|

Traditions Wealth Advisors Noah Skrudland Financial Analyst Intern 4/28/2022 I. Summary: First Quarter 2022 Two major events overshadowed the first quarter of 2022: the sudden hawkish (high-interest rates) stance the Federal Reserve has announced and the Russia-Ukraine war that has contributed to persistent inflation. On a positive note, the unemployment rate is at 3.6%, which is historically low. Jerome Powell stated that there are 1.7 available jobs for every person looking for employment. Meanwhile, corporate earnings have been strong throughout 2021. Earnings increased over 48% for the calendar year 2021. Inflation: Most recent inflation numbers show the all-items CPI up to 8.5%. Gasoline prices have increased 48% since this time last year. Inflation is still being carried by supply chain bottlenecks, high stimulus-induced consumer demand for goods, high shelter prices, wage growth, and rising energy prices.

Rise in Interest Rates:

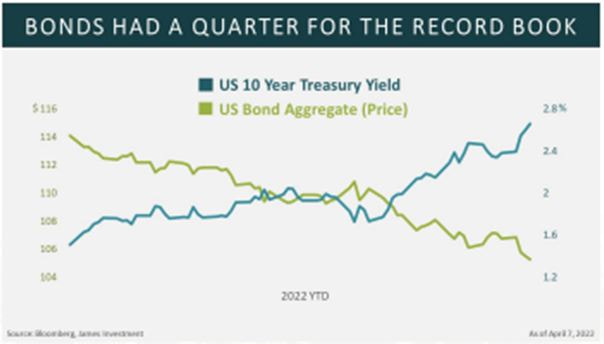

In the bond market, bond yields have seen a steep rise causing a historical bond market selloff. The 10-year Treasury went from a yield of 1.52% on December 31, 2021, to 2.81% on April 25, 2022, an increase of 85%. The Federal Reserve uses rate hikes as a tool to combat inflationary issues. While lowering rates tends to promote economic activity, then raising rates is often a restraint. This is the Fed’s most often used and widely known tool to fight inflation. Their secondary tool is to decrease the level of assets held by the Federal Reserve, also known as their balance sheet. During COVID-19, the Federal Reserve began Quantitative Easing (QE) efforts. QE usually consists of buying a large number of mortgage-backed securities, Treasury notes, and bonds. This was a strategy to add liquidity to the markets so banks could borrow and lend more freely. Now that inflation is here to stay, they plan to decrease the balance sheet by just under $100 billion per month in the near future. By doing this, other investors will have to purchase the government’s assets which will lead to higher rates. It is important to keep a close eye on the Federal Reserve to understand its strategy for raising rates. On May 3-4, The Federal Open Market Committee will have a meeting to increase the federal-fund target range. Some experts are expecting a half-point (.50%) increase, but it will be interesting to see how the Fed handles this predicament. Questions? Contact Brien at 979-694-9100 or [email protected] Source: EO-Booklet-2022-1Q.pdf (jamesinvestment.com)

0 Comments

Leave a Reply. |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|