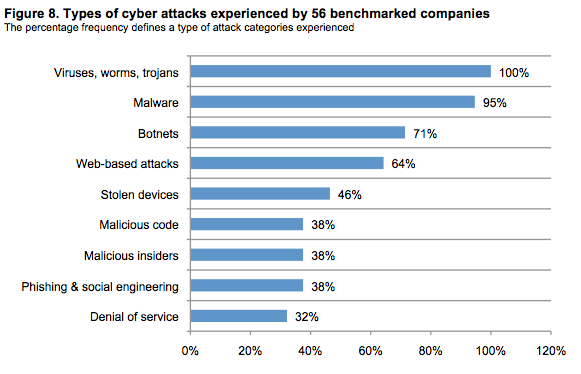

Keeping your personal information safe and secure is a top priority at Traditions Wealth Advisors. We take great care in making sure your information doesn't get into the wrong hands. With the increasing amount of cyber fraud attacks, we wanted to inform you about ways to protect yourself and also share with you the most common tactics that criminals use. The following are six things that you can do to increase personal security and protect against cyber fraud. 1. Manage Your Devices. Make sure to install the most up-to-date antivirus and anti-spyware programs on all your electronic devices and set them up to run regularly. It is also important to only access sensitive data on a secured network and to never access confidential personal data via a public computer or on a shared network, like at a café or hotel. 2. Protect All Passwords. It is important that you reset personal passwords regularly and never use any type of personal information as part of a password. Do not store passwords on a sticky note in your desk or as a word document on your computer; if necessary use a password manager program. 3. Surf the Web Safely. Do not connect to the internet on an unknown wireless network, they may lack virus protection and easily allow hackers into your computer. 4. Protect Information on Social Networks. Limit the amount of personal information that you share on social networking sites. Keep home addresses, telephone numbers, and birth dates off the web. Never underestimate the public sources that criminals will use to gain critical knowledge about you and your family. 5. Protect Your Email Accounts. Make sure to delete emails that have any detailed financial information once it is no longer needed. Review unsolicited emails carefully and do not click links or pop-up ads for programs and emails you do not recognize. Also, it is smart to establish separate email accounts for personal and financial transactions. 6. Safeguard Your Financial Accounts. Constantly review and check your credit card and financial statements, if transactions look suspicious immediately contact that financial institution directly. Do not send account information over email, chat, or any other secure channel. Do not develop online patterns of money movement, because it makes it easier for criminals to make illegal wire transfers seem more legitimate. Cyber fraud criminals use several common tactics to gain access into your personal information. Be suspicious of unknown emails, criminals use malware software in these emails to be able to gain access to your private computer systems. Another ruse is called “phishing”, this technique used to be very simple to spot due to emails with poor spelling and grammar asking you to send money urgently or else there would be consequences. This type of “phishing” email has grown increasingly more complex and common. The criminals masquerade as an entity that you already have ties to, like a bank or credit card company, and claim to need personal information. If you receive one of these emails, call that entity directly and ask them about the email.

1 Comment

|

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|