|

Traditions Wealth Advisors Noah Skrudland Financial Analyst Intern 4/28/2022 I. Summary: First Quarter 2022 Two major events overshadowed the first quarter of 2022: the sudden hawkish (high-interest rates) stance the Federal Reserve has announced and the Russia-Ukraine war that has contributed to persistent inflation. On a positive note, the unemployment rate is at 3.6%, which is historically low. Jerome Powell stated that there are 1.7 available jobs for every person looking for employment. Meanwhile, corporate earnings have been strong throughout 2021. Earnings increased over 48% for the calendar year 2021. Inflation: Most recent inflation numbers show the all-items CPI up to 8.5%. Gasoline prices have increased 48% since this time last year. Inflation is still being carried by supply chain bottlenecks, high stimulus-induced consumer demand for goods, high shelter prices, wage growth, and rising energy prices.

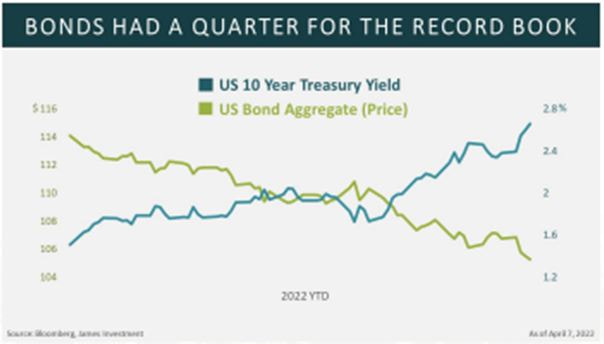

Rise in Interest Rates:

In the bond market, bond yields have seen a steep rise causing a historical bond market selloff. The 10-year Treasury went from a yield of 1.52% on December 31, 2021, to 2.81% on April 25, 2022, an increase of 85%. The Federal Reserve uses rate hikes as a tool to combat inflationary issues. While lowering rates tends to promote economic activity, then raising rates is often a restraint. This is the Fed’s most often used and widely known tool to fight inflation. Their secondary tool is to decrease the level of assets held by the Federal Reserve, also known as their balance sheet. During COVID-19, the Federal Reserve began Quantitative Easing (QE) efforts. QE usually consists of buying a large number of mortgage-backed securities, Treasury notes, and bonds. This was a strategy to add liquidity to the markets so banks could borrow and lend more freely. Now that inflation is here to stay, they plan to decrease the balance sheet by just under $100 billion per month in the near future. By doing this, other investors will have to purchase the government’s assets which will lead to higher rates. It is important to keep a close eye on the Federal Reserve to understand its strategy for raising rates. On May 3-4, The Federal Open Market Committee will have a meeting to increase the federal-fund target range. Some experts are expecting a half-point (.50%) increase, but it will be interesting to see how the Fed handles this predicament. Questions? Contact Brien at 979-694-9100 or [email protected] Source: EO-Booklet-2022-1Q.pdf (jamesinvestment.com)

0 Comments

Howdy, my name is Joshua Vernon and I am a first generation Aggie from Mission, TX. I am currently a junior at A&M (Whoop!) majoring in economics and minoring in financial planning.

After graduation I will commission as an officer into the United States Navy with plans to become a Naval Aviator. After my time in the service I intend to provide economic and financial planning support to the military community. This summer I am excited to complete my military training and learn from my internship at Traditions Wealth Advisors. I will be spending time with an naval aviation unit at sea as well as serving as an instructor for incoming Navy midshipman in Great Lakes, Illinois. Passionate is the word I would describe myself with. I believe in committing fully to the bigger purposes in one’s life and being “all in”. One thing people wouldn’t know about me is that I competed for the Texas A&M rodeo team for two years in saddle bronc riding and steer wrestling.  Michael Pollick Last Modified Date: March 06, 2022 It can be dangerous to put all your eggs in one basket. When it comes to metaphorical egg transportation, it is indeed advisable not to put all your eggs in one basket. For one thing, you may only have a finite number of "eggs" to lose, and that "basket" may not be the sturdiest or most stable in the wagon. The expression "Don't put all your eggs in one basket" generally means not to risk losing everything by pinning all your hopes or future goals on one and only one option. The danger of keeping your eggs together should be obvious once the basket falls off the wagon or experiences some other unfortunate fate. Wherever the basket goes, the eggs must surely follow. In a metaphorical sense, investing all of one's time, energy, attention or money in a single endeavor can be a similar recipe for personal disappointment or even tragedy. While a personal investment in a future goal is a laudable idea, few people can afford to take such a risk without some sort of safety net or fallback plan. Another interpretation of this expression is often seen in the world of investing. Potential investors are encouraged to diversify their investments rather than put all of their money into a single, and possibly volatile, investment option. It is never advisable to put all your eggs in one basket when it comes to financial markets. Investors should have some money put aside in more stable funds to survive any sudden downturns in more volatile markets. There are several stories concerning the origin of the expression, but it may have been inspired by the real-life experiences of poultry farmers who used wagons and baskets to take their eggs to market. If all a farmer's eggs were placed in one basket, it would only take one unfortunate accident along the way to ruin his entire investment. By not putting your eggs all in one basket, you reduce the risk of having nothing to offer at the market. So when should you put all of your eggs in one basket… Managing one’s finances is daunting enough but adding the complexity of planning across multiple providers/institutions can make it seem not worth the effort. Bringing all of your investments to one institution can help make life simpler and more convenient. A consolidated view of your accounts, with a single company or software that provides a complete view of your finances, can make it easier to track your asset mix, tax situation, and financial life. There could also be cost savings – consolidating assets with a single company may qualify you for lower fees/commission and access to enhanced services. Here are some ways that consolidating your accounts could help streamline your financial life. Macro view of investments Whether it’s to provide income, long-term growth, tax-efficiency, or some combination, you want your investments to work together. However, this can prove challenging when you have investments in multiple locations. You could be duplicating exposure to certain asset classes, sectors, or investment types, or even taking unintended risks with concentrated positions. When you consolidate, it’s much easier to take control of your strategy and keep your intended asset allocation on target. Rebalancing – a strategy that all diversified portfolios should be implementing – becomes a much easier task with an integrated view. Moreover, it is much easier to measure performance of your investment mix when it’s all in one place. Effective planning Comprehensive financial planning is growing in popularity and can address a variety of needs ranging from establishing an emergency fund to college savings to retirement income planning. The best financial plans are fluid and flexible, changing with your needs and goals. However, this flexibility may be greatly reduced if your investment accounts are spread across multiple platforms, limiting the ability to put together an aggregate view of your investment mix. Additionally, if you have more than one IRA account held at different institutions, it may be harder to track the amount you are required to withdraw when the time comes at age 72. [1] You’ll also be faced with the decision of which account(s) you want to take that withdrawal from. With all your accounts under one roof, it could be easier to evaluate and implement an optimal withdrawal strategy during retirement. Like anything, it pays to do some homework before making the jump to consolidation. Fees should always be a consideration, and you’ll need to make sure the benefits outweigh any potential costs. You’ll also want to consider whether consolidation will mean liquidating certain investments, and possibly incurring tax consequences. You should evaluate how your accounts are kept safe, and if SIPC protection or FDIC insurance is offered. Though it may be hard to ignore the mantra of “not putting all your eggs in one basket,” the potential benefits of consolidation may be worth your while. You may find it easier to diversify, maintain your asset allocation, lower costs, and improve tax efficiency. Most importantly, you’ll be able to plan more effectively and take control of your finances. If you would like more information contact Brien or Sarah at Traditions Wealth Advisors: [email protected] [email protected] or 979.694.9100 The Impact of Inflation

As consumers, we note the impact of inflation in rising prices of everything from filling up a tank of gas to buying groceries. It started with rising housing prices, making homeowners feel richer. As mortgage rates move higher, buyers are frozen out of the market and sellers will be stuck in place. That’s the recipe for a housing slowdown. This also means less spending on furnishing new houses will add to an economic slowdown. Plus, there's more to come. Ukraine is Europe's breadbasket and harvests this year are predicted to be from 20-40% lower this year, while their export ports are blocked. Shortages can only lead to higher food prices and even hunger. Is there any place to hide and protect your assets during a period of high inflation? For retirees living on fixed income and Social Security, this coming period of inflation – however long it lasts—will be devastating. For 2022, Social Security checks jumped an astounding 5.9% (though impacted by higher Medicare premiums). The latest predictions suggest an 8.9% increase in Social Security checks for 2023. Unfortunately, that still won’t keep up with increased costs in everything from rents to food. Stocks have always been a good hedge against inflation over the long run. In fact, according to market historians, there has never been a 2 year period in the last 100 years where stocks didn’t outperform inflation. Those periods included deep market declines. Those close to retirement might panic if they need to withdraw money from their retirement accounts in a temporary market decline, perhaps caused by higher interest rates. Keeping some cash on the sidelines creates an obvious risk. Buying power of cash is destroyed by inflation – unless interest rates keep up. The system is so flooded with liquidity that banks have no incentive to raise rates and attract deposits. With the inflation uncertainty, banks are reluctant to lend. If you need cash for living expenses, it might be worth taking the inflation hit to have some immediate liquidity, so you’re not forced to sell stocks at a loss for required withdrawals. Free market savings rates will rise eventually. According to the Rule of 72, divide any number into 72 and the result will be the number of years it will take for the value to be cut in half. Thus, 3% inflation cuts your spending power in half in 24 years. But 8% inflation cuts your spending power in half in less than 10 years! So much for choosing an immediate annuity with a lifetime payout that looks good today. Thank goodness, Social Security adds an inflation adjustment. (Wait to take benefits and start with a higher base check to get more money in those annual adjustments!) Bonds can be devastated by inflation. Who wants your old 3%, 20 year bond if inflation rages much higher? Try to sell and you’ll lose money since no one will give you that $1000 face value for an old low-rate bond, even from a great company. If you don’t sell and take the loss, you’re stuck earning less. If you need to own bonds, at least own TIPS – Treasury Inflation Adjusted bonds – easily found in mutual funds from major companies. Warning: Only buy TIPS inside a retirement account. Otherwise you will be taxed on the unrealized appreciation every year. Gold might be old-fashioned, but it has awakened from its long sleep as an inflation protector, now approaching the $2,000 mark. For those who thought crypto was the new gold, perhaps think again. It didn’t help Russia avoid sanctions. It hasn’t been hidden from governments, per the recent seizures of crypto assets taken in frauds. Digital might be the wave of the future, but at present it has not been an escape from governments that would degrade their currencies. Series I Savings Bonds have become the go-to inflation beating investment. Currently they carry a 7.12% rate, which will be adjusted every 6 months in May and November to match inflation. Expect the May 1st adjustment to be higher. Sadly, there is a limitation of $10,000 per year on individual purchases of these digital savings bonds purchased through TreasuryDirect.gov. A reminder, you must hold them at least one year. And if you sell before holding for 5 years, there is a penalty of 3 months loss of interest. Commodities, everything from energy to soybeans, are rising in the face of inflation expectations. You can hedge by using ETFs that track commodity prices, but be warned that these are volatile investments. The Outlook for Inflation There’s a wide range of estimates on Wall Street for how high inflation will go, and how sharply the Fed will act, and whether those actions will trigger a recession. There are no perfect answers. In a worst-case scenario we could have the worst of BOTH worlds: high inflation and an economic slowdown. Expect to hear more about the word STAGFLATION. And if the economy does slow, we will likely see the return of the “Misery Index” – calculated by adding the unemployment rate and the inflation rate. Surely the Fed does not want to see that! The U.S. dollar is the world’s reserve currency, reflecting the underlying strength of our economy. This is not the end of the dollar or Armageddon for our nation. Times will be turbulent and few have any memory of the impact of inflation on the public psyche and on the markets. You’re smart. This inflation is not transitory. It will not end without pain. Be diversified. Stay on top of your entire financial situation. Adjust your lifestyle to prepare. No inflation in the past has been contained without pain. Source: Savage, Terry. www.TerrySavage.com. 13 April 2022. It's the most important financial headline of this century: Inflation!

A new generation of Americans is about to face the impact of inflation – on their daily lives, their financial decisions, their investment choices, and their retirement lifestyle. While many pundits proclaim that this period of inflation will come to a quick end, history shows that inflation has always ended not with a whimper, but with a bang. Once started, the fires of inflation are not easily tamped down. Whether in Germany in the 1930s or in Zimbabwe a decade ago (their trillion-dollar note became worthless!) or in the United States in the late 1970s, it has taken a ruthless hand to stamp out the persistent belief that prices would go higher. It’s important to understand what inflation is—and isn’t, what causes it, what “cures” it –- and the potential impact on your life. What IS Inflation? The late, great Nobel laureate Milton Friedman clearly established that inflation is always a monetary phenomenon. It may show up as higher prices, but the root cause is excessive money creation. The fear of declining value of the currency leads sensible people to exchange their money for goods and services before prices rise again. The cycle is exacerbated by workers demanding higher wages to “keep up” with inflation, thereby driving the cost of everything still higher. We may point to shortages because of supply chain disruptions or the war in Ukraine and its impact on energy prices as contributing factors. But if governments—ours and in Europe – had not created so much new “liquidity” (a euphemism for money printing in this digital age) to fight the impact of the pandemic, there wouldn’t be excess money in the system to push prices higher. People would suffer and stop buying. And with lack of demand, prices would eventually come down. But not without pain. That’s Econ 101. Lessons of History History tells us the only way to stop inflation is to slow the economic demand by slowing the economy. That slowdown comes from raising interest rates. Paul Volcker had the determination and discipline to do that in the early 1980s. And it cost then-President Jimmy Carter the election (along with other factors). As Fed chairman, Volcker pushed the prime lending rate to 21%. Mortgage rates jumped to over 15%. And the economy moved into a steep recession. It worked – but not without pain. So that’s what policymakers face now. Jerome Powell tried to wish inflation away by pronouncing it transitory. But as of this writing, the Fed has still not started to withdraw liquidity from the economy by selling its bond portfolio. Interest rates remain historically low. And inflation is roaring. The longer the Fed waits, the more likely we will see double-digit inflation in the coming months. In an election year. And even if the Fed moves soon and more strongly than expected, policy always works with a lag. That means a slowdown (recession?) would come at exactly the wrong time – at election time! Continue reading in next month's newsletter to find out the impacts and future outlooks of inflation. Source: Savage, Terry. www.TerrySavage.com. 13 April 2022. |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|