|

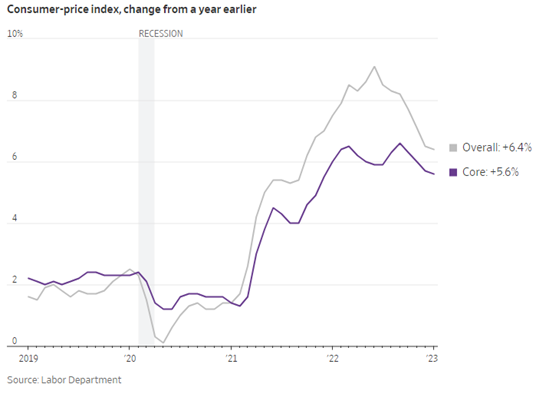

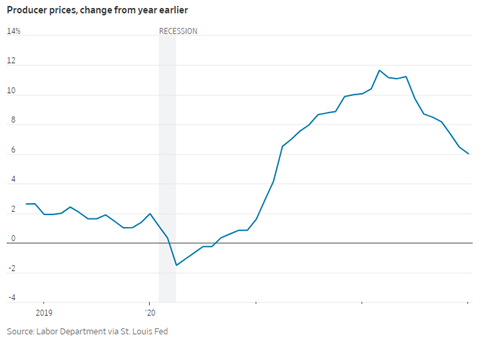

I. Summary: Recent price data on Consumer Price Index and the Producer Price Index from the U.S. Labor Department came in hot for January, increasing worries for investors that the Federal Reserve may have to keep interest rates elevated for a prolonged period of time. Consumer Price Index (CPI) Recent Consumer Price Index data showed that prices for energy, housing, food, and other items increased for the month of January. Compared to January 2022, the CPI inflation measure climbed 6.4%, edging down slightly from 6.5% in December. The good news is that the consumer price index has had 7 consecutive months of easing inflation since peaking at 9.1% in June, which was the highest reading since 1981. The bad news is that this cooling trend is moderating and strong inflation reports are likely to keep Federal Reserve officials on track to raise interest rates in March, with further potential increases after that. Fed officials in recent public appearances have forewarned of a longer fight than anticipated by many investors, who recently have anticipated faster declines in inflation. Jerome Powell recently stated that the process of reaching the Fed’s goal of 2% inflation “is likely to take quite a bit of time. It’s going to be, we don’t think, smooth. It’s probably going to be bumpy.” Core CPI rose 5.6% from a year earlier, down from 5.7% in December. Core CPI, which is similar to CPI is an aggregate of prices paid by consumers for a typical basket of goods, excluding typically more volatile food and energy costs. Underlying data in the CPI report showed that shelter prices have risen by 7.9% from a year earlier, the most since 1982, reflecting the lagged effects of booming demand for houses and apartments and remote working earlier in the pandemic. However, shelter prices are expected to ease later in the year. Grocery prices rose 11.3% in January from a year earlier. While grocery inflation has moderated from highs this past summer, some particular items like eggs and carbonated beverages remain considerably expensive. Prescription drug prices increased by 2.1% for the month while clothing and household furnishings were also more expensive. Producer Price Index (PPI) The recent Producer Price Index report, which measures the average change in selling prices received my domestic producers of goods and services, showed that US supplier prices rose 6% in January from a year earlier, a sign of still stubborn inflation pressures in the economy. The January report of 6% is still down from 6.5% in December and the all-time high of 11.7% in March, the most recent peak. PPI increased 0.7% in January from the prior month, compared with a revised 0.2% drop in December, which is significantly faster than the 0.2% average monthly rise in the year before the pandemic. The recent PPI report just provides further evidence to the Fed to hold interest rates higher and potentially even raise rate at the next FOMC meeting. Dallas Federal Reserve President Lorie Logan stated, “We must remain prepared to continue rate increases for a longer period than previously anticipated if such a path is necessary to respond to changes in the economic outlook or offset any undesired easing in conditions.”

Despite the recent inflation data, the broader economy has shown signs of resilience. The unemployment rate last month fell to 3.4%, the lowest level since 1969, and retail sales jumped 3% in January as consumers broadly boosted spending on vehicles, furniture, clothing, and dining out. However, Jerome Powell and the Federal Reserve have maintained their viewpoint that taming inflation is their #1 priority, and they will keep interest rates elevated until there is clear evidence that inflation is coming down. The recent CPI and PPI reports have provided additional evidence that the Fed still has a ways to go on bringing inflation down.

0 Comments

Most people are worried about making mistakes on their taxes that will get them in trouble with the IRS. In reality, most mistakes are simple human errors or missed opportunities that would reduced taxes owed. Last year, 9.4 million 'math-error' notices were sent out. Other mistakes involved forgetting to report invested income, getting bank or social security numbers incorrect, or forgetting to sign your return. In all of these circumstances, a little extra time or paying a tax professional can help save you money and give you peace of mind. Below are 8 common tax pitfalls to avoid: 1. Missing investment income 2. Selling too soon 3. Poor record keeping 4. Forgetting losses 5. Waiting too long to strategize 6. Engaging in wash sales 7. Not taking advantage of tax breaks 8. Forgetting deadlines Tax Mistakes do happen, but the more you understand your situation and tax rules, the less impact they can have on your wallet. Don't forget, this year's tax deadline is April 18, 2023. If you want more details on tax pitfalls, click on the article here or contact us at [email protected] or 979-694-9100. |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|