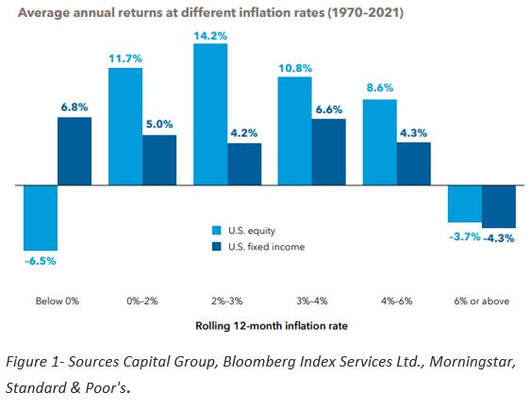

What to expect: As 2021 comes to an end, Traditions Wealth is actively researching all possible scenarios that the financial markets will bring in 2022. The risks we are watching closely are inflation and increasing interest rates combined with federal reserve policy changes. It seems everyone was talking about inflation in 2021. The federal reserve started its inflation stance as being “transitory”, while quickly adapting to a “non-transitory” stance in the latter half of 2021. Supply chain issues coupled with rising wages make us believe that inflation will not be going away anytime soon. The latest 12-month reading of the Core-CPI, which is a measure of consumer prices without accounting for food and energy prices, was 4.9%. The latest 12-month reading of CPI-All Items increased 6.8%. We are going to be watching closely the CPI reading for December 2021, which is scheduled for January 12th, 2022. If this reading is higher than consensus, we may see some turbulence in the markets. Our research indicates that the Federal Reserve will start to increase interest rates in 2022 as most of the Federal Reserve board members anticipate three rate hikes. This does not come as a surprise as the loose-monetary policies the Fed implemented during the COVID-19 pandemic era are now not necessary. The U.S. economy has bounced back from its pandemic lows. Unemployment is near pre-pandemic levels with more job openings than in 2019 and 2020. In addition, fewer people are filing for unemployment insurance. These are all signs that the U.S. economy is recovering. How does this affect investments? I know that most of you are wondering how this information will affect your investments. We’re watching the inflation reading for December 2021 closely as increased inflation has historically proven to cause markets to be volatile. Figure 1 below depicts how inflation has affected average annual returns at different inflation rates from 1970-2021. As you can see from the chart, higher rates of inflation have caused both equities and fixed income to have negative returns. Some investments do, on average, act as an inflation hedge, which are TIPS (Treasury Inflation-Protected Securities). Sectors that have historically done well during inflationary periods are the energy and materials sectors. Increased interest rates will influence all asset prices. As interest rates rise, this could hinder equities as borrowing becomes more expensive and economic growth slows. Some money managers are drawing comparisons to 2018, in which the U.S. economy slowed due to Fed tightening of fiscal and monetary policy. Some ways to combat this are to rotate into more defensive sectors, which include banks, staples, and utilities. For any questions, please don’t hesitate to contact me at [email protected] or (979) 694-9100.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|