'The traditions the school possess brought me to A&M' our new accounting intern shared with us in a recent interview. Class of 2023, Kendall is looking forward to applying and starting the PPA program this year. After graduation, she would like to move to Dallas to work for one of the Big 4 Accounting firms. Until graduation, Kendall is just enjoying summer time and likes to visit her family in Marble Falls. She especially loves her time with her 1 year old nephew. Just for fun we asked Kendall what her ultimate vacation would be? She said Greece for the gorgeous views and she would love to dive into the culture. Learn more about Kendall and her roll at Traditions Wealth Advisors, on our 'About' 'Our Team' tab.

0 Comments

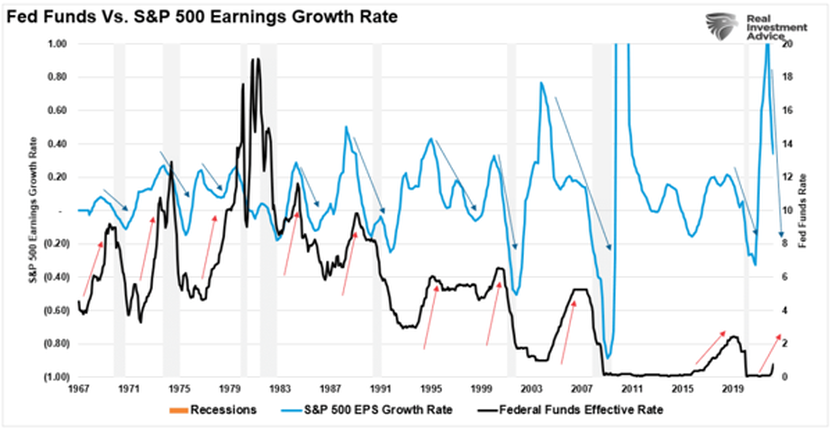

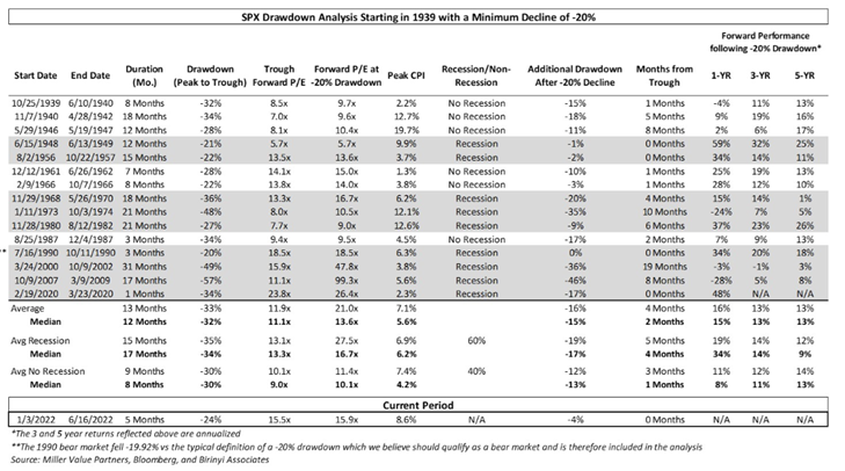

What Is A Recession? With current market conditions, many media outlets are calling for a recession or stating that we are already in a recession. There are many broad ways to define a recession, many economists say that a recession is two quarters in a row with negative GDP growth. However, this is debatable as there are many different opinions on what a recession is. My personal favorite is from a committee of experts at The National Bureau of Economic Research (NBER), a private non-profit research organization that focuses on understanding the U.S. economy. They define a recession as “a significant decline in economic activity that is spread across the economy and lasts more than a few months.” The NBER takes account of a number of monthly indicators such as employment, personal income, and industrial production, as well as quarterly GDP growth. Therefore, while negative GDP growth and recessions closely track each other, the NBER’s consideration of monthly indicators, particularly employment, means that the identification of a recession with two consecutive quarters of negative GDP growth does not always hold. Latest Macroeconomic Update Some of the top economists in the world have posted their thoughts on the current macroeconomic environment in the U.S. and abroad over the past week. Byron Wien who is Vice Chairman of Blackstone’s Private Wealth Solutions group stated that he believes that if we do go into a recession, it will be a short and shallow one. He believes that this recession will not resemble the recession of the Dot.com crash and the Great Recession between 2007-2009. Wien said that the difference between the current markets and these two particular recessions is that consumers and companies are in much better shape compared to the two previous recessions. Consumer savings have been built up over a sustained period of time and companies currently have strong balance sheets. Wien also stated that the two previous recessions were marked by extremes. There were extreme valuations of companies with no earnings in 2001 and excessive speculation in the housing market in 2008, with unemployment ticking up and inflationary pressure starting to ease, Wien doesn’t believe that this recession will be caused by an extreme. Another economist that gave his recent macroeconomic outlook is Dr. David Kelly, Chief Global Strategist and Head of the Global Markets Insights Strategy Team for J.P. Morgan Asset Management. Dr. Kelly also believes there will be a shallow and lighter recession in the future, he also stated that this recession would be nowhere near the magnitude of the 2001 Dot.com recession and the Great Recession of 2007-2009. Dr. Kelly also believes that the markets have not bottomed out yet, as consumer sentiment is still very low, and inflation is still high but starting to decline. The Fed also released its June Meeting Minutes, they reaffirmed their commitment to bringing down inflation with more rate hikes between 0.5%-0.75% in the upcoming meetings. They acknowledged that the policy tightening would likely come with a price, “participants recognized that policy firming could slow the pace of economic growth for a time, but they saw the return of inflation to 2% as critical to achieving maximum employment on a sustained basis.” The approach comes with the U.S. economy already on shaky ground. Gross Domestic Product (GDP) in the first quarter fell 1.6% and is on pace to decline 2.1% in the second quarter, according to an Atlanta Fed data tracker. Some people would view this as an official recession; however, it would be a historically shallow recession. The Fed officials also noted some reports of consumer sales slowing and businesses holding back on investments due to rising costs. The war in Ukraine, as well as supply chain bottlenecks and Covid lockdowns in China, were also a concern. Officials also penciled in a much bigger inflation surge than before, now anticipating headline personal consumption expenditures prices to jump 5.2% this year, compared to the 4.3% previous estimate. The meeting minutes also noted that after a series of rate hikes, the Fed would be well-positioned to evaluate the success of the moves before deciding whether to keep going. They said “more restrictive policy” could be implemented if inflation fails to come down. Is A Recession Already Priced Into The Markets? Equities have fallen so quickly, well ahead of profits, that equities have already factored in a recession. A broad range of data suggests recession risks in the U.S. are mounting. Economist Albert Edwards stated “The leading indicators look grim as well. For example, the Conference Board’s leading indicator fell for the third month in a row in May and that now makes 4 declines in the last 5 months. That is normally stuff of recession.” Stocks also remain under selling pressure due to issues causing a repricing of valuations. These issues include surging inflation, aggressive fed rate hikes, reducing or tapering of the Fed’s balance sheet, lack of stimulus support from the government, rising inventories, weakening retail sales, declining real disposable incomes, and high gas and food prices weighing on consumption. Another major concern is decreased earnings, as the Fed hikes rates to slow economic growth, they risk putting the economy into a contraction. With consumers dependent on low rates to support economic growth via debt. Since earnings remain highly correlated with economic growth, earnings don’t survive rate hikes. As the arrows show Fed rate hikes lead to earnings recession. During the previous four recessions and subsequent bear markets, the typical revision to consensus EPS estimates ranged from -6% to -18%, with a median of -10%. So far, those estimates have not fallen enough. While forward Price/Earnings ratios have declined, much of that is due to the decline in the Price and not the Earnings. Therefore, if an earnings recession is coming, as the data suggests, then the current bear market still has more work to do as earnings decline.

However, there is a positive side to these down markets and a potential recession. They present great times to invest your money while many securities are trading at a discount. Based on history, the evidence overwhelmingly points to great market returns over the next 1, 3, and 5 years, whether we have a recession or not! |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|