|

What Russia Invasion of Ukraine could mean for U.S. Markets? Find out more here: https://mailchi.mp/fe54d3a88a9f/ukraine-impact

0 Comments

Special Edition newsletter sent to clients on Saturday, February 19, 2022:

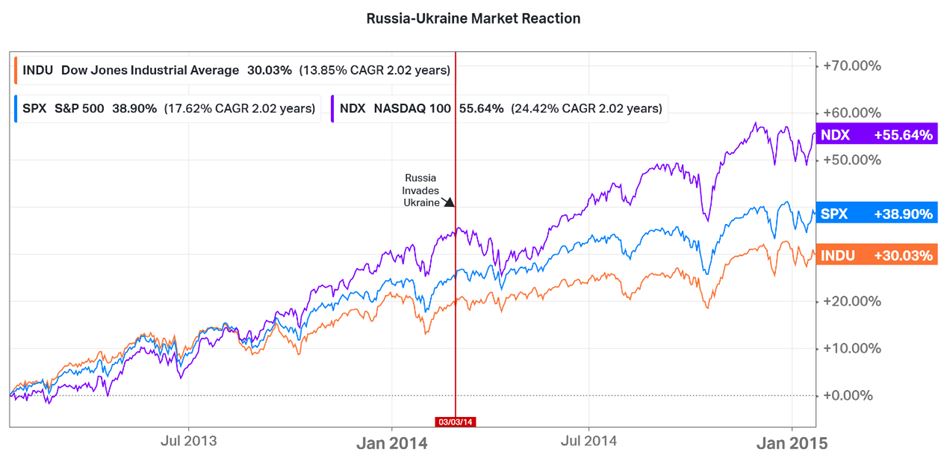

Remain Calm about Investments during this Ukraine Crisis  Current Event: Russia has gathered over 100,000 troops near Ukraine’s borders. The U.S. has responded by deploying an additional 3,000 troops to Eastern Europe. One-third of deployed US troops will be going from Germany to Romania. The other two-thirds will be moving to Germany and Poland. When it comes to energy production, Russia is one of the largest producers in the world. They export over 5 million barrels of oil per day (eia.gov). Analysts are concerned that if Russia invades Ukraine, then this will shift oil prices above $100 a barrel. Meanwhile, Europe obtains about one-third of its natural gas from Russia. Therefore, causing European countries to lean harder on Americans for fuel shortages caused by the Russia-Ukraine invasion. This would have a significant impact on inflation considering energy is an important driver of inflation. This chart shows the market’s reaction to the 2014 Russia invasion of Ukraine. Slightly after the initial invasion, the markets slid about 25% throughout the next month. Inflation: It seems everyone was talking about inflation in 2021. The Federal Reserve started its inflation stance as being “transitory”, while quickly adapting to a “non-transitory” stance in the latter half of 2021. Supply chain issues coupled with rising wages make us believe that inflation will not be going away anytime soon. The latest 12-month reading of the Core-CPI, which is a measure of consumer prices without accounting for food and energy prices, was 6%. The latest 12-month reading of CPI-All Items increased 7.5%. We are going to be watching closely the CPI reading for February 2022, which is scheduled for March 10th, 2022. Interest Rates: The Federal Reserve plans to start the interest rate hike sometime this year. Increased interest rates will influence all asset prices. As interest rates rise, this could hinder equities as borrowing becomes more expensive and economic growth slows. Some money managers are drawing comparisons to 2018, in which the U.S. economy slowed due to Fed tightening of fiscal and monetary policy. Some ways to combat this are to rotate into more defensive sectors, which include banks, staples, and utilities. As for bonds, rising rates will cause their value to decrease. It is known that bond yields and prices move in the opposite direction. Therefore, the expected rate hikes this year could cause longer-term bonds to lose value. One way bond investors fight against rising rates is by considering bonds with shorter durations. The shorter a bond’s duration, the less sensitive it is to interest rate hikes. Foreign Investments: Global equities found strong returns in the 4th quarter and double-digit returns for the calendar year. The best returns typically arose from European holdings; financials, pharmaceuticals, consumer staples, and machinery. With the end of 2021, JP Morgan Chase continues to favor US, Europe, and Japan equities but remains skeptical on emerging markets. In 2022, they expect to see above-trend global growth, with upside to earnings and a positive outlook for markets. Over the year, foreign currencies declined against the US dollar. Which have helped American consumers with cheaper imports and less expensive foreign travel. Reducing the amount of money you owe in taxes is always an admiral opportunity. Tax credits and tax deductions are two of the ways to reduce this number, although they are not identical opportunities. There are key differences between them in how they work to reduce your total tax liability.

Tax Deductions Tax deductions reduce your taxable income. That is, the amount of your income that gets taxed by the federal government. Reducing this taxable income therefore reduces the amount of taxes that you have to pay for a certain year. The most common form of tax deductions is the standard deduction. The amount of your standard deduction is dependent on your filing status and is adjusted every year. Other available deductions are listed on the IRS Schedule A and Schedule 1 on Form 1040. Many tax deductions do come with certain eligibility rules and restrictions. So, you can’t automatically claim all deductions on your tax return. Be sure to confirm qualification rules with the IRS or a professional tax preparer. Deduction amounts also vary depending on the limit or size of particular deductions. For instance, deduction limits for Traditional IRA and HSA contributions is $6,000. Tax Credits Tax Credits directly lower your tax liability, on a dollar-for-dollar basis. For example, if you end up owing $6,000 in taxes this year and are eligible for a tax credit of $2,000, then your tax credit would lower your tax bill to $4,000. Contrary to tax deductions, the value of tax credits is not tied to your income tax bracket, so a $2,000 credit is worth exactly $2,000 when it comes to how much you save on your taxes. As is the case with tax deductions, you will not qualify for all tax credits you come across, so you must get details from the IRS or a professional tax preparer for any credits that you would like to claim. There are two types of tax credits: refundable and nonrefundable. Refundable tax credits simply mean that any unused amount of the credit will be refunded to you. However, with a nonrefundable tax credit, the amount of taxes you owe can only be reduced up to the amount of your tax credit. Any portion of the tax credit that remains unused won’t be refunded to you. For instance, if you owe $500 in taxes and have a $2,000 nonrefundable tax credit you qualified for, you could use $500 of that credit to bring your tax bill to zero. But the unused $1,500 would be forfeited. It is important to remember that in order to claim tax deductions and tax credits, many eligibility requirements are present. These requirements mean that the IRS expects certain documentation to be provided with your tax return to show that you are indeed qualified to claim them. So, it is important to partake in good tax recordkeeping as well as maintaining contact with the IRS, or a tax professional should you be unsure about a deduction or credit.  Our newest financial analyst intern is Sam Cox class of 2021. Sam was born in San Antonio, Texas and raised in multiple cities including Nashville, TN and Corpus Christi, TX. Sam is a graduate student at Texas A&M University. He is pursuing his Masters in Economics with a Financial Economics concentration. Upon graduation, Sam aspires to work for a capital management firm. Aside from work and school, Sam enjoys playing golf and basketball at TAMU's recreation center. Let's get to know Sam further below:

|

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|