|

Financial markets are booming as long-awaited signs of a slowing economy and declining inflation have finally appeared in the recent prints of important economic indicators. The unemployment rate clocked in at 4.1% in June, its highest level since November 2021. In 2022 and 2023, an overheated labor market had the unemployment rate hovering between 3.4 and 3.8% before it began inching upward this year. Estimates hold that the natural rate of unemployment is between 4.3 and 4.4%, indicating that there is still room for the current rate to rise before it reaches that equilibrium level. The other reading of significant import is from the June CPI report, and it indicated a -0.1% change in consumer prices. For the first time since 2022, prices actually decreased on a month-to-month basis, bringing the year-to-date Consumer Price Index inflation down from 3.3% to a more modest 3.0%. With growth remaining steady and each of their dual mandate objectives coming into focus, the Fed’s balancing act appears to be working the way it should.

So, why is all of this fueling markets upward? First and foremost, the pressure is now on the Federal Reserve to begin lowering their Federal Funds Rate from the current level of 5.25-5.50%. Following the June CPI report and the unemployment data, markets began pricing in a 100% chance for a 25bps cut in September. While the Fed has proven markets wrong before on rates, Chair Jerome Powell has sounded surprisingly dovish of late. Powell is notoriously close-mouthed about Fed decision-making, but during his congressional testimonies and various speaking engagements this month he has noted, with increasing certainty, that the labor market is cooling, and inflation is moderating to a desired level. Certainty is the name of the game with market sentiment and stocks are soaring because of it. The end of a contractionary rate environment is something that companies and investors are extremely keen on, but other factors have also increased sentiment and kept these market rallies going. As noted earlier, the economy has finally shown consistent enough trends in unemployment and inflation to indicate that it’s behaving as it should. This economy will likely continue to respond as expected, barring any strong supply or demand-side economic shocks while the Fed lowers rates. Another major contributor to the state of financial markets is the rising level of certainty when it comes to November elections. Betting marketplace PredictIt.org now has odds of a Trump victory at 2:1 instead of the coin toss it was just a month ago. In the long-run, markets typically don’t care who sits in the Oval Office, but in the short-run they do prefer less political uncertainty during election season. At this point, the only plausible shakeup on that front would occur if Biden were to drop out of the race. Although the data is cause for optimism about the success of the Fed’s monetary policy, some experts remain skeptical. Recent reports of unchanged retail sales indicate that the economy might be chugging along steadily when it should be slowing down in this environment. It’s also worth bearing in mind that if the Fed lowers interest rates at the wrong time, it could result in a bumpier ride than expected. Transitionary periods are always a little more vulnerable than what we’re used to, but we can’t stay in this spot forever, and everybody knows it. Whether the first cut is in September or December, market confidence in Jerome Powell and the other Fed decision-makers should remain strong. Despite the few worries brought about by the retail sales report and the debate about when to cut rates, a soft landing and “immaculate disinflation” are securely in play for this economy going forward. Sources: https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/market-updates/notes-on-the-week-ahead/is-4-1-percent-unemployment-a-recession-warning/ https://www.investopedia.com/articles/investing/100715/breaking-down-federal-reserves-dual-mandate.asp https://www.yardeniquicktakes.com/the-trump-trade/

0 Comments

Mixed Signals

Traditions Wealth Advisors Greysen Golgert/Brien L. Smith CFP® Economic Analyst Intern/Chief Investment Officer June 25, 2024 Monetary policy among the major central banks officially diverged this month as the European Central Bank (ECB) and the Bank of Canada (BoC) pulled the trigger on a 25 basis point rate cut, with more cuts expected by the end of the year. Meanwhile, the US Federal Reserve System (Fed) and the Bank of England (BoE) remain committed to their current interest rate levels of ~5.25%. This divergence began because the BoC and ECB have seen enough progress on inflation to warrant a gradual easing of their monetary policy. Critics of the cut, especially in the European Union, see the move as premature. For an economy already seeing a resurgence this year, the fear is that cutting rates will bring inflation higher than its current level. While rate cuts are expected later this year in the US and UK, the Fed and Bank of England remain hawkish for now. Each has indicated that they need to see further evidence of cooling inflation and a corresponding decline in economic growth before they can begin easing monetary policy. In his opening remarks at a press conference following the FOMC meeting this month, Jerome Powell emphasized the Fed’s commitment to keeping the Federal Funds Rate high for as long as the FOMC deems necessary. Pressed on all fronts by reporters, he answered again and again that the Fed would continue to pursue its dual mandate objectives of stable prices and maximum sustainable employment. Notably, fifteen members of the nineteen-member FOMC penciled in projections for at least one rate cut before the end of 2024. Despite stubborn inflation from Q1, the CPI(Consumer Price Index) and PCE(Personal Consumption Expenditures) numbers have been positive recently, and it is encouraging to see most of the committee project a slight loosening of monetary policy before the end of the year. However, it should be acknowledged that the Fed is content to let this current rate environment ride until its hand is forced. As Chair Powell indicated in his speech, they will decide based on what the data tells them, and right now that data is telling them to remain firm. That said, the US economy has been hit with mixed signals recently. It’s too early to say whether these developments are positive or negative, but at the very least important indicators are not in line with typical expectations. To clarify, the current rate environment should theoretically cause inflation to cool, economic growth to slow down, and unemployment to rise. One figure that finally moved the way it should according to conditions was inflation. The one-month change in CPI inflation for the month from April to May clocked in below expectations at ~0%, bringing the year-over-year rate down to 3.3%. This is still well above the Fed’s stated goal of 2% year-over-year inflation, but it should be viewed as a positive. After all, lower inflation is lower inflation. However, the major expectation for this quarter is that economic growth will decelerate as it did in Q1. Recent developments indicate that this may not be the case after all. Nonfarm payroll employment (up 165,000 in April) was expected to increase by 190,000 in May but instead shot up to 272,000. In conjunction with that surprise reading, the Atlanta Fed’s GDPNow estimate for Real GDP growth in Q2 is hovering around 3% as of June 20th. The official figure for Real GDP growth in Q2 won’t be out until late July, and the adjusted figure won’t be released until August, but a robust US economy will likely defy expectations once more. The next time FOMC meeting will be July 30-31, right after the release of that advance estimate. By the time they meet, maybe these murky waters will clear and make the path forward obvious. As we saw in Q1, sometimes the data has other plans. Sources: https://perc.tamu.edu/blog/2024/06/inflation-wages-june-2024.html https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20240612.pdf https://www.atlantafed.org/cqer/research/gdpnow PPI and CPI: April 2024 as of 5/23/2024 Traditions Wealth Advisors Greysen Golgert/ Brien L. Smith, CFP® Economic Analyst Intern/Chief Investment Officer Howdy, my name is Greysen Golgert, and I am the new Economic Analyst Intern at TWA for the 2024-25 academic year. I am currently a senior in a 3+2 program at Texas A&M, and I will graduate in May of 2025 with both my B.S. and M.S. degrees in Economics. For the next year, I will be assisting TWA and its clients by providing analysis of, and commentary on, the state of the economy as well as relevant macroeconomic trends. On May 14th and 15th respectively, the U.S. Bureau of Labor Statistics (BLS) released the highly anticipated Producer Price Index (PPI) and Consumer Price Index (CPI) numbers for April. Before analyzing the indices and their implications, we should clarify the difference between the two. The CPI measures the prices that consumers face, and the PPI tracks the prices that producers receive for their goods. Prices received by the producer and faced by the consumer are different because sales and excise taxes are a part of the consumer’s out-of-pocket expenditure, but they are not passed on to the producer. Another important consideration is that the PPI only analyzes prices received by U.S. producers, while the CPI data includes imports in its calculation. The CPI is a more accurate inflation indicator than the PPI, which is more useful as a measure of real growth in output. That said, the Producer Price Index rose by 0.5% in April, bringing the year-over-year increase to 2.2%. Hikes in the prices of services account for approximately three-fourths of the total rise. A 3.9% increase in portfolio management fees as the result of a stock market rally appears to be the main reason that services inflation exceeded monthly and annual expectations. Contributors also included rebounding prices for hotel and motel rooms along with steadily rising health and medical insurance prices. Core PPI—which excludes food, energy, and trade services prices—advanced at a monthly rate of 0.4% and an annualized rate of 3.1%, which was the largest year-on-year gain since April 2023. Most of the goods inflation for the month can be attributed to a 5.4% increase in gasoline prices received by producers. Released the following day, the CPI data did not reflect the unexpected PPI increase. After three straight months of inflation data defying expectations, the CPI was finally in line with predictions. On a year-over-year basis, CPI rose by 3.4% and Core CPI—which excludes volatile food and energy prices—only rose by 3.6%, the lowest percentage increase since 2021. Shelter and gasoline costs for consumers accounted for almost three quarters of the 0.3% monthly increase in the index. Other sectors that saw rising consumer prices besides shelter and energy include medical care, motor vehicle insurance, and apparel. The index saw notable declines in the prices for used vehicles, new vehicles, household furnishings and operations, and airline fares. Even though the PPI data gave expectations a bit of a shock, the CPI data indicates that inflation is likely on the decline. It also probably confirms that the Fed will not need to raise rates this year. Investment markets such as the S&P 500, the Nasdaq Composite, and the Dow Jones Industrial Average rejoiced at the news, all closing on record highs this week in anticipation of rate cuts and/or a soft landing. A consistent decline in inflation without an extreme rise in unemployment over the coming months is the only way the Fed will consider cutting rates this calendar year. A soft landing is becoming increasingly probable as we proceed through Q2 of 2024. Other key indicators that work in tandem with inflation data are beginning to paint a clearer picture of the future. The labor market is cooling as only 175,000 jobs were added in April compared to 303,000 in March. GDP growth slowed to 1.6% in Q1 of 2024 from a previous growth rate of 3.4% in Q4 of 2023, unemployment is at an encouraging 3.9%, and retail sales were unexpectedly flat in April. All of these pieces of information, even if they may seem counterintuitive, are cause for relief and cautious optimism going forward. Sources:

https://www.bls.gov https://www.wsj.com/economy/inflation-april-cpi-report-interest-rate-55eda190 https://www.reuters.com/markets/us/us-producer-prices-increase-more-than-expected-april-2024-05-14/ Ryan Hill

Associate Wealth Manager Director & Manager of TWA Sponsored Internships Ryan is a 3rd generation Aggie and class of 2024. He was lured to Texas A&M University primarily by his desire to keep his family’s tradition alive and knowing that A&M is a premier university specifically, in recent times, in business. He initially wanted to follow in the footsteps of his mother and become a veterinarian. After recognizing that this was not his core passion, he obtained an interest in the operation of private businesses as well as obtaining a strong interest in the field of wealth management. Ryan's role as an Associate Wealth Manager/Director & Manager of TWA Sponsored Internships keeps him busy by researching and presenting current investments and investment opportunities for clients. He also directs and manages the TWA sponsored internship program. Ryan is the newest full time professional so he enjoys joining and taking notes in client meetings and helping to prepare financial projections. Ryan serves our clients by keeping a close eye on their portfolios and looking into their current funds as well as researching any additional funds TWA might recommend to the the client for investment purposes. When Ryan is not at work, he spends his free time with his wife Elizabeth, and their 6 month old daughter, Margaret. Ryan is an avid hunter and fisherman and also enjoys reading, playing the guitar, and cooking. Ryan volunteers at his church, St. Mary's Catholic Center, as a Rite of Christian Initiation of Adults(RCIA) small group leader. As a global leader, the U.S. economy often sets the tone for worldwide economic trends. However, recent updates have revealed mixed signals, with a notable slowdown in GDP growth alongside persistent inflation challenges. According to the latest data, GDP growth decelerated to an annual rate of 1.6% for Q1 of 2024, the slowest pace in almost two years. This reduction in growth rate was largely due to decreases in private inventory investment and a rise in imports, which, despite boosting consumer buying power due to lower prices from a stronger dollar, could reduce the competitiveness of American exports on a global scale.

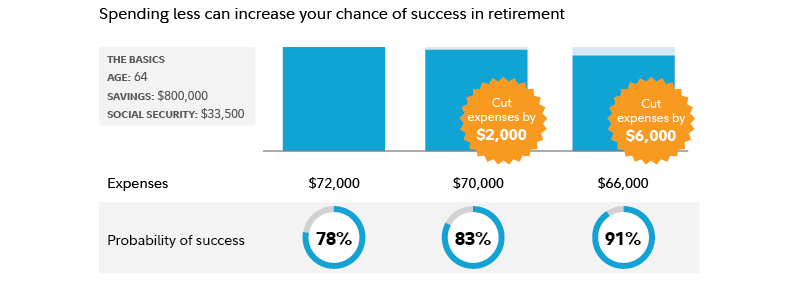

Shifting focus to the domestic front, inflation continues to be a central concern, as evidenced by the latest readings from the Personal Consumption Expenditures (PCE) price index. The PCE index, which the Federal Reserve uses as a primary gauge of inflation, rose at a 3.4% annualized rate during the quarter, its biggest gain in a year and up from 1.8% in Q4 of 2023. The core PCE, which strips out the volatile food and energy components, increased to 3.7% during the first three months of the year, well above the Federal Reserve’s target of 2%. These figures demonstrate the stubborn persistence of inflation within the economy, despite prior interest rate hikes designed to temper such pressures. Additionally, these economic challenges are compounded by the United States' escalating national debt, which has reached a record $33 trillion, with a debt-to-GDP ratio of 123%. This substantial fiscal burden influences monetary policy decisions, potentially impacting the nation's economic trajectory. In this complex economic environment, the Federal Reserve faces the crucial task of managing inflation without triggering a recession. The upcoming Federal Reserve meetings on April 30th and May 1st are poised to be insightful, promising to provide a clear view of the central bank's stance on controlling interest rates and providing indicators of how it views the economic recovery and inflation risks. In his role, it would be crucial to confront and clearly communicate the reality of economic pressures. The 22% surge in auto insurance prices over the past year, a direct result of supply chain disruptions increasing the costs of vehicle parts and labor, exemplifies these pressures. These disruptions not only raise the cost of vehicles, causing drivers to keep their cars longer and deal with more frequent breakdowns, but also lead insurers to hike premiums to manage pricier claims. Moreover, rising rental costs, influenced by investor and corporate ownership of homes as well as immigration factors, further compound the economic challenges. Despite these inflationary pressures, consumer spending has remained resilient, with a robust 0.8% increase in March, reflecting that consumers have adjusted to the higher inflation and interest rates. Yet, this trend cannot continue indefinitely. Evidently, there appears to be a conflict of interest between the strategic objectives of the Federal Reserve and the actions undertaken by the U.S. government, especially with recent fiscal initiatives that may exacerbate inflationary pressures. For effective macroeconomic management, it is imperative that the U.S. government policies align with the monetary strategies set by the Federal Reserve. This alignment is essential for addressing significant economic challenges such as persistent inflation and escalating public debt, both critical for the long-term fiscal health of the economy. Coordinating these efforts is vital for maintaining a stable economic trajectory and promoting conditions conducive to sustainable growth! A financial professional can help you find your balance Retirees save for a wide range of reasons. Some take pride in getting a deal, others want to put cash away for a big goal that arose after retirement planning, and some want to leave as much money as possible for heirs. There are also those who reduce expenses to hedge against inflation or a stock market downturn. Yet, if you have a solid retirement plan—including enough guaranteed income to match your essential expenses—and you're still pinching every penny, take a step back to examine your real reasons for doing so. You may have unrealistic financial fears, or need assistance transitioning away from the "saving" and toward the "withdrawing" phase of your financial life. If you have an inkling that you might be a bit too frugal or are continually urged by family or friends to enjoy your hard-earned money, it can be useful to work with a financial professional. Small cutbacks can make a big difference If you find that you do still want or need to reduce your spending, the good news is that even small reductions can have a big potential impact over the course of your retirement. One way of understanding this impact is by looking at how adjusting your spending can impact the "probability of success" of your retirement plan—meaning, the likelihood that you won't run out of money during your retirement plan. Here's how smaller savings, of just $2,000 per year, or larger cutbacks, of $6,000 per year, could impact those figures for a hypothetical 64-year-old pre-retiree. Ways to save big Once you feel comfortable with your reasoning, you can unleash a wide range of savings techniques. As you probably guessed, you'll need to make bigger changes for bigger savings. One simple way to potentially save thousands each year? Hold off on buying that new vehicle. Or, if it's no longer needed, selling a second car can potentially put some cash back in your pocket, while also helping you save on insurance and maintenance. For many people, the single most impactful way to reduce their cost of living is by taking a hard look at where they live. To be sure, moving is a deeply personal decision and comes with plenty of tradeoffs—including the transaction costs of buying and selling, the stress of moving, and the disruptions from adjusting your routines. But downsizing or moving to a lower-cost area can potentially bring the double benefits of unlocking equity and reducing ongoing expenses. Ways to save small Once you've evaluated your potential sources of big savings, consider turning your attention to your day-to-day spending. The first step is to find an approach that works for you. If you delight in finding the perfect outfit at a super-sale price, scour those clearance racks. If you relish the art of negotiation, -feel free to do so in appropriate settings. And if the idea of paying $14 for a glass of wine makes you shudder, then put together a list of all the BYOB restaurants in your area. Here are some more places to look for savings: Scrutinize your subscriptions: Review your credit card bills to ensure you're not paying for unused services. Be aware of subscriptions that renew automatically. Stay on top of those, as well as the end of free-trial periods, by setting a calendar reminder. Before re-upping for any subscription, weigh how much you spend against how much you actually use the service. Reduce energy use: You can potentially save hundreds of dollars a year with little effort. Among the tactics to deploy: Install a programmable thermostat that adjusts temperatures automatically, switch to energy-saving LED lights, seal up window cracks with caulk, and strategically use blinds, drapes, and other window coverings. If you're considering more significant upgrades, look into any federal or state incentives for improving your home's energy efficiency. Travel during off-peak times: As a retiree without a set work or school schedule, you can capitalize on the savings that come with taking a vacation during off-peak months. Another idea? Plan short trips, cultural events, and entertainment for midweek. Prices at hotels, as well as some restaurants, museums, and concert and theater venues, can be less than what you'd pay on the weekend. And always ask about discounts through any memberships or clubs you belong to. Consider your insurance: Shop around for home, auto, and other insurance to get the best deal. Many insurance carriers provide discounts when you buy more than one policy. Service providers may offer a better price if you call and say you're considering switching to a competitor. Use a rewards credit card: From getting money back on purchases to earning travel points, rewards cards can provide a wide range of perks. Making savings even simpler, many financial institutions will automatically deposit cash rewards into a checking, savings, or brokerage account. As with any credit card, pay your balance in full each month to avoid interest charges. Shop strategically: Avoid unnecessary purchases by creating, and sticking with, a shopping list. If you buy in bulk, portion out perishable food items like meat and freeze them before they spoil. And if you have a weakness for retail therapy, consider imposing a cool-off period on yourself to try to avoid impulse buys—like waiting a week before making an unplanned purchase. Enjoy your money with confidence While cutting costs can bring satisfaction, it's also important at times to let yourself spend. The key, as with most things in life, is in finding the balance. Start by gaining a clear understanding of how much money you can comfortably spend. That's where a comprehensive financial plan and a well-thought-out budget come into play. Creating a budget can help give you clear objective rules for your spending, so that you know if a given expense would put you over your limit. Then, before you swipe your credit card or pull out cash for a nonessential expense, consider the value you'll receive in exchange for your money. If you usually avoid pricey restaurants but a good friend invites you out somewhere nice for her birthday, you may decide that this time, the cost is worth it. If you've budgeted properly, you can order that Cabernet Sauvignon and comfortably raise your glass in a toast to friendship. Then, the next day, you can haggle with your cable company if it pleases you. Questions about the above article? Please reach out to [email protected] or call 979-694-9100.

Source: Fidelity Viewpoints: 8 March 2024. https://www.fidelity.com/learning-center/personal-finance/spend-less-in-retirement Did you know that the Federal Reserve, often simply referred to as the Fed, doesn't actually print money? This common misconception is just one aspect of the complex role the Fed plays in shaping the United States’ economic policy. Bear with me.

Established in 1913 by the Federal Reserve Act, the Fed serves as the central bank of U.S. Its primary functions include implementing the nation's monetary policy, regulating banks, ensuring financial stability, and providing banking services. Importantly, the Fed operates independently, meaning its decisions are not subject to presidential or governmental approval, though it remains under congressional oversight. The Fed's independence is crucial during election years, when there is intensified governmental pressure for economic stability to aid reelection campaigns. Historically, the Fed has adjusted interest rates in every election year since 1980, with the sole exception of 2012, when the economy was still recovering from the financial crisis and interest rates were at zero. Recently though, while initial speculations pointed towards a potential rate cut, the prevailing economic data has led to increasing expectations of a rate hike instead. Moreover, the Fed's financial activities are not for profit. It is required by law to transfer its net earnings to the U.S. Treasury, after covering all necessary expenses, legally required dividend payments, and maintaining a limited balance in a surplus fund. In terms of currency, while the Fed is responsible for putting money into circulation, it is the Bureau of Engraving and Printing, an agency of the U.S. Treasury, that actually prints the money. The Fed then purchases this currency at cost and puts it in the economy’s money circulation. Here is where it gets interesting. Despite how skilled the Fed members can be at implementing policies, if they do not work hand in hand with the government, it becomes extremely difficult to manage the economy. The current state is a perfect example. In the aftermath of the pandemic, which severely disrupted the global supply chain, the U.S. government chose to engage in foreign conflicts by providing aid. However, this aid does not directly leave American shores; instead, it finances the purchase of U.S. military equipment that is then supplied to those countries. The funds are directly drawn from the national budget. This action creates a budgetary deficit while paradoxically stimulating GDP growth as equipment involves both manufacturing and labor. Growth is the opposite of the Fed’s current goals as it contributes to inflation. Since April 2022, the Fed has been systematically increasing interest rates to keep inflation in check. Higher interest rates make loans more expensive, which can cool off spending and investment by making it costlier for consumers and businesses to finance new purchases and projects. This is a classic monetary tool used to temper economic activity when prices start rising too quickly, thus preserving the value of the currency and maintaining the purchasing power of consumers. The economy is thus showing resilience despite persistent inflation, largely driven by rising rent and auto insurance costs. Auto insurance prices have surged by 22% over the past year due to continuing supply chain disruptions that have increased the cost of vehicle parts and labor. The escalated cost of vehicles is causing drivers to keep their cars longer, leading to more frequent breakdowns and a greater need for repairs. Insurers, facing expensive claims, are raising premiums to cover these costs. Concerns are also mounting over rising rental costs, which are being influenced by investor and corporate ownership of homes, as well as immigration factors. Considering the imperative role of the Federal Reserve in managing the U.S. economy and recent governmental actions that inadvertently complicate its inflation-control efforts, it is evident that there is a need for closer alignment between government and the Fed. The government must reengage with the Fed and adopt a regulatory mindset that supports the Fed’s objectives. Such cooperation is crucial for harmonizing efforts to ensure economic stability, particularly in addressing challenges like inflation and budget deficits, which are critical for the long-term health of the economy. Kristina Badrak/Brien L. Smith, CFP® Professional Financial Analyst Intern/Chief Investment Officer celebrating 35+ years of fiduciary service Traditions Wealth Advisors, L.L.C. 2700 Earl Rudder Freeway S. Suite 2600 College Station, TX 77845 www.traditionswealthadvisors.com (979)694-9100 This communication may contain confidential and/or privileged information. If you are not the intended recipient (or have received this communication in error) please notify the sender immediately and destroy this communication. Any unauthorized copying, disclosure or distribution of this material is strictly forbidden. Investment Advice offered through Traditions Wealth Advisors, LLC, a registered investment advisor. Traditions Wealth Advisors, LLC does not render legal or tax advice, and the information contained in this communication should not be regarded as such. Jerome Powell faces a relentless dilemma: whether to raise or cut interest rates, a decision that shadows him day and night. Initially, market speculation hinted at potential rate cuts as early as March, but reassessments have pushed these expectations further out, with June cuts now seeming highly unlikely. This re-evaluation stems from March’s Consumer Price Index (CPI) figures. The headline Consumer Price Index (CPI), which tracks the price changes urban consumers experience for a broad array of goods and services, recorded an increase of 0.4% for both headline and core CPI in March, surpassing the expected 0.3%. Although the core CPI, which filters out the volatile food and energy sectors, only exceeded expectations by 0.1%, it did so for the third consecutive month, surpassing forecasts. If this trend continues, inflation could solidify at over 4% annually—twice the Federal Reserve’s target rate.

The increase in March's CPI was predominantly driven by the shelter and energy sectors, which collectively accounted for more than half of the month-over-month (MoM) gain. According to the Bureau of Labor Statistics (BLS), gasoline prices rose by 1.7% MoM. In the shelter category, rent prices increased by 0.4% MoM, a slight decrease from February's 0.5% rise. Owners' Equivalent Rent (OER), which estimates the rental equivalent or potential rental income of homeowners' properties, also increased by 0.4%, maintaining the consistent growth rate as in February. Despite these monthly increases, the year-on-year (YoY) inflation for these shelter categories showed signs of cooling. Significant movements within the core CPI included motor vehicle-related costs, with insurance surging by 2.6% and repair costs climbing by 3.1%, along with a 0.5% increase in healthcare costs. Other categories displayed mixed trends; apparel and personal care products saw price increases of 0.7%, while there were decreases in the prices of used cars and trucks (-1.1%), recreational goods (-0.1%), and new vehicles (-0.2%). Another key economic indicator released was the Producer Price Index (PPI), which provides insights into the wholesale price trends of goods and services. Some of the drivers of the core CPI, such as motor vehicle insurance, are not included in the personal consumption expenditures price indexes, which the Fed monitors for its inflation target. Both headline and core PPI registered a 0.2% increase, with analysts having anticipated a 0.3% rise respectively. The 0.2% rise marked the lowest monthly growth in PPI since December and a decrease from February’s 0.6%. Nonetheless, the employment report offers some positive news. Although nonfarm payroll surged by 303,000 jobs last month, the unemployment rate remains below 4%, and YoY wage growth is stable at approximately 4.1%, lower than last year's end. This indicates that wages are rising at a manageable rate without adding to inflationary pressures. Despite some concerns about these measures, the upcoming release of the Personal Consumption Expenditures (PCE) index, which tracks consumer spending on goods and services is preferred by the Federal Reserve due to its broader aspect allocation of spending categories. In addition, it is important to note that Jerome Powell has consistently emphasized caution throughout the quantitative tightening process, underscoring the significance of this measure in shaping monetary policy. Sources: https://www.nytimes.com/2024/04/11/business/economy/federal-reserve-soft-no-landing.html https://perc.tamu.edu/blog/2024/04/inflation-and-wages-though-march.html Kristina Badrak/Brien L. Smith, CFP® Professional Financial Analyst Intern/Chief Investment Officer celebrating 35+ years of fiduciary service Traditions Wealth Advisors, L.L.C. 2700 Earl Rudder Freeway S. Suite 2600 College Station, TX 77845 www.traditionswealthadvisors.com (979)694-9100 This communication may contain confidential and/or privileged information. If you are not the intended recipient (or have received this communication in error) please notify the sender immediately and destroy this communication. Any unauthorized copying, disclosure or distribution of this material is strictly forbidden. Investment Advice offered through Traditions Wealth Advisors, LLC, a registered investment advisor. Traditions Wealth Advisors, LLC does not render legal or tax advice, and the information contained in this communication should not be regarded as such. You work at your job, you pay taxes, then when you retire, you get Social Security benefits tax-free, right?

Wrong. Up to 85% of the Social Security benefits you get each year could be subject to tax, depending on your household income. What’s more, 100% of your withdrawals from traditional IRAs and traditional 401(k)s will likely be considered taxable income. There are ways to keep more of your retirement income—but first, it helps to understand how retirement income is taxed. Taxes on retirement income: In retirement, different kinds of income are taxed differently:

So as you work with financial and tax professionals, consider the following 2 strategies. (Note that if your and your spouse’s combined annual retirement income is more than $100,000, you will likely need additional tax planning.) 1. Converting savings into a Roth IRA: "One strategy to reduce the taxes you pay on your Social Security income involves converting traditional 401(k) or IRA savings into a Roth IRA," says Shailendra Kumar, director at Fidelity's Financial Solutions. Not everyone can contribute to a Roth IRA or Roth 401(k) because of IRS-imposed income limits, but you still may be able to benefit from a Roth IRA's tax-free growth potential and tax-free withdrawals by converting existing money from a traditional IRA or a workplace retirement savings account into a Roth IRA. This process of converting some of your IRA or 401(k) into a Roth IRA is known as a partial Roth conversion. "You can choose to convert as much or as little as you want of your eligible traditional IRAs. This flexibility enables you to manage the tax cost of your conversion," adds Kumar. "A Roth IRA or Roth 401(k) can help you save on taxes in retirement. Not only are withdrawals potentially tax-free, they won't impact the taxation of your Social Security benefit. This is an important aspect of a Roth account that most people are not aware of.” Remember: The amount you convert is generally considered taxable income, so you may want to consider converting only the amount that could bring you to the top of your current federal income tax bracket. You also may want to consider basing your conversion amount on the tax liability you may incur, so you can pay your taxes with cash from a nonretirement account. Consult a tax professional for help. Tip: To learn more about Roth conversions, read Viewpoints on Fidelity.com: Answers to Roth conversion questions 2. Delaying your Social Security benefit claim: "The other strategy,” says Kumar, “involves postponing when you first take Social Security. Both approaches can help shave dollars off your tax bill in retirement every year—it just takes a little forward planning." Consider a hypothetical couple named Natalie and Juan: For every year they delay taking Social Security past their full retirement age (FRA), they get up to an 8% increase in their annual benefit. In general, many people would benefit from waiting to age 70 to take Social Security. Others may need the income sooner and may lack the resources necessary to meet expenses during the delay period, or they may not live long enough to reap the rewards of delaying their claim. Natalie and Juan’s strategy is to reduce the amount they withdraw from their taxable IRAs over time and make up the difference in income by waiting until age 70 to claim Social Security. This has a big payoff for them because by delaying claiming Social Security until age 70, the percentage of their Social Security income that gets taxed is cut from 85% to 47.2%. It gets better: While Natalie and Juan’s retirement paycheck of $70,000 remains the same, they pay approximately 41% less in taxes and withdraw smaller amounts from their respective IRAs each year. Natalie and Juan should also look for ways to mitigate their tax liability between ages 65 and 70 while they delay Social Security and supplement their income with other sources. Withdrawing solely from taxable IRAs over this time period could result in relatively higher tax bills, potentially offsetting some the tax savings they expect to get at ages 70 and beyond. Bottom line: Social Security income becomes even more valuable for retirees when they realize that it is taxed less in retirement versus other forms of retirement income. Consider how long you may live, your financial capacity to defer benefits, and the positive impact the claiming decision may have on taxes you'll pay throughout your retirement. Tip: To learn more about timing and Social Security, read Viewpoints on Fidelity.com: Should you take Social Security at 62? Planning ahead: As you develop short- and long-term retirement income strategies, remember:

Tip: As you approach retirement, think about increasing your contributions to these preretirement savings vehicles such as Roth IRAs. These accounts are federally tax-advantaged and can help reduce your combined taxable income. This approach makes it possible to help reduce the taxes you pay on your Social Security benefit because you will likely have to withdraw less from traditional taxable IRAs to fund your retirement. Do you have more questions? Please reach out to Laurie or Brien at [email protected] [email protected] We are here to serve you. Source: Fidelity Viewpoints. https://www.fidelity.com/viewpoints/retirement/taxes-on-social-security |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|