|

1) Open a no-penalty CD: Interest rates are falling, a fixed-rate no-penalty CD can be a great way to lock in rates. Talk to your bank, but usually your money need to stay in place for seven days. Once you pass that hands-off period, no-penalty CDs don’t charge a withdraw penalty for taking out your money before the CD term expires.

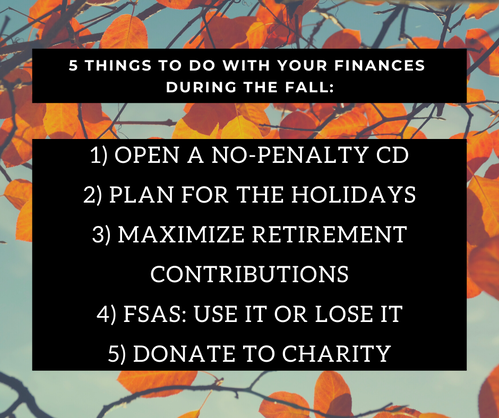

2) Plan for the holidays: Thanksgiving, Hanukkah, Christmas, and everything in between is right around the corner. Who is hosting? Who is attending, and what are they bringing? It is not too early to start planning. Keep in mind the COVID pandemic is still lurking and depending on where you live, cases are rising each day. Stay safe and consider a smaller or outdoor holiday gathering. 3) Maximize your retirement contributions: Whether it’s your 401(k) through your employer or an IRA, now is the time of year to think about topping off your retirement contributions. The 2020 limits for 401(k)s are $19,500 with an additional $6,500 allowed for those 50 and older. For Traditional and Roth IRAs, this year’s limits are $6,000, plus an additional $1,000 for those 50 and older. If you have some extra funds and can afford to put some money here, consider doing so. Your future self will probably thank you. 4) FSAs: use it or lose it: If you have a Flexible Spending Account (FSA) as part of your healthcare plan, you probably know that these are “use it or lose it” accounts. The maximum individuals could contribute for 2020 is $2,750. Start by figuring out what you contributed and what you’ve already used. Now, what’s leftover? Whatever it is, this is the time of year to use it up. Book that dreaded dentist appointment, see the dermatologist because you can, or stock up on some common over-the-counter meds. Double check with your insurer to see exactly which expenses are covered. 5) Donate to charity: Because you’re a good person and it’s always a good time to give back, right? Plus, if you do donate to charity it could also mean you get a tax deduction. A tax deduction effectively lowers your taxable income. Questions? Don't hesitate to reach out to TWA's CEO, Brien Smith, at [email protected] or 979-694-9100. Source: Goldman Sachs. 19 October 2020. https://www.marcus.com/content/marcus/us/en/resources/personal-finance/five-things-to-do-with-your-finances-this-fall

0 Comments

Leave a Reply. |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|