|

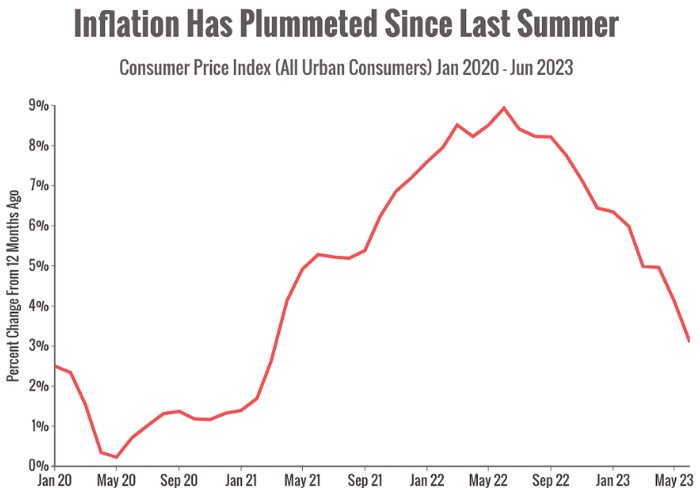

A word about recessions. Are we still going to see one this year? Let's discuss. Why did so many people think a recession was coming? Inflation and interest rates, primarily. Historically high inflation has cast a pall over the economy since early 2021. In response, the Federal Reserve has raised interest rates rapidly to bring inflation back down. Analysts worried those rapid interest rate hikes could trigger a "hard landing" recession. But it looks like the dark mood is lifting. You can see in the chart above that inflation has been on a definite downward trend since last summer. That trend suggests that the Fed's interest rate program has worked to tame inflation.

So, will the Fed keep raising interest rates? Hard to say. The Fed raised interest rates again by a quarter of a point at its July meeting, but it's possible that it won't raise rates again if inflation remains on a downward trajectory. In fact, some analysts think that the Fed's next move might be to lower rates in 2024. Does that mean a recession is definitely off the table? That's far too optimistic. While the economy has been much, much more resilient than even seasoned analysts predicted, the accumulated effects of interest hikes may still deal a serious blow to growth. There are signs that the economy is weakening in some areas. For example, while American consumers are still spending, they aren't buying as much stuff. That's hurting the manufacturing sector, which has been in a slump for a while. Since consumer spending is worth about 70% of economic activity in the U.S. it’s an important indicator for future economic growth. Employment trends will also be important to watch. So far, the work of lowering inflation seems to have succeeded without damaging the job market. However, there are signs that the labor market may be weakening, so that's something to keep an eye on. Bottom line: things seem to be looking up. The dark clouds on the horizon appear to be breaking and there are reasons to be optimistic. But, it won't be smooth sailing. Is it ever? I'm keeping an eye on trends and I'll reach out as needed. Questions? Don't hesitate to reach out, [email protected] Source: Life Strategy Financial. Munoz, Juan. 2 August 2023.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|