|

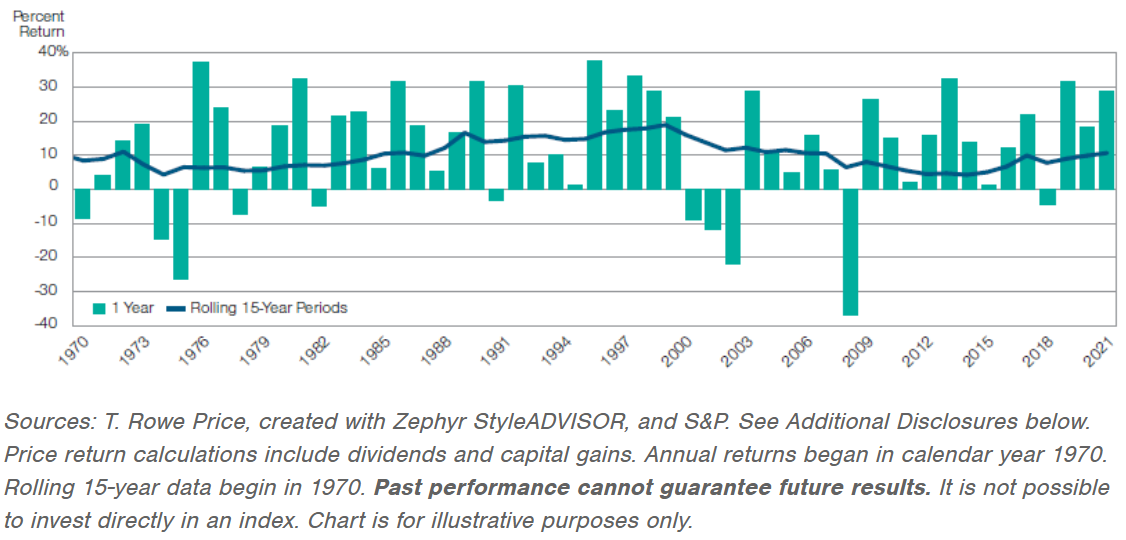

It may be tempting to take money out of the stock market. Sticking to a long-term plan is usually best. It can be hard to stay the course. Acting on emotion or trying to anticipate the market’s direction can compromise a portfolio’s long-term return potential. In general, having an asset allocation aligned with the time horizon of an investor’s goals is the most prudent path. Staying the course takes patience and discipline and can be especially difficult during times of uncertainty. Investors with a healthy dose of equities in their portfolio are likely to benefit from the long-term growth potential of stocks since, over time, the magnitude of market gains has been significantly greater than that of losses. Of course, past performance cannot guarantee future results. Remaining invested through downturns and corrections may allow investors to take advantage of long-term growth potential. While it may be challenging to stick with a long-term strategy, doing so means an investor could be well positioned to reap potential gains as the market recovers.

In times of market volatility, it’s impossible to know when it may end. Investors who feel a strategy change is in order could consider gradual adjustments. They could also wait until the volatility subsides to make wholesale shifts to their strategy. “These are challenging times for many people,” says Judith Ward, CFP® of T. Rowe Price. “If investors control the important things, such as how much to save and spend, and position their investments to balance this short-term volatility with longer-term growth, they can give themselves the best chance to achieve a comfortable retirement.” Questions about your portfolio and staying the course article? Contact [email protected] Source: T. Rowe Price. 25 July 2022. Personal Finance. https://www.troweprice.com/personal-investing/resources/insights/does-staying-the-course-still-make-sense.html?cid=PI_Single_Topic_NonSubscriber_ACC_PRE_EM_202207&bid=1046947328&PlacementGUID=em_PI_PI_Single_Topic_EM_NonSubscriber_202207-PI_Single_Topic_NonSubscriber_ACC_PRE_EM_202207_20220728&b2c-uber=u.4BDAB1C8-0F6B-9872-F733-7678B43EBF89

0 Comments

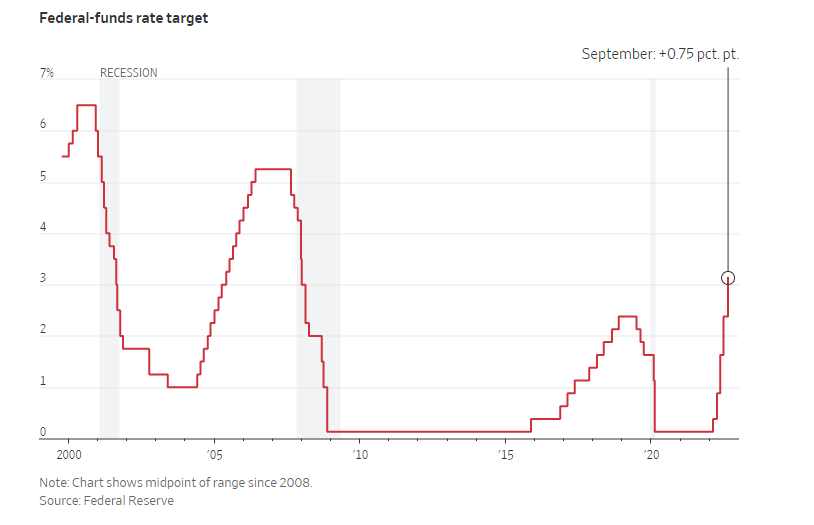

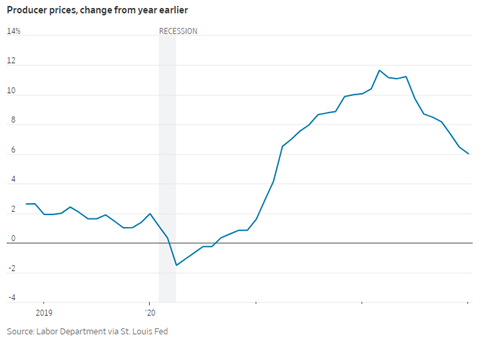

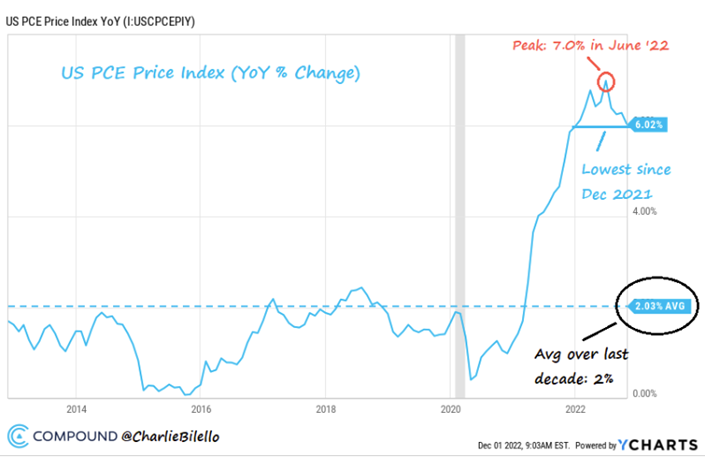

There is still a lot of uncertainty about the current economic environment, some economists are calling for a mild and shallow recession while others think it will be far more severe. However, we would like to keep all our clients updated on the most recent economic reports and our thoughts on the current data. The most recent jobs report from July was unexpectedly stronger than expected which gives off mixed signals for the current economic state of our nation. On the other hand, the inverted U.S. treasury yield curve among other leading economic indicators that have historically been harbingers of recession are showing pockets of weakness in the economy. U.S. Stocks and Economy July’s jobs report was undoubtedly hot with wages growing 5.2% year-over-year in addition to the economy adding 528,000 jobs. This boosted payrolls above their pre-Covid peak in February 2020. However, this report has two different points of view. Bulls were ecstatic to see these report numbers and viewed them as a sign of the economy strengthening. However, this goes against the Federal Reserve’s course of action for slowing down the economy. Adding many more jobs than analysts estimated means that the economy is still expanding which could tempt the Federal Reserve to continue implementing higher interest rate hikes. Meanwhile, leading economic indicators are not suggesting a strong backdrop for the labor market. As shown in the chart below, the Conference Board’s Leading Economic Index (LEI) has fallen by nearly 2% over the past 6 months. Excluding the Covid-19 pandemic, we have not seen the LEI stumble like this since August 2009. Similar declines are consistent with prior recessionary periods. Fixed Income: Yield Curve Inversion During the Fed’s campaign to tame high inflation, we have now seen the target range for the federal funds rate raised 4 times since the rate-hike cycle began in mid-March. The upper end of the range is now 2.5% compared to the starting level of 0.25%, making this one of the most rapid tightening cycles in the past 40 years. In September, the pace at which assets roll off the Fed’s balance sheet (quantitative tightening) is also set to accelerate. Although the annual inflation rate has come down slightly from 9.1% and flattened out at 8.5% and wage growth running at more than 5%, more interest rate hikes are expected. The current market pricing suggests investors expect a peak in the federal funds rate of 3.6% in the first quarter of 2023. Then there is an expected series of rate cuts that will bring the interest rate down to 3% by early 2024. There is always a degree of uncertainty when trying to predict future interest rate hikes from the Fed and this outlook may be too optimistic in terms of the Fed’s actions. However, we’ve also seen recent inflationary pressures start to decrease. Commodity prices have dropped, inventories are rising relative to sales, the U.S. dollar is stronger, and global economic growth has been soft. Another response to the Fed’s rapid tightening cycle is an inverted yield curve, where short-term interest rates are higher than longer-term rates. By boosting short-term borrowing costs and reducing the liquidity available to the financial system, the Fed’s actions should slow economic growth and inflation down the road. An inverted yield curve has been a reliable sign of an impending recession in the past. However, not all 2-year/10-year inversions have led to recessions, but they all have resulted in some degree of economic slowdown. Global Stocks and Economy

An inverted U.S. treasury curve hasn’t just been a negative sign for the U.S. economy historically, it has also argued for global recessions. While the high and rising risk of an economic recession may not be news to everybody, the yield curve could be signaling an earnings recession ahead. Although earnings held up well in the first half of the year, Wall Street analyst forecasts continue to point towards double-digit earnings growth over the next 12 months. This is a very unusual occurrence during an economic recession. Decreased earnings could cause stocks to pull back further than they appear now. High dividend paying stocks may continue to reward should the economy and earnings slow down. Alternatively, if earnings growth remains resilient as inflation begins to subside then stocks may recover. Especially for those with the brightest earnings growth prospects and lowest price-to-earnings ratios, which tend to be more prevalent in the stock markets of Europe and Japan. It might be hard to remember, but only 2 years ago the pandemic started and doubts if it would ever end or a vaccine would ever be developed were on the minds of most people. Today, it is a much better place. Here are some reasons to stay optimistic in the current market environment.

1. Global supply chain pressures are easing 2. Commodity prices are on the decline 3. There are some bright spots in recent inflation data 4. Long-term US inflation expectations are becoming better anchored. 5. Positive economic signs have emerged in China. 6. COVID has improved in China. 7. When pessimism permeates markets, positive surprises can be more powerful. Do you want more details on the above reasons? Find out more: Invesco.com  Welcome James Lane to the TWA team! As a Financial Analyst Intern, James's primary scope of analysis is ensuring that investments our clients hold are optimal given their risk level through diligent quantitative and qualitative research and assigning them buy, sell, and hold ratings. He engages in investment research and portfolio modeling to aid and support portfolio management decisions made by Brien and Sarah for the TWA clients. James is from Austin, Texas and a current senior at Texas A&M University pursuing a bachelor’s degree in economics. In his free time he enjoys playing golf and watching Aggie football and baseball. James is also an avid outdoorsman. He will never pass up an opportunity to get out in nature whether that be swimming and hiking the creeks and trails of Austin or fly fishing and hunting all over Texas and other parts of the U.S. |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|