|

Monday, April 20, 2020

Dear Clients, I hope all of you had a nice Easter. I know it was special for me, as our son made it back from Rome and out of his quarantine. Along with our son, our two daughters, our grandson and son-in-law, Kathy and I had a great Easter. All of you should now have had a chance to receive and review your March 31st monthly statements. Just like our monthly statements here at the Smith household they were not pretty. However, remember the bad month of March was offset by the great 2019 and the first 2 months of 2020. For most of you, your rates of return were up 20%, 25% and, some of you, up 30% for the period January 1, 2019 until February 29, 2020. When we add in the terrible March and the first couple of weeks of April, most of you are still positive for that one year plus rate of return. When the markets are still down 20% from the highs of the markets back in February, most of you might be down half of that minus 20% for the year to date rates of return in 2020. So keep in mind you are not investing for one month, one quarter or even one year. We are investing for the long run or at least 5 years or more. Where do we go from here than? I can make this analogous to a sporting event. Let’s take Aggie football for example. The Aggies are down 21 to nothing in the first quarter of the game. So, just like in the markets, do we panic and become very conservative and move all of our investments to cash and C.D.s? Do the Aggies only run the football on every play for the rest of the game so they don’t have an interception, passing the ball, and lose the game 42 to nothing? No, the Aggies maintain their game plan and slowly come back in the game because they have 3 more quarters in the game. Just as we need to maintain our financial and investment plans to recover what losses we may have. Yes, we may reallocate SOME of our investments, but most of our investments were carefully chosen to begin with, to not only decline much to begin with, but to climb or ascend after a downturn in the markets. Therefore, we are analyzing all of your portfolios and we might make some fine tuning recommendations, but not wholesale changes. Right now large growth companies (like Microsoft, Apple, Amazon, and many others) are doing well, but are they overpriced or overvalued? We are constantly researching the markets (both the macro economy and individual securities), listening to objective experts and second guessing and back testing your portfolios in an effort to improve the long term outcomes of your portfolios. We will not be able to keep your portfolio positive every month, quarter or even every year, but will always strive to have your portfolio meet your goals while keeping risk, volatility and fees as low as possible. Thank you again for not overreacting to these tough times. Just like 2008-2009, 2001-2002 and even back to 1987 the markets and the economy will come back and thrive. However, it doesn’t make it easy right now and we recognize and empathize with that. As always we are here for you. So don’t hesitate to contact any of us with your questions or concerns. Be safe and healthy, Brien

1 Comment

Even in quarantine, raising 'em right, WHOOP! Brien's grandson, Jack, exploring his future university as class of 2041!

First, I would like to wish you a Happy Easter.

Amidst all the issues and concerns that are going on with the Covid-19 virus, there are some reasons we can be happy—Easter being one of them! As your friend (and advisor) I want to reach out to you, to ensure you are okay and that you are making it through this quarantine period. Above all, I want to let you know that I am here for you. If you want to bend my ear on a phone call or if you would like to send me an email or two, I would love to hear from you. Let me know how you are doing. Happy Easter. Stay well and I look forward to hearing from you. As a reminder, the stock markets are closed on April 10, 2020 in observance of Good Friday. The office remains closed, due to the pandemic, but feel free to touch base with me. Your friend and advisor, Brien L. Smith. CFP® TRADITIONS WEALTH ADVISORS 979-255-0952 cell [email protected] April 1, 2020

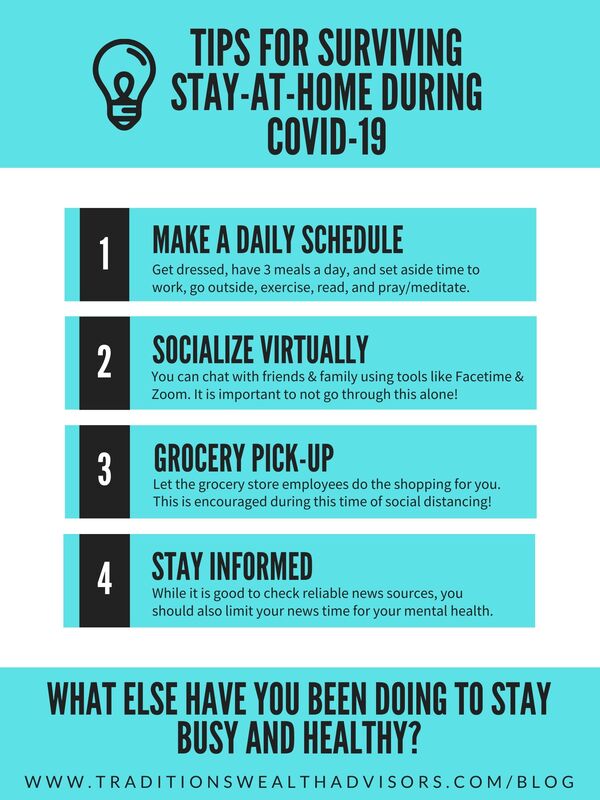

Dear Client: One of the hardest aspects of this crisis is this social distancing required between you, me, friends, neighbors, colleagues, even our families! Our son came home from Italy and is quarantining near Belton, Texas and we couldn’t go to see him, even from a distance. We haven’t seen him in almost a year and now he is less than 2 hours away, but we could not visit him. That was tough and frustrating both, but we know we will be together next week when his isolation time has completed. In difficult times, America’s greatest strength has come from pulling together – to generate the ingenuity, resilience and tenacity that solves problems and creates opportunities. We’ll overcome this crisis, too, I have no doubt. From six feet apart, if necessary. But we have to stay connected…even as we socially isolate. That’s why you’ll be hearing regularly from me and my team while this volatility lasts--by phone, email, more emails and phone calls… it’s critical we stay in touch. One thing I want you to remember as you watch the markets, the news and you receive your not so good March statement: You have the strength and the fortitude to survive this market storm. Remember, those of you that did not sell in the 2008-2009 Great Recession recovered much quicker than those who sold and took a paper loss and realized it into a real loss. Because this is a market storm…a temporary event you and I have long prepared for by making smart, responsible decisions about allocating assets and diversifying holdings. We based your portfolio on Nobel prize-winning investment strategies that have protected investors for the last 60+ years, and they are protecting you now. Given the strength of the economy before the health crisis, some experts believe a recovery could be fairly fast and strong. No one knows, of course, and I am monitoring the markets and your investments with extreme diligence to keep us well-positioned for positive days ahead. Because prosperous days will come again. They always do. This time is no different. Let me leave you with a story that illustrates how I view market downturns. You may have heard this before, but it perfectly explains my mission in managing your portfolio: Years ago a farmer, whose fields stretched along the eastern seaboard, was looking for hired hands. It wasn't easy to find help. People were reluctant to work on the Atlantic coast. They dreaded the regular raging storms that wreaked havoc on buildings and crops. Interviewing applicants for the job, the farmer received a steady stream of refusals. Finally, a short, thin man, well past middle age, approached him. "Are you a good farmhand?" the farmer asked. "Well, I can sleep when the wind blows," answered the little man. Although puzzled by this answer, the desperate farmer hired him. The little man worked well around the farm, keeping himself busy from dawn to dusk, and the farmer was satisfied with his new hire. Then, late one night, the Atlantic wind began howling in from offshore. Jumping out of bed, the farmer grabbed a lantern and rushed next door to the hired hand's sleeping quarters. He shook the little man, yelling, "Get up! A storm is coming! Tie things down before they blow away!" The little man rolled over in bed and said firmly, "No, sir. I told you, I can sleep when the wind blows." Enraged, the farmer was tempted to fire the old man on the spot. Instead, he hurried outside to prepare for the storm. To his amazement, he discovered that all of the haystacks had been covered with tarpaulins. The cows were in the barn, the chickens in their coops, the doors barred, the shutters tightly secured. Everything was tied down; nothing would blow away. The farmer returned to his bed, and the sound of the storm wind lulled him to sleep. I like to think that I’m the hired hand who keeps you safe while the wind blows. I hope you think so, too, and if there is anything more I can do to “lull you to sleep,” please let me know. Stay in touch. Stay well! Your friend and advisor, Brien Brien L. Smith, CFP® [email protected] P.S. Here are all the ways to contact me and the team. Keep these handy! Office: (979) 694-9100 My Mobile: (979) 255-0952 Director of Financial Planning Sarah Buenger: [email protected] Client Service Rep: Michael Maerz: [email protected] March 28, 2020

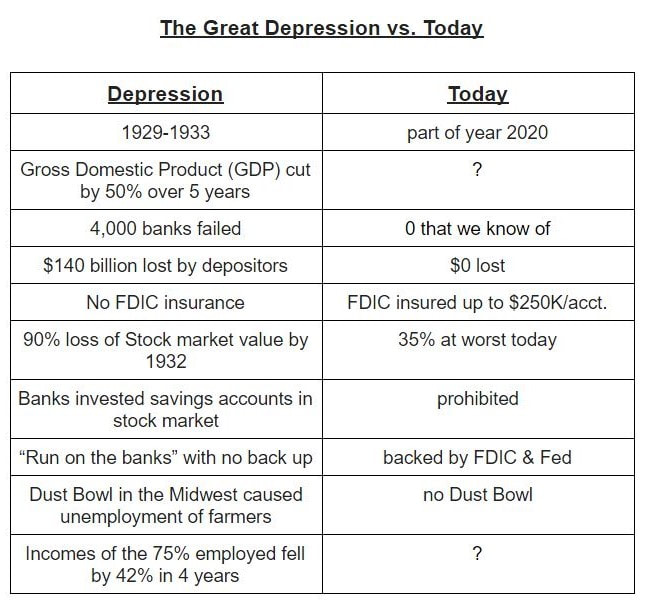

Clients, Despite what some negative media or pundits might be saying we are NOT heading for a Depression. Take care, Brien, Sarah and Michael Thursday, March 26, 2020

Dear Clients, We, at Traditions Wealth Advisors, hope this finds you well—literally, during these Covid 19 virus times. We hope you are isolating, when necessary, and enjoying the great outdoors, if the pollen is not too high, like it is here in the Brazos Valley. We are being diligent and prudent during these challenging times—all of us are working from home and I will be the only one to venture in to the office only on an occasional basis to check the snail mail and any voice mail messages. We are all being very careful and cautious so that we may continue to be productive on your behalf. In fact, I have no choice but to be very careful as my daughter has already forewarned me that if I don’t “shelter in place” at home, instead of staying at the office, I may not receive a visit from her 20 month old son, my first grandchild, as soon as I hoped. We are financially healthy as well, which is very important, and we are “practicing what we preach”. We have in excess the 3-6 months of fixed expenses cash reserves that we recommend for all of our clients. We also very little debt on the company. In other words we are very solvent and control our expenses closely so that we may continue to serve you for long time. Be healthy physically, mentally and financially. We will help with the financial side and if we can help with anything else don’t hesitate to ask. We are here to serve you! Take care, Brien, Sarah, and Michael Brien L. Smith, C.F.P.® Practitioner Wealth Manager/ Founder / Owner celebrating 30 years of service Traditions Wealth Advisors, L.L.C. 2700 Earl Rudder Freeway S. Suite 2600 College Station TX, 77845 www.traditionswealthadvisors.com (979)694-9100 Tuesday, March 24, 2020

Dear Clients, We have been asked by local government authorities, in this case Brazos County, to “shelter in place”. Therefore, we will all being working from home, but by the magic of the internet, our email addresses will not change. So please utilize the internet and emails to communicate to us. If you do not have access to the internet and it is a semi-emergency please call my private cell phone number of 979-255-0952. I will not be answering that phone after 6 pm, but feel free to text me on that number any time. I will be checking the mail and any phone messages up at the office business daily. We hope that this inconvenience will only be for two weeks, but we will keep you posted. The markets came back up substantially today, and although we do not think we will ascend in the markets daily, may be the markets are near a bottom. Thank you again for your unbelievable patience during this very trying time. We will continue to communicate to you, but as always do not hesitate to reach out to me with any questions or concerns. Just as we always have in the past, we will recover from this recession and will learn from it as well. Take care and keep healthy, Brien, Sarah and Michael |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|