As a Financial Analyst Intern, Brian served as one of Traditions Wealth Advisors’ financial researchers. His research has centered primarily on macroeconomic and monetary policy topics using econometric methods to separate trends from noise. He is quantitatively driven, thorough, and loves working with data. Brian is a graduating senior and will be receiving his bachelor's degree in Economics with a minor in Mathematics in May of 2019. Post-graduation, Brian will obtain a master's degree in Applied Mathematics before ultimately pursuing a PhD in Economics. It is his dream to become an economist researching questions surrounding finance, macroeconomics, and monetary policy. He hopes to develop models which allow people to better understand the intersection of these complex topics. In addition to his work with Traditions Wealth Advisors, Brian is a Research Assistant for two professors in the Department of Economics and a member of the Aggie Investment Club. When he is not in the office or on campus, he is most likely spending time with friends, frequenting a coffee shop, or doing something outdoors.

0 Comments

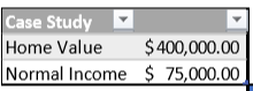

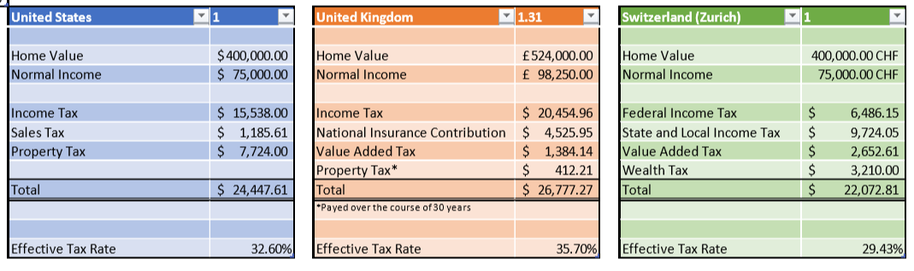

Raoul Bascon Financial Computing Intern Brien Smith CFP Traditions Wealth Advisors Owner With Tax Day just behind us, you may have to suffer with friends and family grouching about their taxes. And the new tax plan that went into effect last year make this time of year even more relevant. Our friends across the pond react similarly to their taxes. Which begs the question, who has it worse? We’ll take a look at three nations—the UK, Switzerland and the US—and compare what’s coming out of our paychecks this year. United Kingdom The United Kingdom implements a fairly aggressive taxing paradigm. While just as nuanced and confusing as the US tax code, the UK code differs in key ways. First, taxes are taxed on a national level— there are no state taxes (although, Scotland has a different marginal tax rate table, but the funds still all funnel into the HMRC, which is the British equivalent of the IRS). Second, the tax applies to different categories of goods, services and holdings. Third, the rates differ as well. The main points of difference in strata of taxes include a savings tax, which taxes income from savings; employee benefits tax, which taxes the value of benefit an individual receives from a company; value added taxes (VAT), which act as sales tax but applies differently; and National Insurance Contributions (NICs), which supplies the funds for the UK’s National Insurance. Switzerland Taxes in Switzerland are very similar to those in the US. Taxes are collected at three levels: confederation, cantons, and communes (loosely equivalent to federal, state and local levels). The key differences in the code include a value added tax, which is similar to the UK’s; a withholding tax, which taxes certain forms of investment income (notably: dividends, interest on loans, lottery payments); and stamp duties, which tax income from trading securities. Like the United States, the different cantons and communes (states and municipalities) have varying taxing schemes for the citizens of their region. Of note, some cantons do not have property taxes, but all have a wealth tax that is implemented on all real assets. Example Suppose the same individual who has a salary of $75,000, living in a house worth $400,000 is calculating his taxes in the US, the UK, and Switzerland. The appropriate exchange rates have been considered. What do the numbers say? Overall, Switzerland seems to have the lowest effective tax rate, making it the least painful place to live from a tax perspective. It is important to note that this analysis only takes into account taxes that relate to salary, normal consumption, and real estate assets. The example does not include taxes on investments for retirement or taxation on corporations, which may heavily differentiate the three countries. Happy Travels!  Sarah Buenger, director of financial planning at Traditions Wealth Advisors, will be speaking at this workshop on May 17th. It is a FREE financial and estate planning event for women of ALL ages. Find out more and register here. April 15, 2019

Michael Maerz Client Services and Marketing Director Whether you plan to stay put or move for retirement, you must answer these questions if you hope to enjoy a high quality of life. It's fun to dream and enjoy reading lists of the best places to retire. Do not let the pictures and the lists of places flood your mind as to rush into retirement. The questions below insightfully help you determine if any of your dream (retirement) places will work for your retirement. 1. Who will help care for me? No one wants to burden children or friends. But, in reality, loved ones often must step up when elders need care. So, make things easier for your kids and be realistic when you make a move. Adult children who are holding down jobs and rearing children will be severely burdened if they must travel long distances to help elderly loved ones. 2. Is good medical care nearby? Living longer usually means living with a chronic disease. About 80 percent of older adults have at least one chronic disease, according to the nonprofit National Council on Aging. And 77 percent of older Americans have two or more (source). With age, medical tests become more frequent. So do visits to specialists like oncologists, cardiologists, pulmonologists and orthopedists. Managing a chronic condition well — avoiding hospital stays and emergency room visits — requires easy access to care you trust. The joys of living in a scenic but remote retirement mecca are diminished if you have to drive hundreds of miles — frequently — for expert care. So again, consider not only what you need today but what you’ll need in the future. 3. How safe is this place? Research crime rates in the area before deciding to relocate there. You’ll find plenty of free tools online. Check data from local law-enforcement agencies. Some departments post their crime data online. Do a web search for words like: “College Station (choose your city) police department crime statistics.” Look also for maps showing the prevalence of crime by area, and look for local news reports about crime in the city or town. If you strike out searching online for crime data, call the local law-enforcement agency and ask how to learn about crime in specific neighborhoods. Visit neighborhoods you’ve got your eye on numerous times at various times of the day and evening, as well. 4. How will I get around if I can’t drive? At some point in their elder years, drivers have to face a hard truth: It may be time to hang up the car keys.

Considering retirement? Contact Brien L. Smith, CFP® at Traditions Wealth Advisors [email protected] for questions about retirement or other financial advice you may have. Source: Marilyn Lewis • December 30, 2018 |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|