|

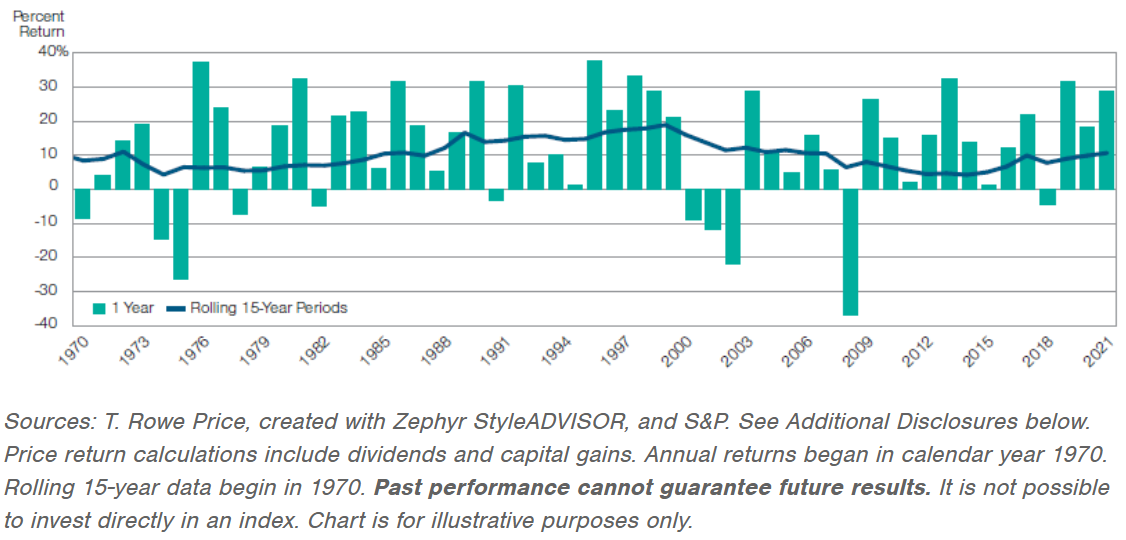

It may be tempting to take money out of the stock market. Sticking to a long-term plan is usually best. It can be hard to stay the course. Acting on emotion or trying to anticipate the market’s direction can compromise a portfolio’s long-term return potential. In general, having an asset allocation aligned with the time horizon of an investor’s goals is the most prudent path. Staying the course takes patience and discipline and can be especially difficult during times of uncertainty. Investors with a healthy dose of equities in their portfolio are likely to benefit from the long-term growth potential of stocks since, over time, the magnitude of market gains has been significantly greater than that of losses. Of course, past performance cannot guarantee future results. Remaining invested through downturns and corrections may allow investors to take advantage of long-term growth potential. While it may be challenging to stick with a long-term strategy, doing so means an investor could be well positioned to reap potential gains as the market recovers.

In times of market volatility, it’s impossible to know when it may end. Investors who feel a strategy change is in order could consider gradual adjustments. They could also wait until the volatility subsides to make wholesale shifts to their strategy. “These are challenging times for many people,” says Judith Ward, CFP® of T. Rowe Price. “If investors control the important things, such as how much to save and spend, and position their investments to balance this short-term volatility with longer-term growth, they can give themselves the best chance to achieve a comfortable retirement.” Questions about your portfolio and staying the course article? Contact [email protected] Source: T. Rowe Price. 25 July 2022. Personal Finance. https://www.troweprice.com/personal-investing/resources/insights/does-staying-the-course-still-make-sense.html?cid=PI_Single_Topic_NonSubscriber_ACC_PRE_EM_202207&bid=1046947328&PlacementGUID=em_PI_PI_Single_Topic_EM_NonSubscriber_202207-PI_Single_Topic_NonSubscriber_ACC_PRE_EM_202207_20220728&b2c-uber=u.4BDAB1C8-0F6B-9872-F733-7678B43EBF89

0 Comments

Leave a Reply. |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|