|

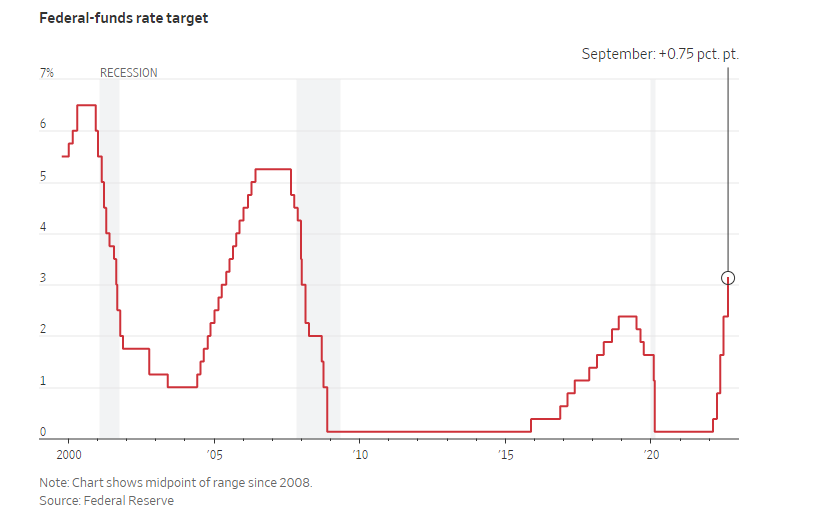

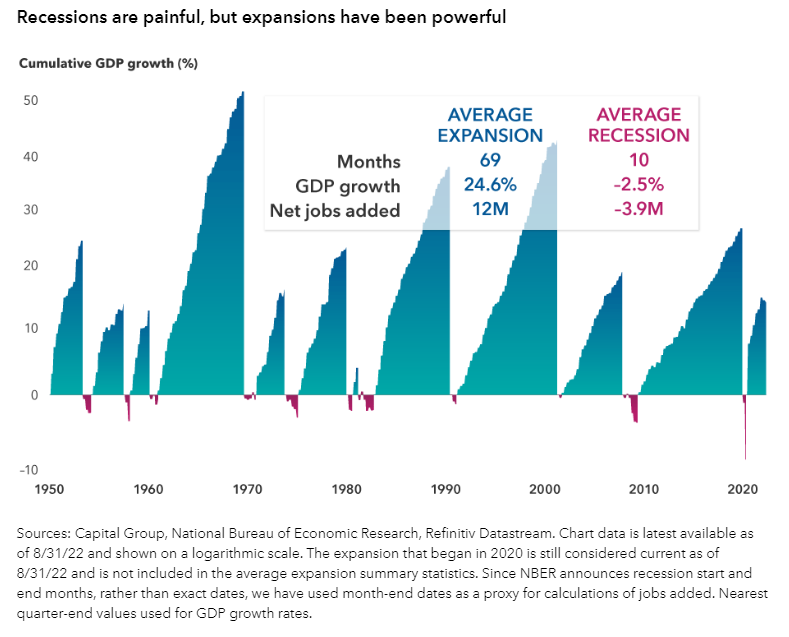

There is currently a lot of talk about a recession approaching by the end of this year and as a result, we have seen recent market selloffs as investors become worried about our economies future. The National Bureau of Economic Research (NBER) defines a recession as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production and wholesale-retail sales.” The source of these recessionary concerns stem from The Federal Reserve, which is currently increasing interest rates to slow down economic growth and combat high inflation levels. They are specifically increasing the federal funds rate. The federal funds rate refers to the interest rate that banks charge other institutions for lending out excess cash. The federal funds rate is important because the rate can determine how much it costs for you to borrow from the bank in the form of interest rates. The main goal of the Federal Reserve right now is to reduce rampant inflation by increasing interest rates and slowing down economic growth. Higher interest rates do not mean the economy suffer a major crash. An economic slowdown is necessary to ensure that price stability is maintained. Boston Federal Reserve President has recently said in a press conference that “history has shown that price stability is a precondition to achieving maximum employment over the medium and long term”. Therefore, short-term pain for consumers and businesses will be necessary to achieve the fed’s goal of 2% inflation. Many people within the Federal Reserve and outside experts believe that the damage to overall growth would be limited. In a recent press conference, the chairman of the Federal Reserve, Jerome Powell, stated that “Higher interest rates, slower growth, and a softening labor market are all painful for the public that we serve, but they’re not as painful as failing to restore price stability”. Making sure inflation can be controlled is painful for us as investors in the short term, but we believe it is necessary to foster a more stable future for long term investments. Although many investors are becoming fearful of an imminent recession, economy and survey data have held up well. Healthy gains in employment and disposable personal income are fueling nominal consumer spending growth, and confidence in our economy has lifted. According to a credible source from Goldman Sachs, “The US economy has about a one in three chance of slipping into a mild recession by the middle of 2023”. A lot of economic experts are predicting a mild recession with only a limited increase in the unemployment rate of 1%. With economists and market experts predicting a shallow and mild recession, there is a good chance that this recession will not be nearly as painful as ones seen in the 1980s and 2007-2009. More current evidence for a mild recession are unusually high level of job openings typically seen during a recession. This should dampen the recessionary effect of higher unemployment in the economy. Experts are also predicting that consumer spending will be higher than in past recessions. In other words, consumers may feel the effects of this recession much less than the recessions of the past. Another big reason to have optimism for the future is that there are many sectors in the economy that are currently growing and have room to normalize to their pre-pandemic levels, even during a recession. Due to the negative market effects we saw during the covid pandemic of 2020, sectors such as transportation services, tourism, and infrastructure were already negatively affected before the recent market selloff. Now that covid restrictions and have been lifted, these sectors have started recovering even among upcoming recession fears.

Randall Kroszner, former Federal Reserve governor, claims that “A U.S. recession this year or next is looking likely, but Americans can rest assured that the worst-case scenario of a ‘devastating early-1980s–type recession’ probably won’t come to pass”. The economic conditions of today are different from the past, therefore many experts are expecting the predicted recession to be very mild. A deep recession would only occur if inflation levels do not decline further by next year. The Federal Reserve would be forced to take even further action and increase interest rates more. Thankfully, this is highly unlikely as inflation has peaked and has been slowly declining after each inflation report. To combat the predicted mild recession, Traditions Wealth Advisors has been researching new potential investment opportunities for you, our valued clients. We have been avoiding and trimming our clients’ holdings in volatile growth funds and have placed an emphasis on value funds. Dividend stocks also provide a cushion for a portfolio during a recessionary period. Fixed income investment opportunities continue to remain as a solid income generator during slowdowns. We also have been researching investment opportunities in the real estate market, and have added TIAA-CREF Direct Real Estate to most of our clients’ portfolios, which has produced positive gains while most other asset classes have been hit hard. It is important as investors to not overreact to a recession and all the over-the-top news headlines. It is important to stay focused on long term investment goals and not make any decisions due to a short-term disruption.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories

All

|

Let our team work for you. Call 979-694-9100 or

email [email protected]

|

TRADITIONS WEALTH ADVISORS

2700 Earl Rudder Frwy South, Ste. 2600 College Station, TX 77845 |

VISIT OUR BLOG: Stay current with industry news and tips.

|