|

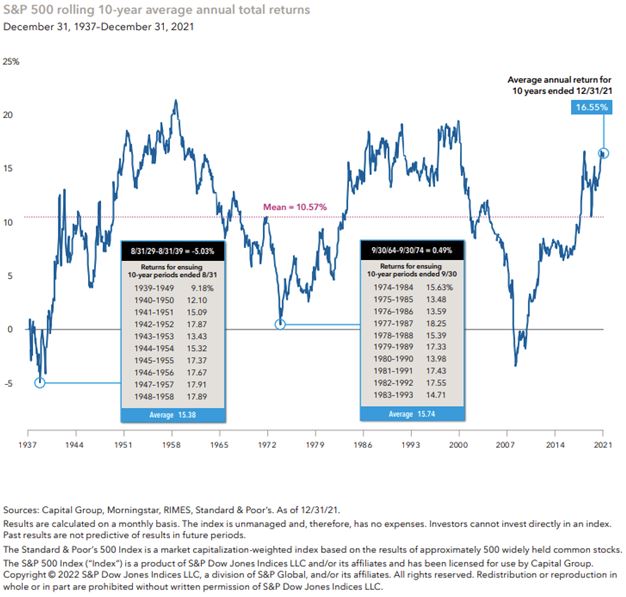

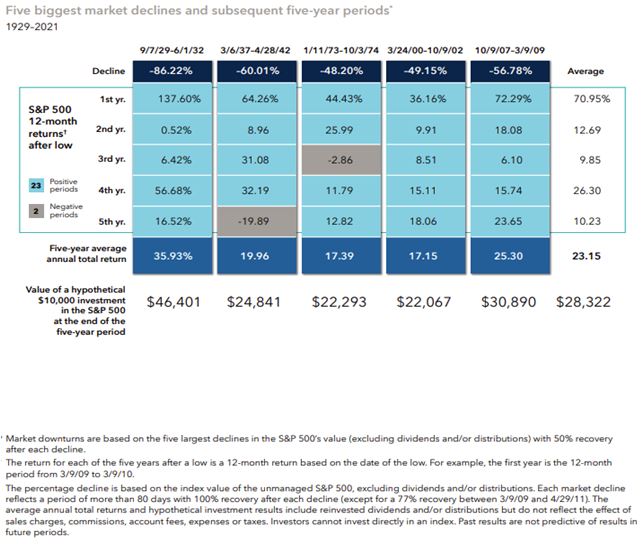

Keys To Prevailing Through Stock Market Declines Traditions Wealth Advisors Brien L. Smith, CFP®/James Lane May 23, 2022 “The market is the most efficient mechanism anywhere in the world for transferring wealth from impatient people to patient people” Warren Buffett “Thank you, clients, for being those patient people.” Brien L. Smith, CFP® I. Summary: 1. Declines have been common and temporary occurrences.

2. Proper perspective can help you remain calm

3. Don’t try to time the market

4. Emotions can cloud judgment

0 Comments

Leave a Reply. |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|