Now that you have started making your 2022 resolutions such as to eat healthy, exercise more, and do more for the community, it is time to act on your finance resolutions. Maybe you made finance goals at the end up 2021, but let's tune them up and make sure you are set for 2022. Here are some tips to accomplish your finance goals: 1) Stay current on student loans. Pay the minimum monthly payment and use extra money to invest. 2) Not all debt is bad. "Being debt-free doesn't give you a great credit score. Being responsible with debt gives you a good credit score," Jacquette Timmons added. "Use your credit card. Pay it off fully at the end of the month. You don't have to go into debt. Companies just want to see that you pay your bills." 3) Reflect on 2021 in order to make changes for 2022. Where am I at with my investments? What kind of savings do I want to have? What am I saving for? What worked, what didn't work, what lessons did you learn? If you aren't already, start tracking your finances; there are many apps to help with that. Look for financial patterns. What's the point of moving forward if you're not being intentional? You want your financial decisions to support your goals. 4) Keep an emergency savings account, but cap it. Emergency savings accounts are great. Put the money in the highest interest-bearing account you can find and still keep it liquid. Cap that emergency account between 3-6 months of fixed expenses and invest after that. Maybe you have an account for emergency situations, another for a goal you are trying to reach. Timing is a good way to determine if you should keep your money accessible. If your goal is going to be achieved in 0-5 years, that needs to stay liquid. If your goal is more than 6 years away, then you can invest it and look for a higher return. If you need help making your finance resolutions, don’t hesitate to schedule a meeting with Brien Smith at Traditions Wealth Advisors or call 979-694-9100. Farrell, Chris, and Kelly Gordon. ‘How to Make Personal Finance Resolutions for 2019’ 29 December 2018, https://www.mprnews.org/story/2018/12/26/personal-finance.

0 Comments

Dear Clients,

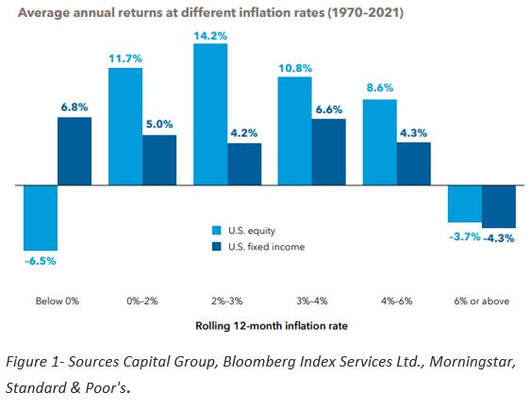

It seems like just yesterday our biggest fear was surviving through Y2K (Year 2000). That was 22 years ago, and I believe we all came through it unscathed. Since then, we have seen many trends in the stock markets. Some were welcomed, others we would like to forget. We now have Aggie interns working in our office who were born in 2000 (or later!) and probably do not know what Y2K is! This past year the world was shaken by two variants of COVID-19. While these variants seemed to place the world in fear (as did Y2K), I’m happy to say, we have heard of no serious effects for our clients or staff. To this we say…God is good! In the past my resolutions have been to appreciate all that is around me, choose what I say and do to positively impact lives, learn something new quarterly, do more for the community, and live a healthier life style. While these resolutions have been beneficial, I would like to suggest you join me in simplifying and narrowing down your resolutions. Instead a list of resolutions that might be difficult to achieve, why not have 1 or 2 that you can complete? We are still paving our way through a pandemic. It is important make your resolutions attainable. Share these goals with an accountability partner who can check in with you periodically on how you are doing. You won’t be perfect. At times, life will get in the way. That’s ok. Just keep coming back. You may not accomplish your resolutions right away, but with persistence, you’ll see success. As we navigate the new year together, I look forward to our growing friendship and pray for good health for us all. As always, I’m honored and humbled that you have given me the opportunity to serve as your financial advisor. Best wishes for a happy, healthy, and prosperous New Year. Brien L. Smith, CFP® Sarah D. Buenger, MPAS®, MSPFP, CFP® Traditions Wealth Advisors  What to expect: As 2021 comes to an end, Traditions Wealth is actively researching all possible scenarios that the financial markets will bring in 2022. The risks we are watching closely are inflation and increasing interest rates combined with federal reserve policy changes. It seems everyone was talking about inflation in 2021. The federal reserve started its inflation stance as being “transitory”, while quickly adapting to a “non-transitory” stance in the latter half of 2021. Supply chain issues coupled with rising wages make us believe that inflation will not be going away anytime soon. The latest 12-month reading of the Core-CPI, which is a measure of consumer prices without accounting for food and energy prices, was 4.9%. The latest 12-month reading of CPI-All Items increased 6.8%. We are going to be watching closely the CPI reading for December 2021, which is scheduled for January 12th, 2022. If this reading is higher than consensus, we may see some turbulence in the markets. Our research indicates that the Federal Reserve will start to increase interest rates in 2022 as most of the Federal Reserve board members anticipate three rate hikes. This does not come as a surprise as the loose-monetary policies the Fed implemented during the COVID-19 pandemic era are now not necessary. The U.S. economy has bounced back from its pandemic lows. Unemployment is near pre-pandemic levels with more job openings than in 2019 and 2020. In addition, fewer people are filing for unemployment insurance. These are all signs that the U.S. economy is recovering. How does this affect investments? I know that most of you are wondering how this information will affect your investments. We’re watching the inflation reading for December 2021 closely as increased inflation has historically proven to cause markets to be volatile. Figure 1 below depicts how inflation has affected average annual returns at different inflation rates from 1970-2021. As you can see from the chart, higher rates of inflation have caused both equities and fixed income to have negative returns. Some investments do, on average, act as an inflation hedge, which are TIPS (Treasury Inflation-Protected Securities). Sectors that have historically done well during inflationary periods are the energy and materials sectors. Increased interest rates will influence all asset prices. As interest rates rise, this could hinder equities as borrowing becomes more expensive and economic growth slows. Some money managers are drawing comparisons to 2018, in which the U.S. economy slowed due to Fed tightening of fiscal and monetary policy. Some ways to combat this are to rotate into more defensive sectors, which include banks, staples, and utilities. For any questions, please don’t hesitate to contact me at [email protected] or (979) 694-9100. |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|