|

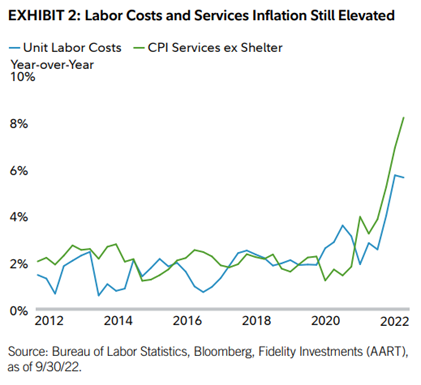

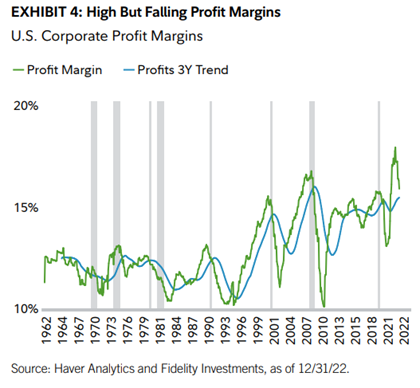

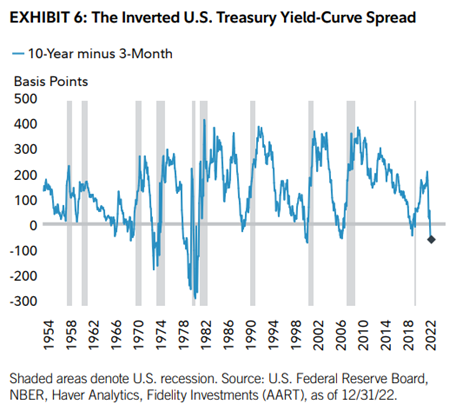

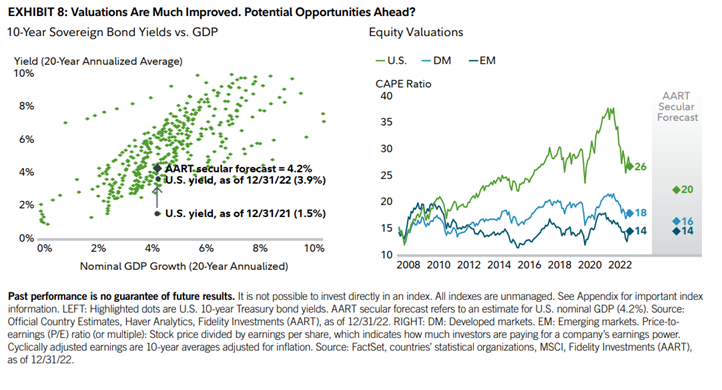

I. Summary: The main factors that affected the market selloffs (a situation in which many investors sell their shares of a stock suddenly, often because of bad news) of equities and bonds during 2022 are still relevant today in 2023. These include high inflation, tightening monetary policy and higher interest rates, slowing U.S. and global economic growth, and geopolitical turmoil. However, it is how these factors evolve that will be critical to the 2023 outlook. Top Things To Watch in 2023 Fidelity expects inflation rates to decline in 2023 but remain higher than what the market expects. Two key indicators to keep track of to determine when inflation may slow in 2023 are the housing and labor markets. Inflation peaked at above 9% in 2022 -the highest in four decades- the good news is inflation has decelerated to about 7% year-over-year in the second half of 2022 and is expected to be headed toward a further significant slowing in 2023. This has caused supply-chain disruptions to improve, energy prices to drop off their recent highs, and prices for most goods to come down late in 2022. The bad news is that financial markets have priced in a return to low and stable inflation quickly and painlessly, which many analysts and economists believe is not the case. The key to 2023’s outlook is the degree to which disinflation occurs in services industries, which often sees sticky inflation. A weakening housing market could help slow rental inflation rates in 2023. Labor markets will be a main focus for disinflation as well, where employee costs typically have had a heavy influence on the price of services. There have been signs of softening demand for labor, but aging demographics and other structural issues may continue to restrain labor supply and keep wage growth above levels compatible with 2% core inflation. The potential for stickier wages to continue supporting elevated labor costs means inflation could be more persistent than commonly believed. There would need to be a much larger weakness in the labor market and a significant increase in unemployment for the market’s low inflation forecasts to be correct. Monetary Policy Inflation trends are now headed in the right direction and the Fed may be in the final innings of its tightening cycle. Current market pricing indicates a belief that the Fed could stop hiking at around 5% by mid-2023 and possibly begin easing policy by the second half of the year. However, analysts at Fidelity do not expect inflation to come down as quickly as the market expects. They also believe that the fed will be willing to tolerate some economic pain through higher unemployment to make sure core inflation continues downward toward its 2% target. U.S. Business Cycle Leading indicators suggest that recession risks could continue to rise in the coming months. Credit conditions have deteriorated as lending standards at banks have tightened, the treasury bond yield curve remains inverted, inventories have risen as sales decreased, while new orders for manufacturing goods have also declined. Company profit margins have fallen, which is typical of the final months of the late-cycle phase. According to consensus estimates, the market expects positive earnings growth of about 3% in 2023. It’s possible that earning growth will hold up better than the 18% average decline during typical recessions, but Fidelity analysts think there is downside risk relative to market expectations. Economists are also following employment markets and consumer spending in 2023 Consumers’ willingness to spend may be threatened by savings rates that have dropped to near all time lows, the apparent exhaustion of excess savings for low and some middle-income cohorts and falling asset prices. On the upside, labor markets appear structurally tighter and more supportive of medium-term wage growth. Additionally, household balance sheets remain in good shape, the increase of fixed-rate mortgage debt implies a lack of financial stress, and falling inflation may boost real (inflation-adjusted) income growth. Interest Rates By the end of 2022, long term 10-year Treasury yields dropped well below the shorter term 3-month Treasury bills. This steep inversion of the current US Treasury bonds yield curve –with long term rates higher than short term rates– is historically a leading economic recession indicator and a sign that the financial markets believe that at some point in the future the Fed will have to start cutting rates in reaction to economic weakness. Economists are keeping track of business cycle indicators previously mentioned to monitor whether a U.S. recession becomes the dominant story of 2023. Investment Conclusions Overall, Fidelity analysts believe that both inflation and policy rates could remain higher than current consensus investor expectations. The Fed’s latest inflation and interest-rate projections tend to agree, markets are overly optimistic at the moment. Uncertainty around these trends is likely to persist well into 2023, implying high odds of continued market volatility and heightened need for portfolio diversification. However, this greater market volatility could provide even greater opportunities to purchase assets at discounted prices. Over the past 11 recessions since 1950, a diversified portfolio of stocks and bonds has returned an average of 6% and 11% over the one- and two-year periods after the start of a recession. Valuations are perhaps the most important indicator of expected returns over the medium and long term, and 2023 is a more attractive starting point for valuations than at any time in the past decade.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|