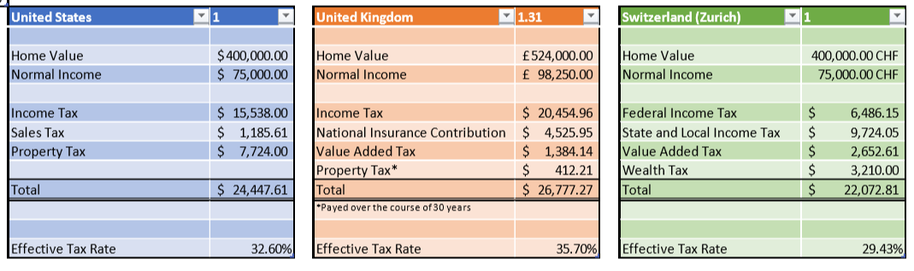

Raoul Bascon Financial Computing Intern Brien Smith CFP Traditions Wealth Advisors Owner With Tax Day just behind us, you may have to suffer with friends and family grouching about their taxes. And the new tax plan that went into effect last year make this time of year even more relevant. Our friends across the pond react similarly to their taxes. Which begs the question, who has it worse? We’ll take a look at three nations—the UK, Switzerland and the US—and compare what’s coming out of our paychecks this year. United Kingdom The United Kingdom implements a fairly aggressive taxing paradigm. While just as nuanced and confusing as the US tax code, the UK code differs in key ways. First, taxes are taxed on a national level— there are no state taxes (although, Scotland has a different marginal tax rate table, but the funds still all funnel into the HMRC, which is the British equivalent of the IRS). Second, the tax applies to different categories of goods, services and holdings. Third, the rates differ as well. The main points of difference in strata of taxes include a savings tax, which taxes income from savings; employee benefits tax, which taxes the value of benefit an individual receives from a company; value added taxes (VAT), which act as sales tax but applies differently; and National Insurance Contributions (NICs), which supplies the funds for the UK’s National Insurance. Switzerland Taxes in Switzerland are very similar to those in the US. Taxes are collected at three levels: confederation, cantons, and communes (loosely equivalent to federal, state and local levels). The key differences in the code include a value added tax, which is similar to the UK’s; a withholding tax, which taxes certain forms of investment income (notably: dividends, interest on loans, lottery payments); and stamp duties, which tax income from trading securities. Like the United States, the different cantons and communes (states and municipalities) have varying taxing schemes for the citizens of their region. Of note, some cantons do not have property taxes, but all have a wealth tax that is implemented on all real assets. Example Suppose the same individual who has a salary of $75,000, living in a house worth $400,000 is calculating his taxes in the US, the UK, and Switzerland. The appropriate exchange rates have been considered. What do the numbers say? Overall, Switzerland seems to have the lowest effective tax rate, making it the least painful place to live from a tax perspective. It is important to note that this analysis only takes into account taxes that relate to salary, normal consumption, and real estate assets. The example does not include taxes on investments for retirement or taxation on corporations, which may heavily differentiate the three countries. Happy Travels!

0 Comments

Leave a Reply. |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|