|

How much do you need to retire? How much will you spend during retirement? How long will you be retired? These are some of the most common retirement questions. Age-based retirement analysis can help you plan with so many uncertainties.

If a person saves 15% of his/her income starting at age 25, invests more than 50% of his/her savings in stock, retires at age 67, and maintains their pre-retirement lifestyle, than he/she needs to save 10x your pre-retirement income by the age of 67. Let’s get on track on how to accomplish this retirement savings: Aim to SAVE at least... 1x your income by age 30, 3x by age 40, 6x by age 50, and 8x by age 60 The longer you can delay retirement the less amount of savings you will need. Your savings will have more time to grow the longer you work and your Social Security benefits will be higher. Due to health and job status, you must choose when is best to retire. One thing is true, the longer you work the easier it is to reach your retirement goals. How do you want to live in retirement? Will you spend more or less in retirement? Besides your age of retirement, spending during retirement is an important factor to consider. No matter what your age is, it is important to set and reach retirement goals. There are ways to catch up on these goals if you fall behind, but the sooner you start saving the better. Want more information on planning and saving for retirement? Contact [email protected] or 979-694-9100.

0 Comments

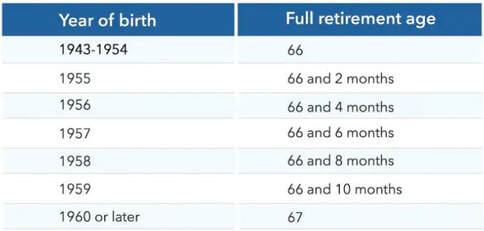

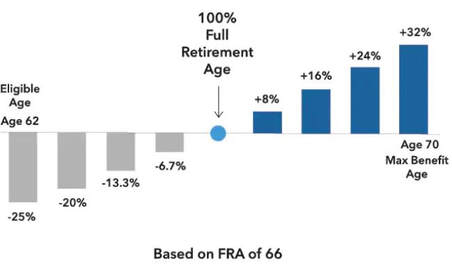

Understanding Social Security benefits can be haunting, but it is an important part of retirement income. Unfortunately, it can be complex to understand fully how Social Security works and the earlier you understand the process the better. Here are some straightforward strategies to answer some of the most common Social Security questions. 1. Who qualifies for Social Security? Each US worker gets a credit for the income he/she earned. In 2021, a credit is received for each $1,470 earned with a maximum of four credits per year. At retirement, anyone with at least 40 credits of work is eligible for Social Security. There are also benefits for spouses, ex-spouses, widowed spouses, disability benefits, and dependents of retired worker’s family. The maximum monthly benefit in 2021 is $3,895, which would go to a maximum wage earner who begins taking benefits at age 70. The size of your monthly benefit will depend on how much you have earned during your working life, but it also depends on when you choose to start receiving Social Security. 2. When should I start taking Social Security benefits? This is your most important decision to make. Your Social Security benefit will be determined by the age you are when you begin receiving benefits. You may choose to begin receiving benefits as early as age 62 (earlier if you are disabled, or at age 60 for widow/widower) or as late as age 70. This decision generally determines the level of monthly income you receive over your lifetime. Social Security defines the age it expects you to retire with full benefits as your full retirement age (FRA). Depending on when you were born, your FRA is currently between age 66 and 67 as seen below: Thinking about retiring early or delaying retirement? See the chart below for how this changes your Social Security benefits. 3. Does marital status affect Social Security benefits?

Marriage does not necessarily change your Social Security benefits. If you and your spouse worked enough years to separately qualify, then you each receive your separate benefits. If one spouse did not work or did not work enough to qualify, then that spouse may be eligible to earn half of the working spouse’s social security benefits. If you are divorced, but married for at least 10 years, you can receive similar benefits from your spouse as mentioned above once you reach the age of 62. If you remarry, you no longer qualify for your ex-spouse’s benefits. Widows/Widowers are eligible to receive social security benefits at age 60. If you remarry, you will not be able to receive these benefits. If you remarry after age 60 it doesn’t affect your widow’s benefits. This is just Part 1 of the most common questions about Social Security benefits. Stay up-to-date with our November newsletter for part 2. Questions about anything in the above article? Don’t hesitate to reach out to Traditions Wealth Advisors at [email protected] or 979-694-9100. |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|