|

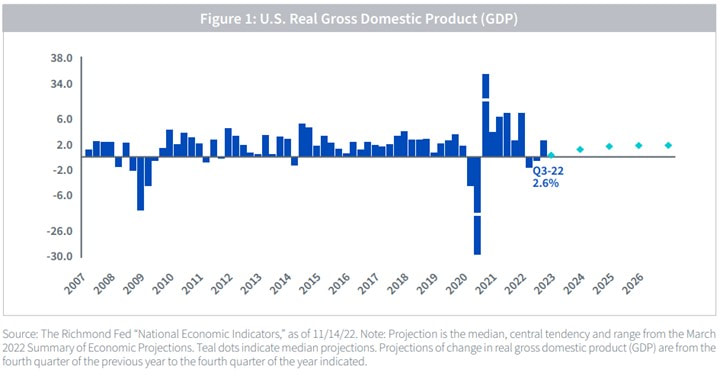

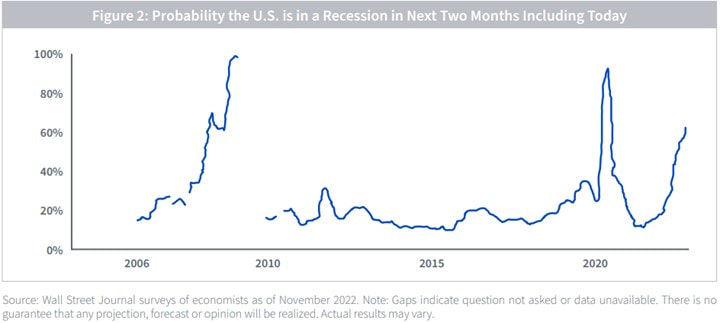

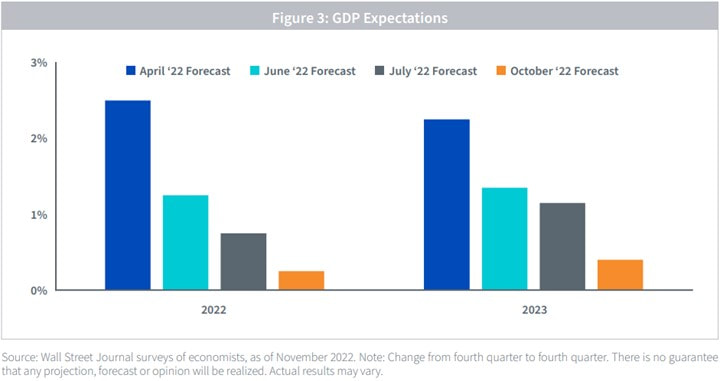

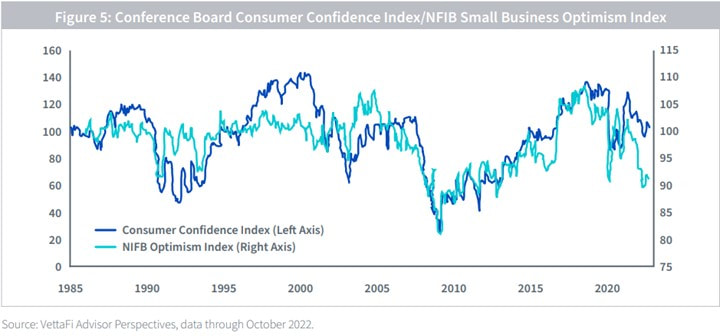

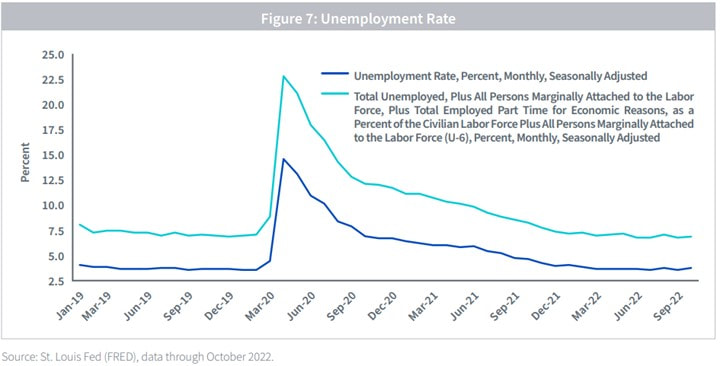

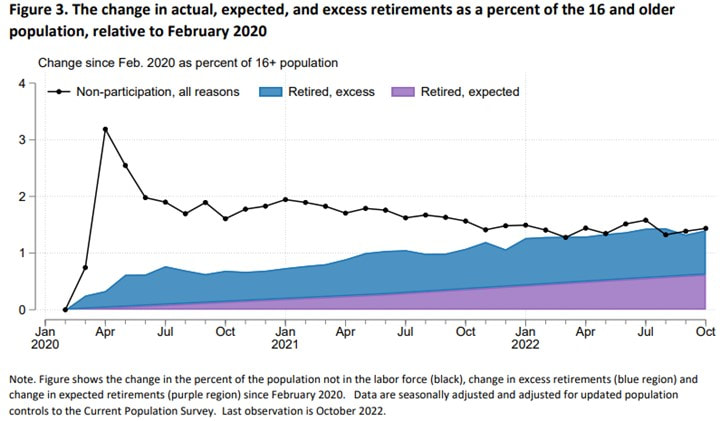

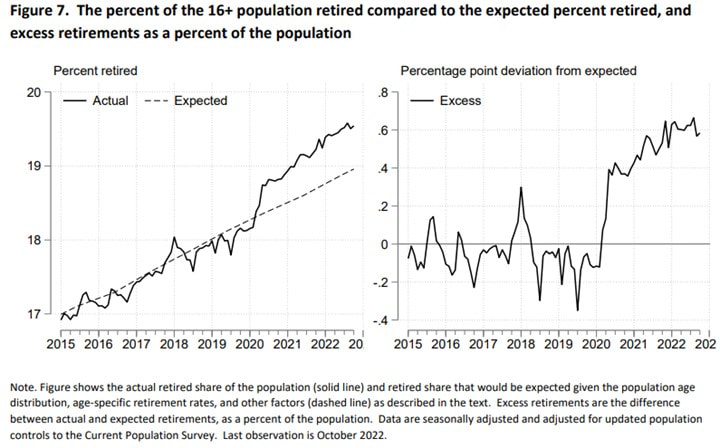

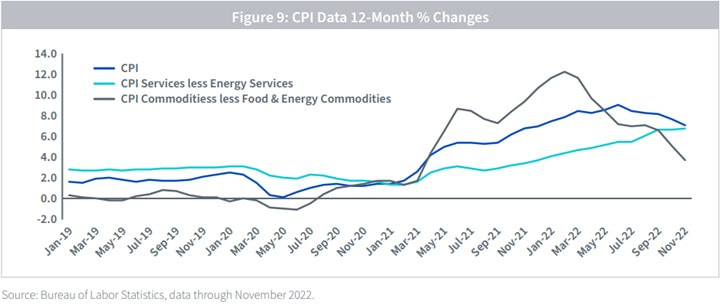

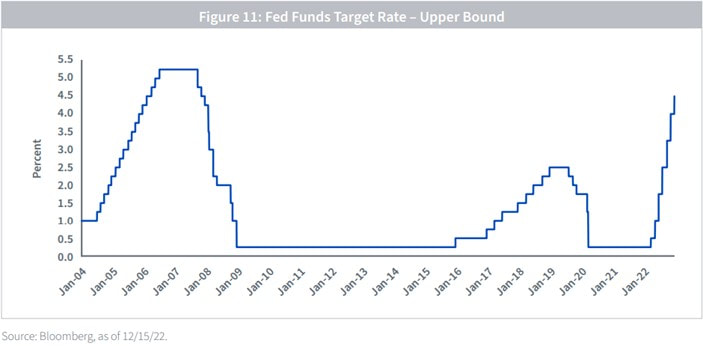

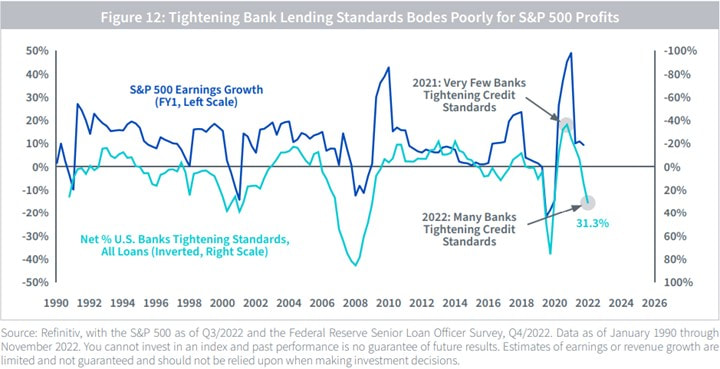

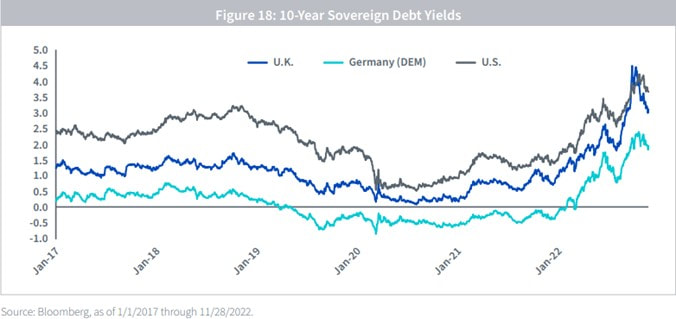

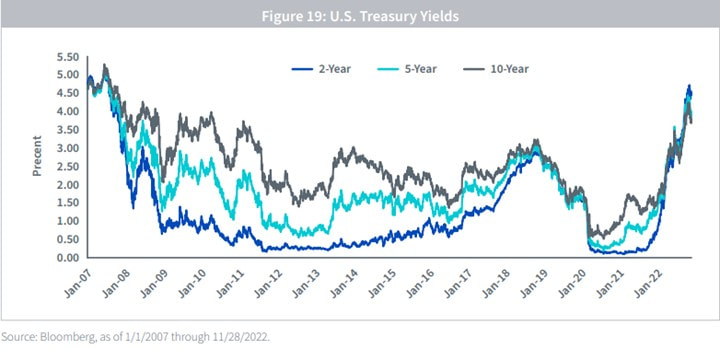

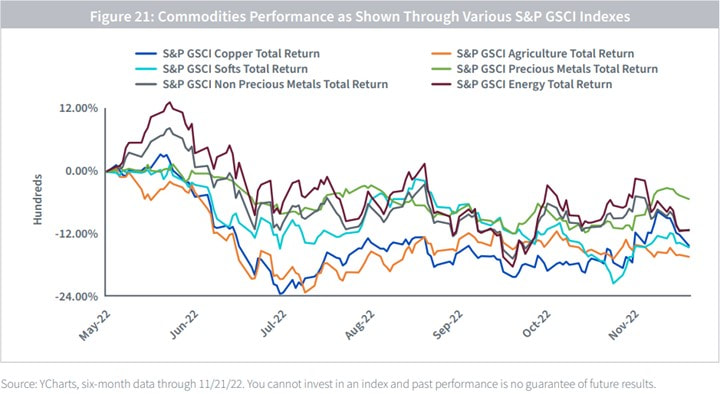

Looking into the new year we have researched economic trends and the possible impact of an upcoming recession. Overall, for 2023 we expect GDP growth to be slim, inflation decelerating, and a shallow recession. Economic Growth Rates In the U.S., after two consecutive quarters of negative gross domestic product (GDP) growth followed by a third quarter of modest economic growth, overall growth for all of 2022 is expected to be positive over the course of the full year — the consensus estimate among analysts is 1.5% – 2.0%. Growth expectations for 2023 are less sanguine. According to the Wall Street Journal Economic Forecasting Survey, there is a rising consensus opinion that the U.S. will fall into recession within the next 12 months. This translates to a consensus estimate for 2023 GDP growth of only 0.4% Small business owners and consumers represent the bulk of economic activity in the U.S., and we see a distinct downward trend in both groups, driven by fears over inflation, rising interest rates and a potential recession in 2023. These trends may prove to be dominating factors in overall economic activity as consumers, business owners and investors take a “seek shelter” approach in their behavior. Unemployment: Despite lower GDP growth the U.S. employment situation remains strong. The “headline” U-3 employment rate suggests that we remain in a tight labor market, and even the less-followed “U-6” partial employment level (workers who are involuntarily working at less than full employment) suggests the continuation of a positive employment market. In addition, weekly jobless claims (one of the leading economic indicators) remain at historically low levels. An interesting occurrence during the Covid-19 pandemic was that there was a higher-than-expected increase in retirements, known as “The Great Retirement Boom”. This number remains elevated and has not yet come down as much as expected, this makes the labor force participation rate look much higher, since retired people are not actively looking for a job, they are not included in the labor force participation rate. The real question is if these retired people have enough savings to remain retired or if they will have to return to the workforce, which would decrease the labor force participation rate. “The Great Retirement Boom” offers a different perspective on how “strong” the current labor market really is. Inflation Expectations A main concern of the Fed continues to be the inflation rate, and Fed Chairman Jerome Powell has made clear that his current goal is to bring down inflation rates. Luckily many analysts are estimating that inflation in the U.S. has more than likely reached its zenith and is poised to continue to decelerate in 2023. According to Consumer Price Index (CPI) data, commodities less food and energy commodities have seen its annualized rate of increase plummet over the last nine months, falling from +12.3% to +3.7% in November. Monetary Policy Federal Funds rate hikes in 2022 have resulted in the Fed Funds target range going from a zero-interest rate policy (ZIRP) as recently as March to 4.50% in December, a total of 425 basis points in rate hikes. The graph below highlights how the current aggressive tightening cycle has compared to the previous two more methodical rate hike episodes. It is still unclear if the Federal Reserve will go into “raise and hold” mode in 2023 or entertains rate cuts during the second half of next year. The next Fed decision on interest rates is February 1st, and the interest-rate move is currently expected to be smaller than past hikes at 0.25 percentage-points. There is still significant economic data to come in ahead of the Fed’s decision and this could change the Feds view. Equity Markets: Corporate Earnings and Macro Outlook A primary concern with regard to the S&P 500’s earnings outlook for 2023 is that banks are indicating a buttoning up of their lending standards, an occurrence that sometimes indicates corporate profit trouble. The fourth quarter marked the fifth in a row in which banks’ total loan books witnessed a tightening in the Fed’s Senior Loan Officers Survey, to a net 31.33%. That reading matches levels seen in 2001, 2007, and 2020, each of which witnessed a fall in S&P 500 earnings thereafter. Fixed Income The global sovereign debt markets have arguably experienced their worst year on record. However, an interesting development has occurred in the process; the era of negative rates has seemingly drawn to a close. With the exception of Japan, government bond markets in the developed world have now seen yield levels move into positive territory for the key 2-, 5-, and 10-year maturity sectors. This development has created an interesting phenomenon: there’s “income back in fixed income.” The recent rise in U.S. Treasury rates has brought yields to levels not seen since 2007-2008. The natural question becomes: is there more to come? In other words, can U.S. Treasury yields continue rising from here? In context of future Fed policy, if the expectation for a 5% Fed Funds terminal rate does not come to fruition, Treasury Yields will more than likely continue to rise, especially along the front end of the curve, as yields need to adjust to this potential higher Fed Funds Rate. Analysts are estimating that the Fed will continue to raise rates in the first half of 2023, around the end of the second quarter. We expect the Fed to pause, which could lead to a modest rally in rates along with a steeper curve. Rate volatility will remain elevated; however, we believe we will not experience the rise that we witnessed this year. Real Assets And Alternatives Global supply shortages driven by the Russian invasion of Ukraine, combined with relative restrictive U.S. domestic energy policies, would normally provide a solid macroeconomic backdrop of support for global commodity prices. But a global economic slowdown, particularly in China, provides an offsetting counterbalance. Copper is often viewed as a leading indicator of expected future economic growth-in which case, we are in for a week global economy in 2023. Potential Government Shutdown

Another current event with potential economic implications is a potential government shutdown due to the inability to raise the government debt ceiling. If Democrats and Republicans cannot agree on a number than we may have another government shutdown. This has happened three times in the past 10 years, a 16-day shutdown in October 2013 over healthcare, a 3-day shutdown in January 2018 over immigration, and a 35-day shutdown between December 2018 and January 2019. According to the Congressional Budget Office, the 2018–2019 shutdown reduced economic activity by about $11 billion while it was underway, but much of that lost growth was recovered when government activity resumed. Overall, the shutdown cost the economy about $3 billion, equal to 0.02 of GDP, CBO found. Treasury Secretary Janet Yellen said on Jan. 19 that the United States has reached its current $31.4 trillion borrowing cap but can continue paying its bills until June by shuffling money between various accounts. At that point, when the so-called extraordinary measures are exhausted, the Treasury would not have enough money coming in from tax receipts to cover bond payments, workers’ salaries, Social Security checks and other bills. It would be catastrophic if the U.S. government was unable to pay its bills. A missed debt payment would likely send shockwaves through the global financial markets, as investors would lose confidence in Treasury’s ability to pay its bonds, which are seen as among the safest investments and serve as building blocks for the world’s financial system. The U.S. economy could face a severe contraction if the 69 million people enrolled in social security don’t get their monthly retirement and disability benefits, or hospitals and doctors don’t get paid for treating patients through government programs like Medicare. In conclusion, we expect the Fed to pause rate hikes sometime in the second half of 2023, possibly in to 2024, when there are sure signs that inflation is coming down. Until then, we should encounter a shallower and shorter recession than previously seen in previous recessions due to labor and workforce statistics as well as strong corporate balance sheets. It would be best for the global economy if the Russia–Ukraine war concluded, and the U.S. could agree to raise the debt ceiling. By James Lane/ Brien L. Smith, CFP® II. Source: Wisdom Tree Investments and Dr. Jeremy Siegel, Professor of Economics Wharton School of Business, University of Pennsylvania

1 Comment

2/22/2023 06:39:14 am

Good overview on the impact of the current economic climates on potential sectors. It's important to seek the services of a wealth advisor too when it comes to planning for retirement and investing in gold. They can provide sound advice on how to plan for your future, which investments are best suited to help meet your financial goals, and how to diversify your portfolio with gold investments.

Reply

Leave a Reply. |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|