|

Dear Clients,

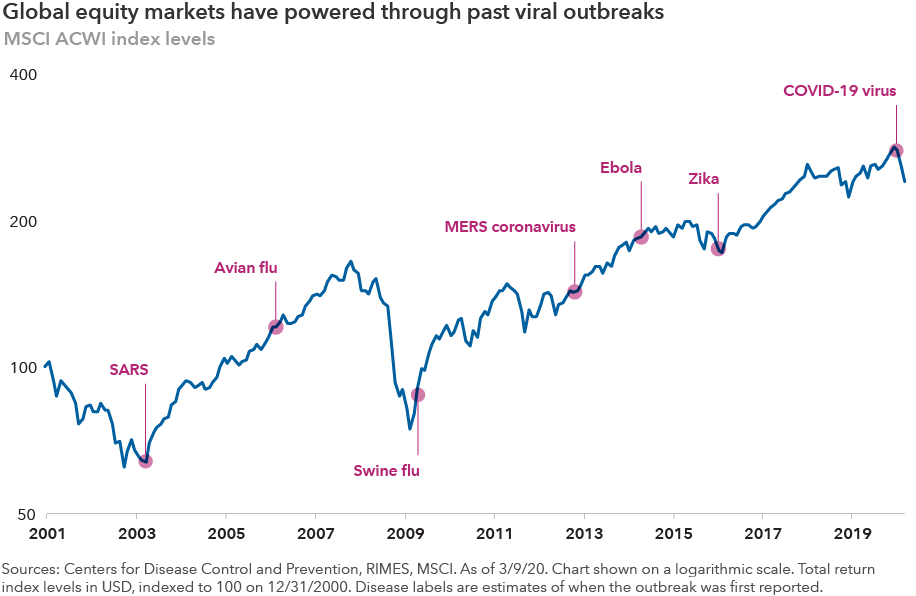

Thank you, thank you, thank you for being rational, calm, patient and for not over-reacting! Many of you have been with the firm since 1989 and we have been through a lot of these down turns together. I allowed some of you to sell during the “Great Recession” of 2008-2009, and for that I apologize. Those of you who didn’t sell in 2008-2009 came out of that recession in much better shape than those who sold. We also came out of the 2008-2009 time period much more conservative in our investment allocations. We have more cash, more fixed income bonds and more alternative real estate investments that are totally out of the stock or any other markets. The worst of this pandemic may not be over yet. I will not sugar coat or exaggerate my communications to you. We, at Traditions Wealth Advisors, truly value our relationships with our clients, so why would we take any chances interfering with that trust? We do not have the perfect crystal ball on forecasting the markets, however we do know the long term trends and are constantly educating ourselves on the markets to better help you, our clients. Remember, we are here to help you achieve your goals, we are not here to beat the S&P 500 every day. Thank you again for your patience and understanding during these trying times. I was blessed to have my 20 month old grandson visiting this past week and he reminded me what is important in life—it is long term relationships and long term thinking and investing. Short term thinking and over reacting is not in anyone’s best interest. I have included this chart below to show you and add some perspective that the markets are still higher in the long run, even with the recent down turn. As always, we are here to answer your questions or concerns, do not hesitate to contact us and we will be happy to talk. Thank you and take care from any virus or health concern, Brien

0 Comments

Leave a Reply. |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|