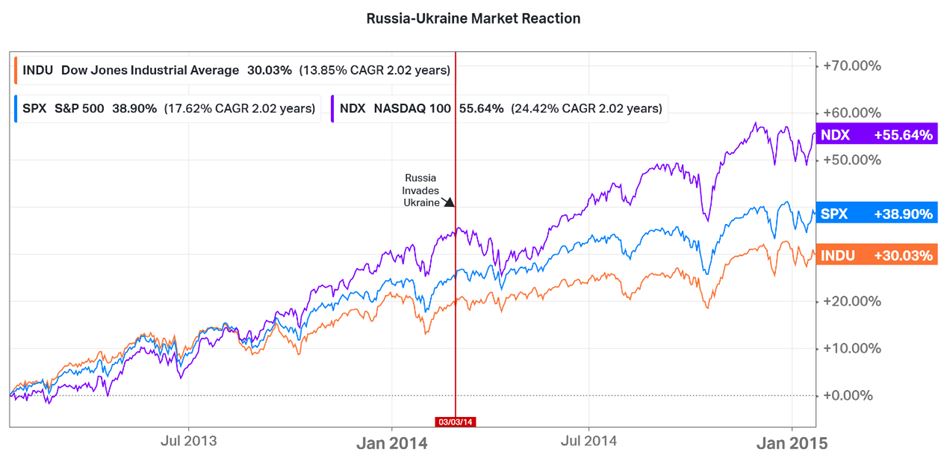

Current Event: Russia has gathered over 100,000 troops near Ukraine’s borders. The U.S. has responded by deploying an additional 3,000 troops to Eastern Europe. One-third of deployed US troops will be going from Germany to Romania. The other two-thirds will be moving to Germany and Poland. When it comes to energy production, Russia is one of the largest producers in the world. They export over 5 million barrels of oil per day (eia.gov). Analysts are concerned that if Russia invades Ukraine, then this will shift oil prices above $100 a barrel. Meanwhile, Europe obtains about one-third of its natural gas from Russia. Therefore, causing European countries to lean harder on Americans for fuel shortages caused by the Russia-Ukraine invasion. This would have a significant impact on inflation considering energy is an important driver of inflation. This chart shows the market’s reaction to the 2014 Russia invasion of Ukraine. Slightly after the initial invasion, the markets slid about 25% throughout the next month. Inflation: It seems everyone was talking about inflation in 2021. The Federal Reserve started its inflation stance as being “transitory”, while quickly adapting to a “non-transitory” stance in the latter half of 2021. Supply chain issues coupled with rising wages make us believe that inflation will not be going away anytime soon. The latest 12-month reading of the Core-CPI, which is a measure of consumer prices without accounting for food and energy prices, was 6%. The latest 12-month reading of CPI-All Items increased 7.5%. We are going to be watching closely the CPI reading for February 2022, which is scheduled for March 10th, 2022. Interest Rates: The Federal Reserve plans to start the interest rate hike sometime this year. Increased interest rates will influence all asset prices. As interest rates rise, this could hinder equities as borrowing becomes more expensive and economic growth slows. Some money managers are drawing comparisons to 2018, in which the U.S. economy slowed due to Fed tightening of fiscal and monetary policy. Some ways to combat this are to rotate into more defensive sectors, which include banks, staples, and utilities. As for bonds, rising rates will cause their value to decrease. It is known that bond yields and prices move in the opposite direction. Therefore, the expected rate hikes this year could cause longer-term bonds to lose value. One way bond investors fight against rising rates is by considering bonds with shorter durations. The shorter a bond’s duration, the less sensitive it is to interest rate hikes. Foreign Investments: Global equities found strong returns in the 4th quarter and double-digit returns for the calendar year. The best returns typically arose from European holdings; financials, pharmaceuticals, consumer staples, and machinery. With the end of 2021, JP Morgan Chase continues to favor US, Europe, and Japan equities but remains skeptical on emerging markets. In 2022, they expect to see above-trend global growth, with upside to earnings and a positive outlook for markets. Over the year, foreign currencies declined against the US dollar. Which have helped American consumers with cheaper imports and less expensive foreign travel.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|