|

Dear Clients,

As Christians and people of faith, I hope you find this article below appropriate on a Sunday. We will be in the office, at least 6 feet apart, first thing tomorrow morning if you need to talk. Hang in there, be calm and this too shall pass, Brien March 3, 2020/in Investing, Life /by Dr. Erik Davidson, CFA “In this world you will have trouble. But take heart! I have overcome the world.” John 16:33 While the Bible does not speak specifically about Coronavirus outbreaks or stock market plunges, it certainly does speak about plagues and pestilence, as well as periods of adversity and trouble. So, with that in mind here are some thoughts on the recent stock market sell-off from the vantage points of investment history, behavioral finance, and biblical wisdom. In my many decades of investment experience, I have seen my fair share of market turbulence and even many “crashes”. During my career, there have been all matter of reasons to spark stock market sell-offs, however, this is the first time in my experience that a pandemic scare has been the catalyst for a significant stock market plunge. Yes, in the past, investors have expressed worries about health-related issues (Ebola, SARS, etc.), but nothing medical that I can remember has had the sort of impact that we are currently seeing. Not being a medical expert (although I am a “doctor”!), from my limited perspective, it seems that the pandemic concerns have legitimacy and therefore the potential to cause significant human and economic damage. While we may have some feelings of despair in the face of this challenge, as Christians, we can pray with confidence to God that the coordinated global forces of human ingenuity being brought to bear on this calamity will prevail. Even with that envisioned success, however, going forward, this new type of risk, global health, will now be a top-of-mind concern for investors for years to come. While, most importantly, caring for and praying for those who have been afflicted (“Weeping with those who weep” – Romans 12:15), prudent investors nevertheless do need to consider the market implications of this medical emergency. Stock market corrections (generally viewed by investors as the S&P 500 being down -10% from the prior high) are very common, coming on average every 11 months. Bear markets (generally viewed by investors as the S&P 500 being down -20% from the prior high) are less frequent, but still have visited investors on average every 44 months. With that context, it is important to remember that this 11-year bull market has been the longest in the history of the US stock market. That combined with recent all-time stock market highs, stretched valuations, record low bond yields, anemic economic growth, polarized political environment, and weak earnings growth, the probability of entering a bear market is material. However, just because there is a heightened risk of a bear market does not mean that investors should reflexively “bail out.” Biblical wisdom certainly supports keeping one’s cool in the midst of adversity: “Do not fear, for I have redeemed you; I have summoned you by name; you are mine” (Isaiah 43:1). Further, while not directly addressing investment timing decisions, the Bible has many admonitions about making predictions and attempting to know the time and place of events. Additionally, the evidence of financial history demonstrates that a strategy of “timing” the market by getting out when the market appears to be trending down and then attempting to adroitly get back in when the markets appear to have bottomed is fraught with risk, not the least of which is the necessity of being “right” twice. Additionally, research studies from Dalbar indicate that while the historical annualized return of the stock market (S&P 500) over the past 30 years (ending 12/31/18) is 10.0%, the average mutual fund stock investor return during the same time period has been just 4.1%. The biggest contributor to that underperformance differential was investors’ failed efforts to “time” the market, oftentimes being sucked into the market’s euphoria near market tops and “buying high,” while subsequently succumbing to despondency near market bottoms and “selling low.” So, what is a biblically responsible investor to do in these circumstances? If an investor has a longer term (> 5 years) financial goal(s), then continuing to have a meaningful level of one’s asset allocation in the stock market is a prudent strategy despite the current market turmoil. In fact, further stock market weakness would likely be an opportunity to deploy more money into equities, i.e., buying low when stocks are on “sale.” Further, investors should consider the current market dislocations as an opportunity to “rebalance” their portfolios by trimming down slightly those assets which have performed better (e.g., bonds), and redeploying those proceeds into the recently beaten down asset sectors (e.g., domestic and international stocks, as well as commodities). Lastly, and most importantly, biblically minded investors should strive to keep these heartfelt concerns of life in their eternal perspective, including John 16:33: “I have told you these things, so that in me you may have peace. In this world you will have trouble. But take heart! I have overcome the world.” Sources: Standard & Poor’s, Inspire Investing, and 2019 Dalbar Quantitative Analysis of Investor Behavior (2019)

0 Comments

March 20, 2020

Dear Clients; Thank you so much for your serenity during this time of uncertainty. Your patience and confidence is greatly appreciated. As we continue to endure the uncertainty and market volatility associated with the coronavirus, we thought it would be helpful to point out some of the factors working in favor of not only the economy but also the markets. The uncertainly is likely to recede only when the rate of infection comes close to a peak. However, there are some considerations that should put a floor under the economy as well as financial asset prices. First start with a few qualitative factors that are important to remember.

The following are more tangible reasons that the economy, after suffering an almost certain recession, should be relatively resilient and quicker to bounce back. These factors include the following:

Hang in there, keep your wits about you, and stay well! We will get through this together. Please let us know if there is anything we can do for you in these challenging times. Your friend and financial planner, Brien March 18, 2020

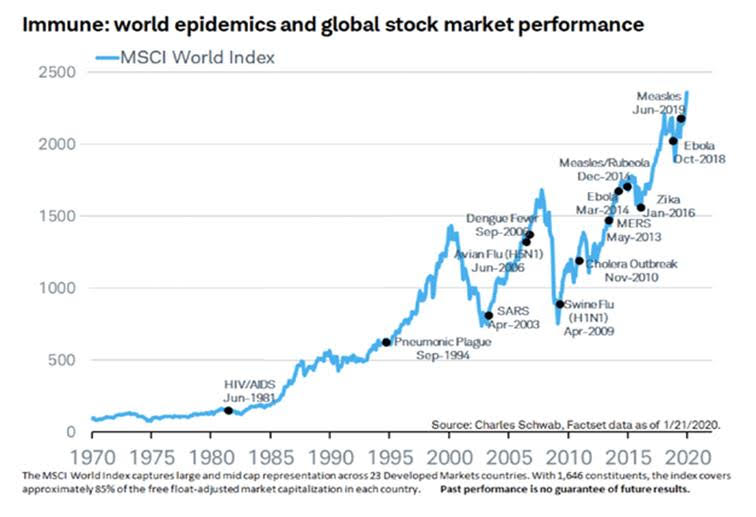

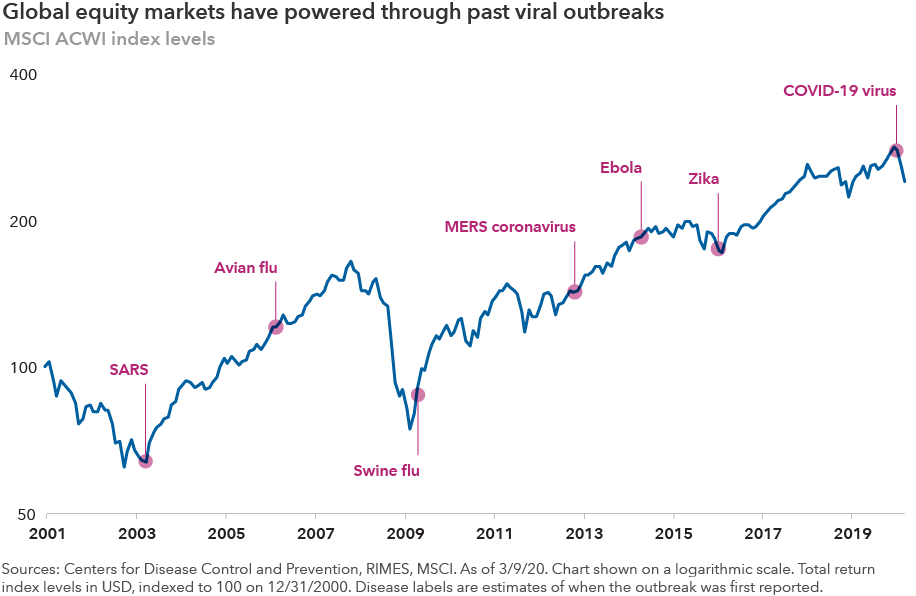

Dear Clients, Thank you again for not panicking! Fear sells! And fear, as an emotion in the markets, is twice as strong on the way down, as greed is on the way up. Last year in 2019 when the markets were up so high and went up almost the entire year, did any of you say “I don’t like seeing my assets accelerating so much”. So I have included 2 charts (1 chart + 1 graph) below to help you at these very “fearful” times we find ourselves. The first chart shows how strong the markets recovered once the Epidemic was either cured or a vaccine was found and what percentage the S&P 500 recovered after 6 months or after 12 months beyond that point. The second, or lower of the 2 charts, shows how the MSCI (a world index of stocks) reacted during other epidemics. As you can see, most of the decline in the markets did not last long. Will this time be different? I am not sure, but I doubt it. As always don’t hesitate to contact us with any questions or concerns. Thank you, Brien Dear Clients,

Thank you, thank you, thank you for being rational, calm, patient and for not over-reacting! Many of you have been with the firm since 1989 and we have been through a lot of these down turns together. I allowed some of you to sell during the “Great Recession” of 2008-2009, and for that I apologize. Those of you who didn’t sell in 2008-2009 came out of that recession in much better shape than those who sold. We also came out of the 2008-2009 time period much more conservative in our investment allocations. We have more cash, more fixed income bonds and more alternative real estate investments that are totally out of the stock or any other markets. The worst of this pandemic may not be over yet. I will not sugar coat or exaggerate my communications to you. We, at Traditions Wealth Advisors, truly value our relationships with our clients, so why would we take any chances interfering with that trust? We do not have the perfect crystal ball on forecasting the markets, however we do know the long term trends and are constantly educating ourselves on the markets to better help you, our clients. Remember, we are here to help you achieve your goals, we are not here to beat the S&P 500 every day. Thank you again for your patience and understanding during these trying times. I was blessed to have my 20 month old grandson visiting this past week and he reminded me what is important in life—it is long term relationships and long term thinking and investing. Short term thinking and over reacting is not in anyone’s best interest. I have included this chart below to show you and add some perspective that the markets are still higher in the long run, even with the recent down turn. As always, we are here to answer your questions or concerns, do not hesitate to contact us and we will be happy to talk. Thank you and take care from any virus or health concern, Brien Traditions Wealth Advisors Brien L. Smith, CFP®, Sarah D. Buenger, MPAS®, MSPFP, CFP® Dear Clients; Thank you for not panicking during these volatile times in the markets! I started in this industry right after Monday, October 19th, 1987 when the stock market declined almost 23% in one day, compared to the 13% we are down in two weeks. Just like in previous down stock markets, you, as a client of Traditions Wealth Advisors, are well diversified! That means that during this down time in the stock market your bonds and real estate investments are up! In fact, your portfolio performed so well in calendar year 2019, your values are higher than when they were in 2018. You have NOT lost money. And unlike previous downturns in the stock market, the economy is very strong. The NEWS OF THE WEEK-Coronavirus, COVID-19, epidemic, pandemic. Whatever it is called, it is in the news and the media has their arms wrapped around this one and has exaggerated it. New.coronavirus outbreaks outside of China are rattling global markets. Investors who had previously taken the epidemic in stride are now coming to grips with concerns about COVID-19's impact on global economic growth and corporate earnings. The new virus draws frequent comparisons to SARS, which killed 774 people worldwide in 2002 and 2003. While there are parallels, researchers still have much to learn about COVID-19. We are aware that the new virus is more easily transmitted and more difficult to detect. This is what we know about the coronavirus:

In just 2 days, the DJIA shed over 1,900 points or 6.6%. In two days, the Dow gave up all the gains registered since the latest upward thrust in stocks began in October. But is the outlook really bad? Are we set to sink into a profit-killing recession that pummels stock? Have short-term investors overreacted, distorting normally reliable indicators?

As of the end of February the total number of cases of Coronavirus have leveled off, active cases have declined. With the virus no longer contained to China and as it poised to spread through Europe and the U.S., fear has spooked investors. The CDC is indicating that we will likely see a pandemic and we should prepare for school closures or telecommuting. That said, it may be several weeks before we see any possible significant impact on the data. The Fed Vice Chair, Richard Clarita says "it's still too soon to even speculate" about how the virus will affect the U.S. economy. The fed isn't ready to blink just yet. How should you, as investors, continue to react?

As your financial planner, I can provide you with an explanation behind the market slide. I would also like to remind you that declines are inevitable and to stay focused on your long-term financial plan. In your financial plan we incorporate setbacks and inevitable market volatility. Keep in mind, that big moves don't foretell the future, both the big loss and the subsequent gain say nothing about what may happen next week, next month or next year, despite what the experts say. Market downturns of -10% or more occur on average once a year with the average length being 112 days. The chart below illustrates occurrences and average lengths of market downturns. There are fears that the coronavirus could morph into something like the Spanish flu (1918). No one knows the ultimate trajectory of the coronavirus, but this is 2020, not 1918. The healthcare system is better prepared to deal with an epidemic. The CDC says there have been at least 29 million cases of the flu, and at least 280,000 hospitalizations (less than 1%) and sadly 16,000-41,000 deaths. With this we go about our daily routines without even blinking an eye. It is important as an investor to avoid becoming too emotional on big up or down moves, but I am confident that over time our research, diversification and patience will be rewarded. We will continue to monitor your financial plan and investments. We will contact you if action is needed, however If at any time you have additional questions or concerns, just ask. That's what we are here for. Your friend and advisor, Brien L. Smith, CFP® |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|