Laurie received her BBA in Accounting from Texas A&M University in 1989. She worked in the audit department for Arthur Andersen in the San Antonio office from 1989-1991 and earned her CPA license in 1991. She has spent the majority of her professional career in Russellville, Arkansas, where her husband was employed at a 2-unit nuclear plant. After taking a few years off to start a family, Laurie worked in the business office of a rural community mental health center with services and facilities in 6 Arkansas counties from 1996-2005. In this position, she was responsible for the accounting functions of the agency, 2 HUD apartment complexes and 2 HUD group home facilities, as well as applying for State grants. Laurie later worked for Kent Dollar and Associates, a local CPA firm from 2005-2007. After taking a few years off to focus on family needs, Laurie worked for Debbie Brown CPA PA in office from 2011 to 2017 and then worked remotely from 2018-2022 when her family moved to College Station. Her primary job duties were performing rural water company audits and the write up work, payroll functions, and tax returns for many small business S-Corporations. Laurie is married and has 3 young adult children. Laurie is a member of the Brazos County Aggie Moms Club and serves on the "Aggies in Need" committee. Laurie and her husband, Darrell, enjoy a variety of Aggie sporting events together and host family and close friends at their home and tailgate on Aggie football weekends. Laurie is also active at her church in many areas including the Women's ACTS retreat team, the bookstore, and welcoming people as a Front Door Disciple. She also enjoys helping at many Knights of Columbus events in the community. Laurie is excited to be a part of the team at Traditions Wealth Advisors and looks forward to assisting Brien with the many aspects of financial and tax planning for the clients.

1 Comment

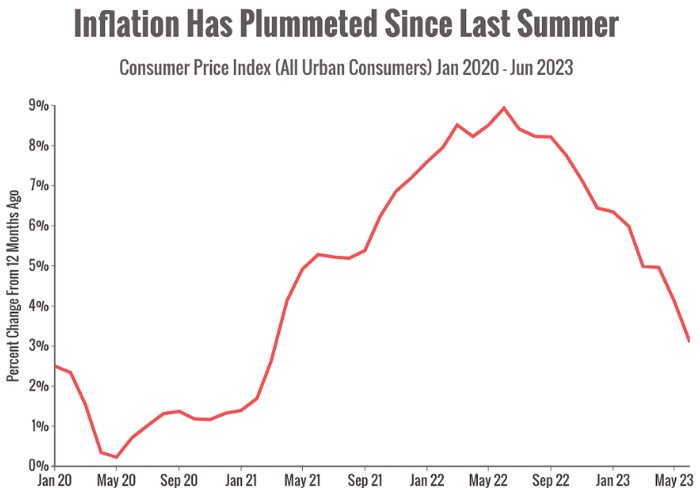

A word about recessions. Are we still going to see one this year? Let's discuss. Why did so many people think a recession was coming? Inflation and interest rates, primarily. Historically high inflation has cast a pall over the economy since early 2021. In response, the Federal Reserve has raised interest rates rapidly to bring inflation back down. Analysts worried those rapid interest rate hikes could trigger a "hard landing" recession. But it looks like the dark mood is lifting. You can see in the chart above that inflation has been on a definite downward trend since last summer. That trend suggests that the Fed's interest rate program has worked to tame inflation.

So, will the Fed keep raising interest rates? Hard to say. The Fed raised interest rates again by a quarter of a point at its July meeting, but it's possible that it won't raise rates again if inflation remains on a downward trajectory. In fact, some analysts think that the Fed's next move might be to lower rates in 2024. Does that mean a recession is definitely off the table? That's far too optimistic. While the economy has been much, much more resilient than even seasoned analysts predicted, the accumulated effects of interest hikes may still deal a serious blow to growth. There are signs that the economy is weakening in some areas. For example, while American consumers are still spending, they aren't buying as much stuff. That's hurting the manufacturing sector, which has been in a slump for a while. Since consumer spending is worth about 70% of economic activity in the U.S. it’s an important indicator for future economic growth. Employment trends will also be important to watch. So far, the work of lowering inflation seems to have succeeded without damaging the job market. However, there are signs that the labor market may be weakening, so that's something to keep an eye on. Bottom line: things seem to be looking up. The dark clouds on the horizon appear to be breaking and there are reasons to be optimistic. But, it won't be smooth sailing. Is it ever? I'm keeping an eye on trends and I'll reach out as needed. Questions? Don't hesitate to reach out, [email protected] Source: Life Strategy Financial. Munoz, Juan. 2 August 2023. |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|