|

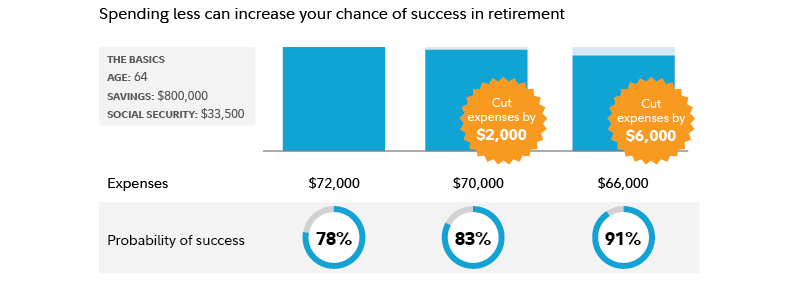

A financial professional can help you find your balance Retirees save for a wide range of reasons. Some take pride in getting a deal, others want to put cash away for a big goal that arose after retirement planning, and some want to leave as much money as possible for heirs. There are also those who reduce expenses to hedge against inflation or a stock market downturn. Yet, if you have a solid retirement plan—including enough guaranteed income to match your essential expenses—and you're still pinching every penny, take a step back to examine your real reasons for doing so. You may have unrealistic financial fears, or need assistance transitioning away from the "saving" and toward the "withdrawing" phase of your financial life. If you have an inkling that you might be a bit too frugal or are continually urged by family or friends to enjoy your hard-earned money, it can be useful to work with a financial professional. Small cutbacks can make a big difference If you find that you do still want or need to reduce your spending, the good news is that even small reductions can have a big potential impact over the course of your retirement. One way of understanding this impact is by looking at how adjusting your spending can impact the "probability of success" of your retirement plan—meaning, the likelihood that you won't run out of money during your retirement plan. Here's how smaller savings, of just $2,000 per year, or larger cutbacks, of $6,000 per year, could impact those figures for a hypothetical 64-year-old pre-retiree. Ways to save big Once you feel comfortable with your reasoning, you can unleash a wide range of savings techniques. As you probably guessed, you'll need to make bigger changes for bigger savings. One simple way to potentially save thousands each year? Hold off on buying that new vehicle. Or, if it's no longer needed, selling a second car can potentially put some cash back in your pocket, while also helping you save on insurance and maintenance. For many people, the single most impactful way to reduce their cost of living is by taking a hard look at where they live. To be sure, moving is a deeply personal decision and comes with plenty of tradeoffs—including the transaction costs of buying and selling, the stress of moving, and the disruptions from adjusting your routines. But downsizing or moving to a lower-cost area can potentially bring the double benefits of unlocking equity and reducing ongoing expenses. Ways to save small Once you've evaluated your potential sources of big savings, consider turning your attention to your day-to-day spending. The first step is to find an approach that works for you. If you delight in finding the perfect outfit at a super-sale price, scour those clearance racks. If you relish the art of negotiation, -feel free to do so in appropriate settings. And if the idea of paying $14 for a glass of wine makes you shudder, then put together a list of all the BYOB restaurants in your area. Here are some more places to look for savings: Scrutinize your subscriptions: Review your credit card bills to ensure you're not paying for unused services. Be aware of subscriptions that renew automatically. Stay on top of those, as well as the end of free-trial periods, by setting a calendar reminder. Before re-upping for any subscription, weigh how much you spend against how much you actually use the service. Reduce energy use: You can potentially save hundreds of dollars a year with little effort. Among the tactics to deploy: Install a programmable thermostat that adjusts temperatures automatically, switch to energy-saving LED lights, seal up window cracks with caulk, and strategically use blinds, drapes, and other window coverings. If you're considering more significant upgrades, look into any federal or state incentives for improving your home's energy efficiency. Travel during off-peak times: As a retiree without a set work or school schedule, you can capitalize on the savings that come with taking a vacation during off-peak months. Another idea? Plan short trips, cultural events, and entertainment for midweek. Prices at hotels, as well as some restaurants, museums, and concert and theater venues, can be less than what you'd pay on the weekend. And always ask about discounts through any memberships or clubs you belong to. Consider your insurance: Shop around for home, auto, and other insurance to get the best deal. Many insurance carriers provide discounts when you buy more than one policy. Service providers may offer a better price if you call and say you're considering switching to a competitor. Use a rewards credit card: From getting money back on purchases to earning travel points, rewards cards can provide a wide range of perks. Making savings even simpler, many financial institutions will automatically deposit cash rewards into a checking, savings, or brokerage account. As with any credit card, pay your balance in full each month to avoid interest charges. Shop strategically: Avoid unnecessary purchases by creating, and sticking with, a shopping list. If you buy in bulk, portion out perishable food items like meat and freeze them before they spoil. And if you have a weakness for retail therapy, consider imposing a cool-off period on yourself to try to avoid impulse buys—like waiting a week before making an unplanned purchase. Enjoy your money with confidence While cutting costs can bring satisfaction, it's also important at times to let yourself spend. The key, as with most things in life, is in finding the balance. Start by gaining a clear understanding of how much money you can comfortably spend. That's where a comprehensive financial plan and a well-thought-out budget come into play. Creating a budget can help give you clear objective rules for your spending, so that you know if a given expense would put you over your limit. Then, before you swipe your credit card or pull out cash for a nonessential expense, consider the value you'll receive in exchange for your money. If you usually avoid pricey restaurants but a good friend invites you out somewhere nice for her birthday, you may decide that this time, the cost is worth it. If you've budgeted properly, you can order that Cabernet Sauvignon and comfortably raise your glass in a toast to friendship. Then, the next day, you can haggle with your cable company if it pleases you. Questions about the above article? Please reach out to [email protected] or call 979-694-9100.

Source: Fidelity Viewpoints: 8 March 2024. https://www.fidelity.com/learning-center/personal-finance/spend-less-in-retirement

0 Comments

Leave a Reply. |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|