful for Americans. Based on a macroeconomic perspective our economy is currently in the late cycle of the Business /economic cycle. This is the period before a recession where GDP growth moderates, credit tightens, the government uses contractionary policy to slow growth, and business inventories grow while sales growth falls. Other signs of a looming recession are seen in The Chicago PMI (a measure of manufacturing activity) which has only been this low in the past recession (last in 2009, before that in 2008-2009). The inverted yield curve in the bond market has also signaled a recession as the yield curve continues to fall deeper into territory, with the 3-Month Treasury bill yield now 0.83% higher than the 10-year Treasury bond. In the last 60 years, the only periods with equal or greater inversion include 2000 (recession in 2001), 1979-1982 (recessions in 1980,1981-1982), 1974 (recession in 1973-1975). It is hard to forecast exactly when Jerome Powell will ease monetary policy and lower interest rate hikes because it takes time for interest-rate changes to slow the economy and even longer to influence inflation. Jerome Powell stated himself, “if you’re waiting for actual evidence that inflation is coming down, it’s very difficult not to over-tighten. We think that slowing down at this point is a good way to balance the risks.” Policymakers expect price pressures to ease meaningfully next year, but brisk wage growth or higher inflation in labor-intensive service sectors of the economy could lead more of them to support raising their benchmark rate next year above the 5% currently anticipated by investors. A 50-basis point rise this month would bring the benchmark federal-funds rate to a range between 4.25%-4.5%, the highest level since December 2007. Most officials in September penciled in rates rising to between 4.5% and 5% next year. That landing zone could rise to between 4.75% and 5.25% in new projections. According to New York Fed President John Williams this is due to “Stronger demand for labor, stronger demand in the economy than I previously thought, and then somewhat higher underlying inflation suggest a modestly higher path for policy relative to inflation. Not a massive change, but somewhat higher.” As of now, Jerome Powell has stated that we will see a rate hike of 50 basis points at the next FOMC meeting in December. This is a good sign as rate hikes have been 75 basis points for every meeting since June. Expectations For 2023: Looking forward into 2023, we expect the Fed to continue with its interest rate hikes in February. If inflation slows but the labor market stays tight, they could be more divided over how to proceed. As of now the, Fed has stated that it is lowering interest rate hikes from 75 basis points to 50 basis points on the evidence that its monetary policy is starting to work. Inflation come down moderately so far. We’ve seen most asset prices drop, as interest rates and the dollar moved sharply upward. Looking to the future, most analysts and economists agree that the markets will continue to be affected by slower liquidity growth, persistent inflation risk, slowing growth momentum, and greater monetary policy uncertainty which will cause continued elevated volatility. Researchers from Bank of America / Merrill Lynch have a year-end target for the S&P 500 at around 4000, as of 12/6/2022 it is trading around 3960. However, the market typically bottoms out 6 months before the end of a recession so there is likely more room for stocks to fall. Luckily, this recession is expected to be shallower due to companies and consumers strong balance sheets so it shouldn’t be comparable to harsher previous recessions such as the great financial crisis and the recession of the 1970s. It is important to remember that Bull markets last much longer and produce much higher returns than bear market length and losses. Therefore, keeping your money invested for the long term is the most efficient form of investing compared to trying to time the market.

0 Comments

As we close out 2022 and ring in 2023, there are some choices you can make to possibly lower your taxes. Consider these tips before year-end to help your 2022 taxes and beyond.

1. Contribute to tax-advantaged accounts. You must make your final contributions to a 401(k) or 403(b) by December 31st. You can contribute up to $20,500 before taxes. If you're 50 or over, you can make additional catch-up contributions of $6,500. That money reduces your taxable income dollar for dollar. And don't forget about health savings accounts (HSAs) if you have a high-deductible health plan. While you have until the April tax filing deadline to contribute, you can put away up to $3,650 for an individual and $7,300 for a family. 2. Consider a Roth. Transferring money in a traditional IRA to a Roth IRA is another tax saving tip. You'll pay taxes on the converted amount, but then the money has growth potential and can be withdrawn tax-free, and it isn't subject to a required minimum distribution for the life of the owner. Why consider a Roth IRA conversion now? First, with many investments down this year, you can convert more shares for the same total amount and same potential tax bill. Also, tax rates are set to increase in 2026, so you could end up paying higher rates later on conversions. 3. Defer some income. If you have freelance income, you could delay billing for your services until next year. Speak with your accountant to be sure if this is a good option for your situation. 4. Donate appreciated assets. Itemizers can also donate appreciated assets held longer than one year to a qualified public charity and deduct the fair market value of the asset without paying capital gains tax. The donation is subject to a 30% adjusted gross income (AGI) limitation. 5. Consider gifting to loved ones. You can gift up to $16,000 per recipient to as many people as you like. While you don't get an income tax deduction for such gifts, the recipient won't owe taxes, and the gift can help reduce the value of your estate, without using up your lifetime gift and estate tax exemption. Want to hear more year-end tax tips? Click on this link for more details and tips: Top Tax Tips for 2022 or contact our office at [email protected] or 979-694-9100 with questions. |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|